1

| The Bakken / North

Dakota Return To Top Of Page |

| They

Say It's So The Info Told To Local's That The USA Has Proven Reserves Greater Then Saudi |

| Bakken /

North Dakota - Boom Or Bust Bakken Data - Production - Decline - Hype - Equity - 2017 The Burgum Challenge - 2020 The Bakken Peak 2 To 5 Years Left Wood Mac Study USA To Produce 27 Million Barrels A Day By 2030 - The Equity Debt Spiral |

| North Dakota Tax

Gimmicks The Governor Is Calling For Budget Cuts |

| Bakken

/ North Dakota - Real Estate Boom Or Bust -

Permits - Sales - Hype - Equity "If The City Folk Have Their Way The Valley Will Die" - Orlin Hanson - Vanishing Minot |

| Hydraulic Fracking - Going To Far Hidden Beneath The Ground ? Biocides |

$4.0 Billion Cracker Plant To

Be Built 1st Plant Announced Oct. 2014 - 2nd June 2015 - 3rd Sept. 2016 - Will There Be A 4th, 5th & 6th? |

The Game Changer Of Shale (Tight) Oil Its The Water! Yes Water With Biocides |

| The

Coming Bust In North Dakota ? |

Shale

Reality Check - 2019 to 2050 A REALITY CHECK ON U.S. GOVERNMENT FORECASTS FOR A LASTING TIGHT OIL & SHALE GAS BOOM |

What If

The Boom Is Just A Bubble |

| Glomerulonephritis | artberman.com | Glomerulonephritis & Chemicals |

| Flint Hills Resources - Oil Price | Market Price

- Bakken Sweet WTI - Crude Return To Top Of Page |

Plains Marketing - Oil Price |

"Finally we have an opportunity to go out and explore for oil and drill without fear of price collapse." Harold Hamm - 10 - 2011

"How North Dakota Became Saudi Arabia" Without An IPO!

Don't Hold Your Breath For $70.00 Oil - & The Demise Of The Bakken

& The Coming Economic Disaster When They Do 02/2017

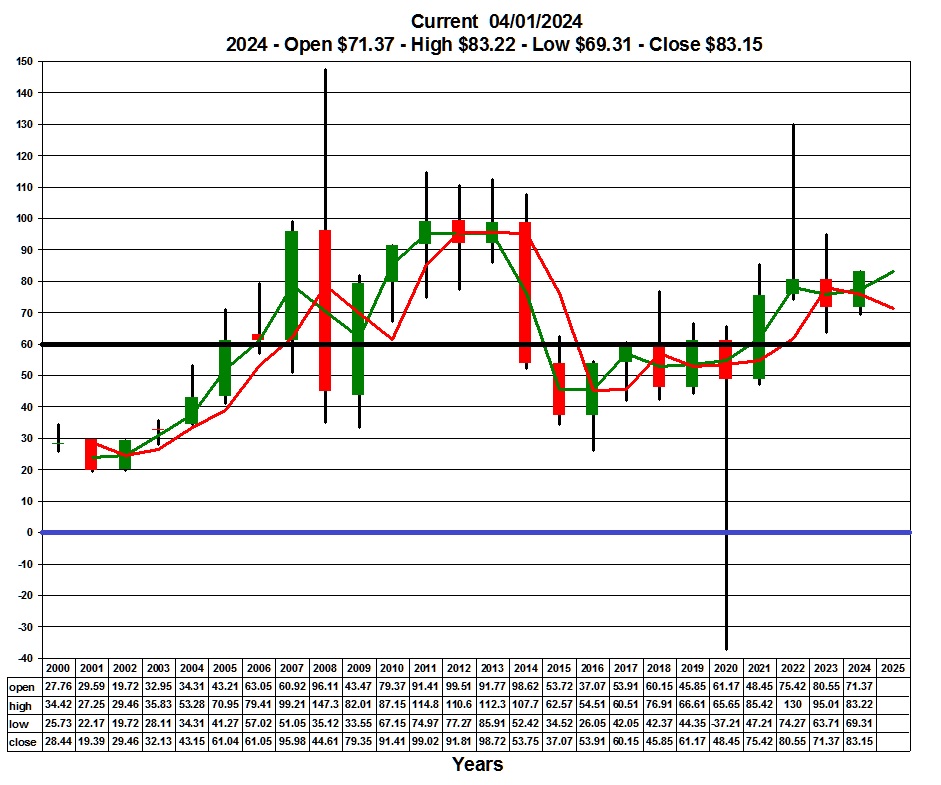

Bakken Sweet Crude Futures - Flint Hills Resources Futures - Years 2000 To 2024

Bakken Sweet Has Only Traded & Closed In A Year Time Frame Above $60.00 - Seven Of The Past Twenty Four Years

Price Per BBL - Time Frame One Year Candles

So I say I say

welcome, welcome to the boom town Pick a habit We got

plenty to go around Welcome, welcome to the boom town

All that money makes such a succulent sound Welcome to the boom town

Welcome To The Boom

TownAll that money makes such a succulent sound Welcome to the boom town

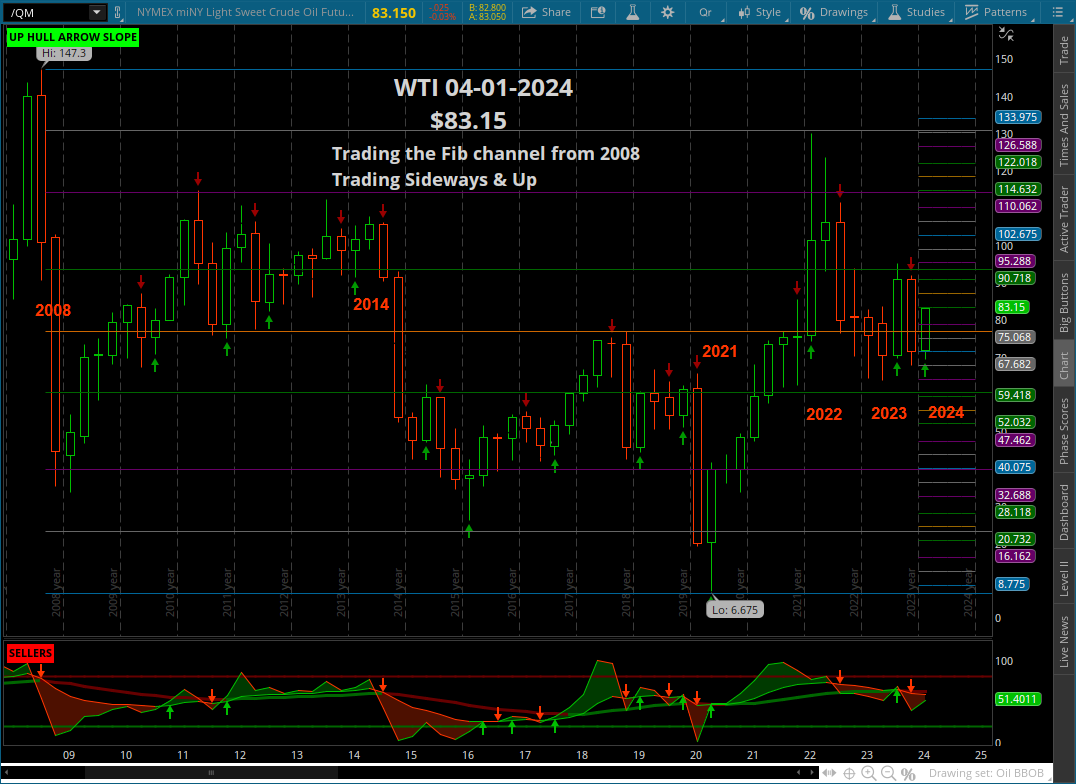

NYMEX - WTI - /QM - Light Sweet Crude Futures - Years 2000 To 2024

WTI Has Only Traded & Closed In A Year Time Frame Above $60.00 - Thirteen Of The Past Twenty Four Years

Price Per BBL - Time Frame One Year Candles

Is Unconventional Unproven Leading To Gas Condensate Not Oil ?

Is All The Oil In The Strategic Reserve Contaminated?

The US Is Selling Contaminated Oil? 03-2018

Oil In A Month Chart

Does It Look Like Oil Has Found A Bottom? - Is It Breakout The Drill Bits Yet? - Drill Baby Drill

"Oil Pioneer Harold Hamm Warns Fellow Producers: Don't Drill Yourself Into Oblivion - 06-2017"

When the US Needs Oil - Who do they call? They call OPEC

Well I don't mind stealing bread From the mouths of decadents

But I can't feed on the powerless When my cup's already overfilled

Temple Of The Dog - Hunger Strike

Does Anyone Think Any Of This Wont End Well

S&P 500 Index Price Overlaid With The Price Of Oil - As Of 2024

The Divergence Of Reality Continues

| Arresting The Decline Return To Top Of Page |

"The hard reality is this: propping up zombie oil companies is only going to make the downturn last longer."

Who Should You Call To Arrest The Decline

What A Irony. Arresting The Decline. Long before oil price went in the toilet, Decline was everywhere. No one spoke much about her.

They seemed to deny that she was everywhere. They just kept feeding her and giving her more and more to decline.

They shrugged her off in quarterly conference calls. Experts and everyday people with calculators warned of her. Wrote of her, charted her.

Respected her. Warned of the day she would overtake their enabling addiction of drilling. Tried to come up with ways to shut her down,

That just don't work in tight oil. So to have her arrested, who do you call? The police, the E&P's, the FBI, the NDIC, the TRRC, the media,

the banks, Wall Street. Probably all of the above. It will be difficult, very difficult to bring her in, she is lurking at every lease, behind every

pump, in every production tank. She is in the paper work, the permits, the earnings, she is the thought that crosses the mind and is brushed off.

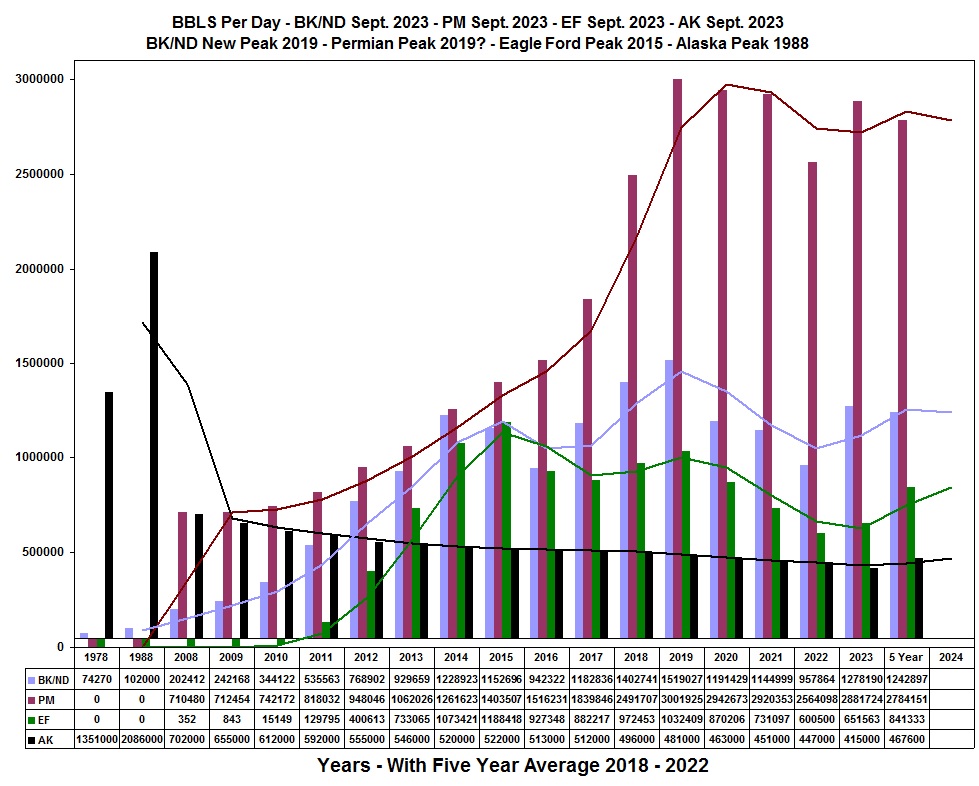

Updated When All Three Report Same Month Data

Bare In Mind - Increased Production Only Seems To Decrease Price

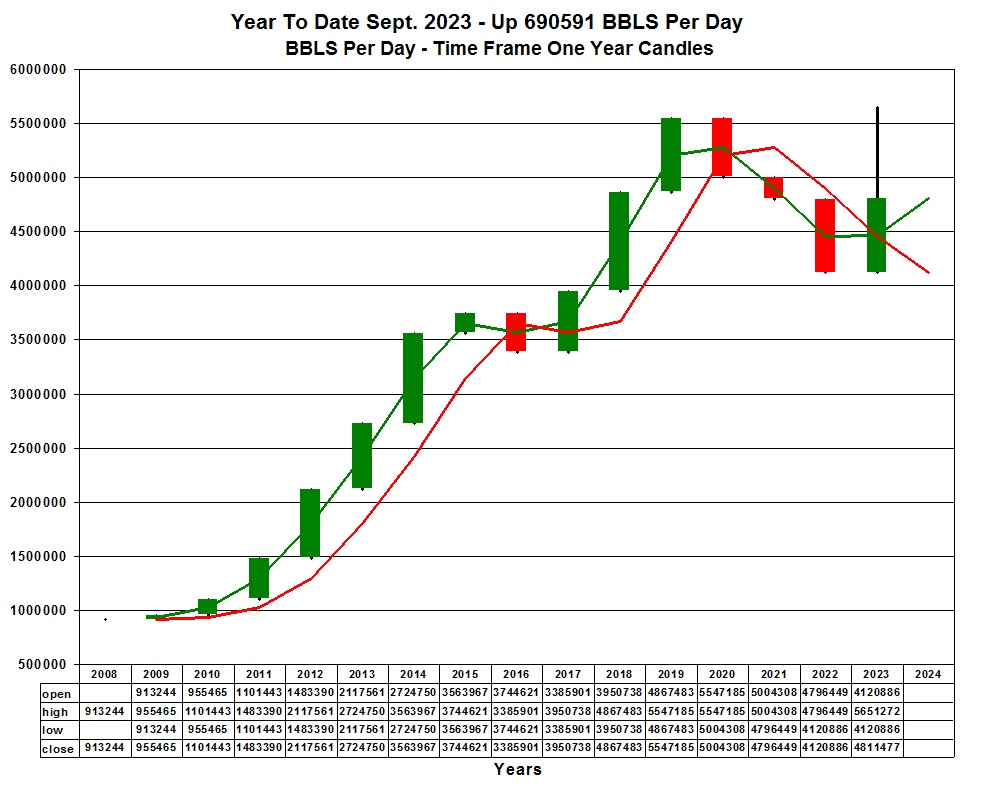

The Combined Production Of The Three Largest Play's - Bakken - Eagle Ford - Permian Basin - Current Sept. 2023

4,811,477 bbl's oil a day - Divided by (2008 to Current Sept. 2023) 153,651 Wells - Is 31.3 bbl's oil a day per well. 153,651 Wells Times An Estimated $8.5 Million Per Well Is $1.3 Trillion Dollars

2022 Combined Production Of The Big Three - Bakken / ND - Permian Texas - Eagle Ford Texas - YTD Sept. 2023 - Up 690,591 Barrels A Day

Year To Date - Bakken Production Is Up 320,316 bbl's Per Day - 802 New Wells

Year To Date - Permian Production Is Up 318,702 bbl's Per Day - 1726 New Wells

Year To Date - Eagle Ford Production Is Up 51,563 bbl's Per Day - 655 New Wells

As Of Sept. 2023 - A Combined Count Of 3,183 New Wells x $8.5 Million A Well Is $27.1 Billion

A Average BBL Per Day Well Production Of 217.3 bbl's Per Day - Not Good

3,183 Wells x $8.5 Million Is $27.1 Billion - Is $99.1 Million A Day - Divided By 690,591 Barrel's A Day - Is $143.50 A Barrel

What Are They Thinking !

The Problem With Oil Prices - They Are Not Low Enough

| Bakken/North Dakota Average1 | Permian Basin Average1 | Eagle Ford Average |

Bakken/ND - Permian - Eagle Ford - Combined Production - 2008 To Current 2023

In 2015 You Did Not See Candle Over Candle Growth - Nothing But Cross - Recross - Test - Of The 3.4 - 3.6 Mark - Doji - Doji - Vroooooooooooooom

2015 Ended As A Hammer - 2016 Ended As A Engulfing Bear Candle - 2017 Is A Engulfing Bull Candle - 2018 Headed Back Up? - 2019 Banging Sideways

2020 Covid-19 Takes a Bite out of the Frackers - 2021 Biden Sends Inflation Through The Roof - 2022 Biden Drains the SPR - 2023 Biden Drains It More

| Tight Oil Charts Return To Top Of Page |

Tight Oil & Conventional Oil - Daily Production - 2008 to Current 2024

Bakken/ND - BK/ND / Permian - PM - / Eagle Ford - EF / Alaska - AK - All State & Federal Data Lags Two to Three Months In Reporting - No Data PM 1988

Alaska Peaked In 1988 - The Bakken / ND & Eagle Ford Combined Have Offset That Decline

Texas Peaked In 1970 At 3,357,000 bbl's Per Day. Texas Has Never Reached That Peak Again. The EIA Is Adding Condensate In Recent Production!

Texas & The EIA, The USA & Their Bad Numbers

Years Of Drilling & Fracking & Not The Bakken, Or The Eagle Ford, But The Permian, Has Surpassed Alaska Peak Production, July 2018

The Permian 2008 to July 2018 - 76,372 New Wells at Some $611 Billion - It Surpassed Alaska Peak 1988 - 30 Years Later

The USA Was Importing 5 Million Barrels A Day In 1988 & Is Still Importing Some 6 Million Barrels Of Oil A Day Today EIA Oil Imports

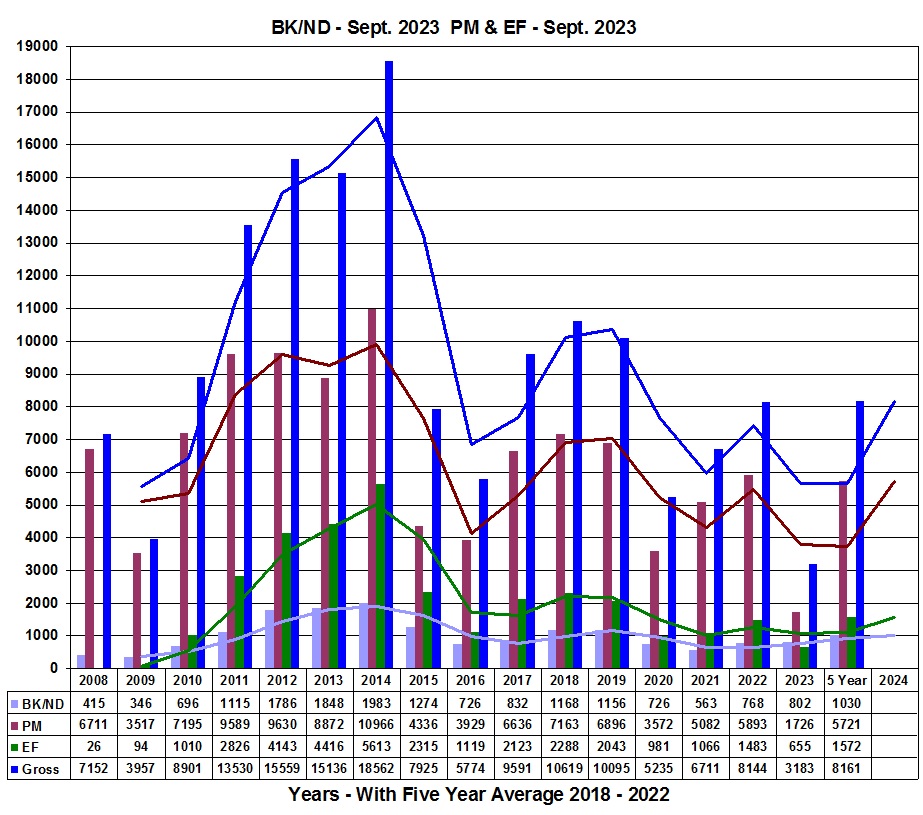

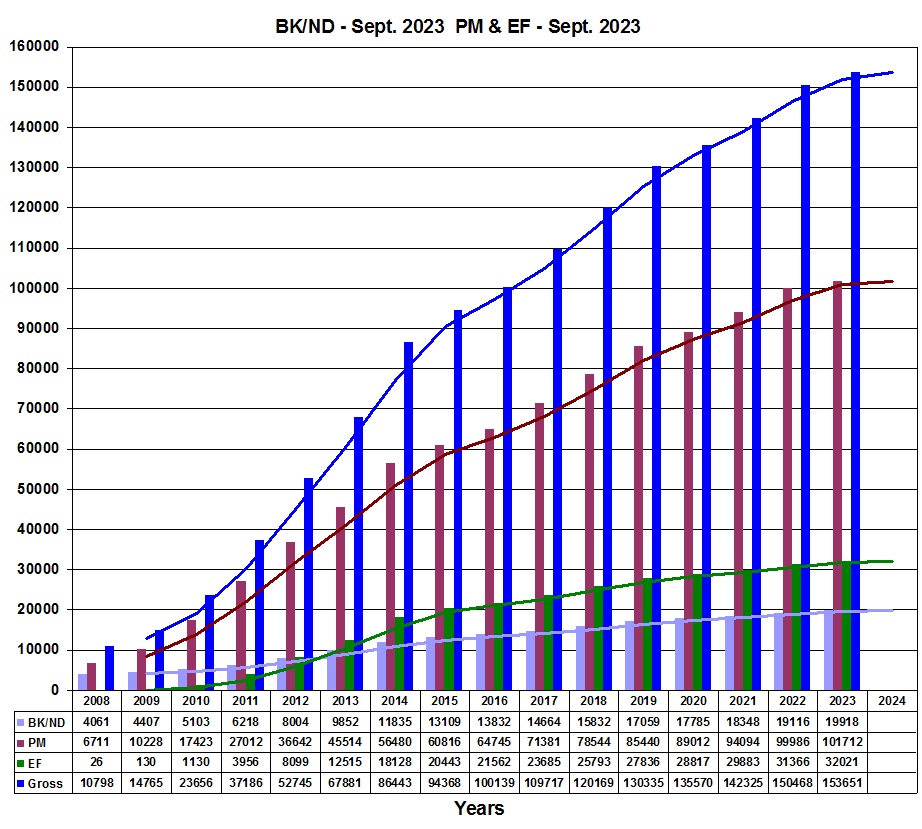

Tight Oil Well Count Added Each Year

Bakken / ND - In Production Since 1951 - Permian West Texas - In Production Since 1921 - Eagle Ford - In Production Since 2008

BK/ND - Bakken / ND Is Actual Producing Count 2008 To 2012 - 2013 On Is Actual Well Completions Count As Reported By The NDIC

PM - Permian Is Permits 2008 To Current - EF - Eagle Ford Is Permits 2008 To Current

Gross Tight Oil Well Count Year Over Year

Bakken / ND - In Production Since 1951 - Permian West Texas - In Production Since 1921 - Eagle Ford - In Production Since 2008

BK / ND - Bakken / ND Is Actual Producing Count 2008 To 2012 - 2013 On Is Actual Well Completions Count As Reported By The NDIC

PM - Permian Is Permits 2008 To Current - EF - Eagle Ford Is Permits 2008 To Current

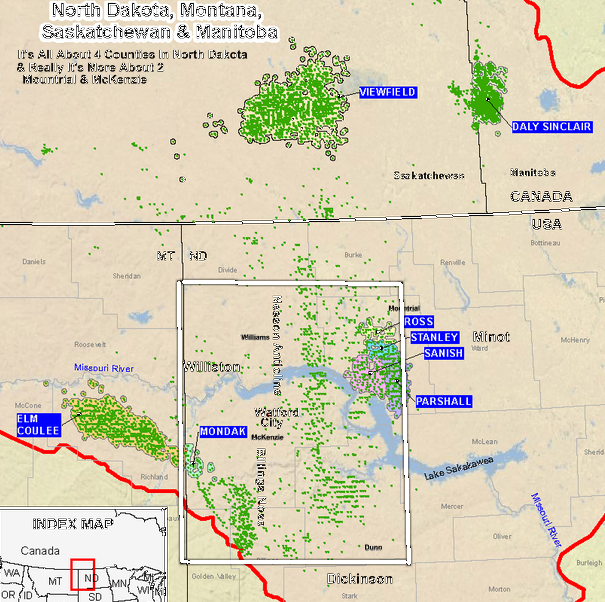

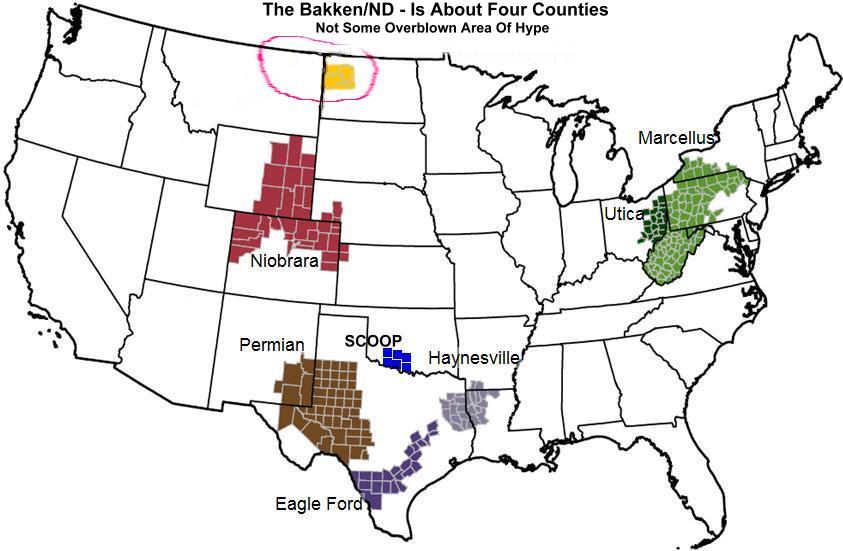

80% Of All ND & Bakken Production Comes From 4 Counties

Oil Production By ND County - dmr.nd.gov

| USA Oil Play's -

Texas Numbers Are Crude Oil - EIA Texas Numbers

Include Condensate! Return To Top Of Page |

Looking back at a prairie town People ask me why I went away To fly with the best, sometimes you have to leave the nest But the prairies made me what I am today

Prairie Town

Current Reported Production - September 2023

| Bakken / ND

1,278,190 bbl's oil a day 18,538 Wells = 68.9 bbl's oil a day per well Niobrara Col. 459,000 bbl's oil a day Wyoming 272,000 bbl's oil a day California 307,000 bbl's oil a day Permian Basin 2,881,724 bbl's oil a day 101,712 Wells Permitted = 28.3 bbl's oil a day per well Eagle Ford 651,563 bbl's oil a day 32,021 Wells Permitted = 20.3 bbl's oil a day per well Texas Annual - 2018 3,492,000 bbl's oil a day 187,401 Wells = 18.6 bbl's oil a day per well January 2019 |

Updated When The Big Three Are All In The Same Month The Combined Production & Well Count Of The Three Largest Play's - Bakken - Eagle Ford - Permian Basin BK/ND - Eagle Ford - Permian Basin - Current Sept. 2023 4,811,477 bbl's oil a day - Divided by (2008 to Current) 153,651 Wells - Is 31.3 bbl's oil a day per well. 153,651 Wells Times An Estimated $8.5 Million Per Well Is $1.3 Trillion Dollars |

Utica Ohio 84,000 bbl's oil a day Marcellus NY 1,000 bbl's oil a day Pennsylvania 12,000 bbl's oil a day West Virginia 48,000 bbl's oil a day SCOOP - Okla. 424,000 bbl's oil a day New Mexico 1,818,000 bbl's oil a day Kansas 75,000 bbl's oil a day Florida 3,000 bbl's oil a day |

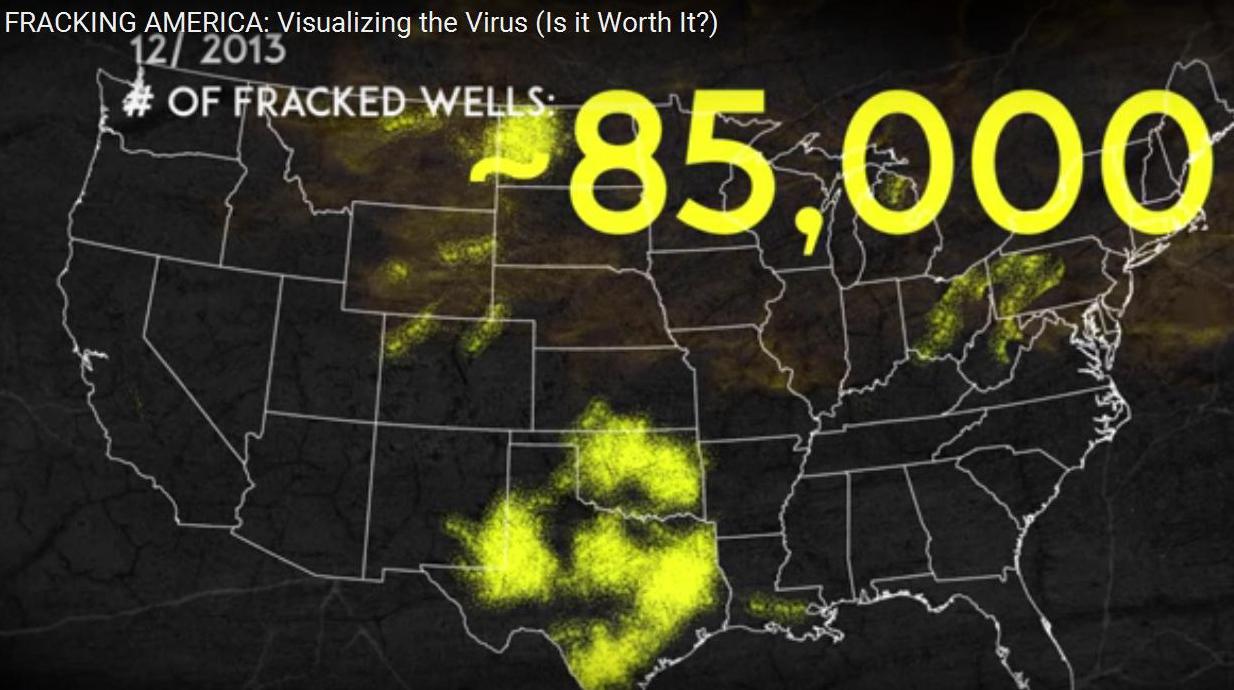

A Visual Of Fracking Spreading Across The USA As Of 2013 - 2008 to Current Sept. Of 2023 - 153,651 Wells Added In The Bakken, Eagle Ford, Permian

675,000 Wells Are Projected By 2040 - Trillions Of Dollars To Get At 20, 30, Barrels Of Oil A Day Per Well

| The USA Return To Top Of Page |

| Texas - Minus The EIA Return To Top Of Page |

Eagle Ford & Texas Boom Or Bust

Permian Basin - West Texas Boom Or Bust

Updated When All Three Report Same Month Data - Sept. 2023

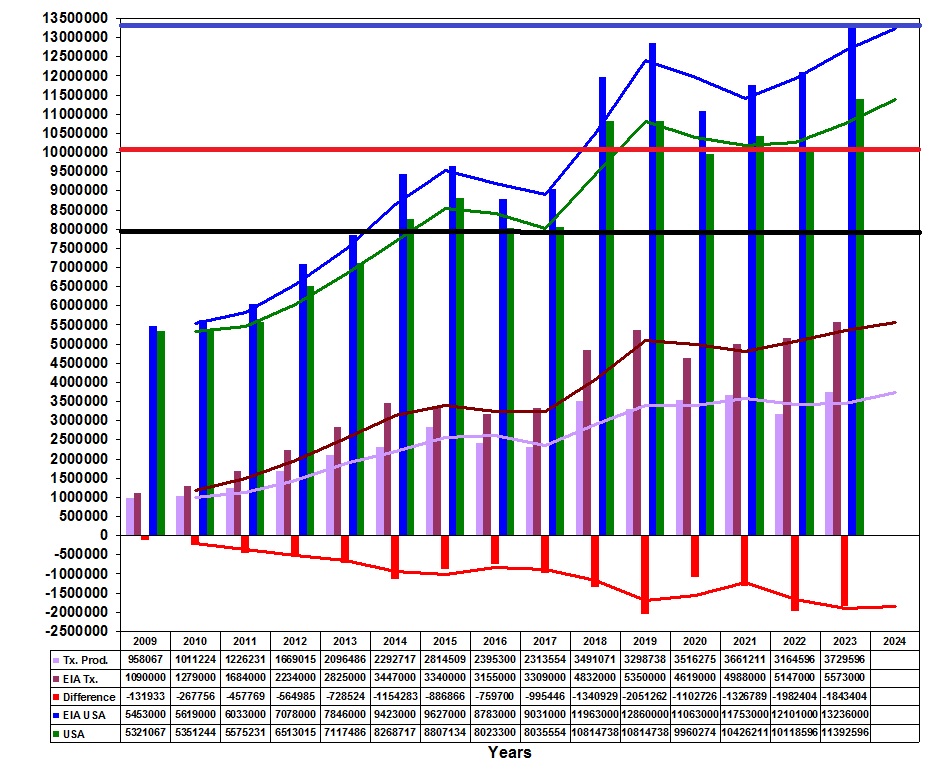

Texas State Production - EIA Texas Production - EIA USA Production

For 14 Years Of Massive Hype & Debt Equity & Pollution - The 1970 Peak Of 10,044,000 Barrels Per Day Just Cannot Be Reached

It Has Been Reached At A Unbelievable Debt - Financially & Environmentally - Can It Be Maintained?

Bare In Mind The EIA Difference In Texas Of Counting Condensate As Crude Oil Production

Condensate & Crude Are Not The Same

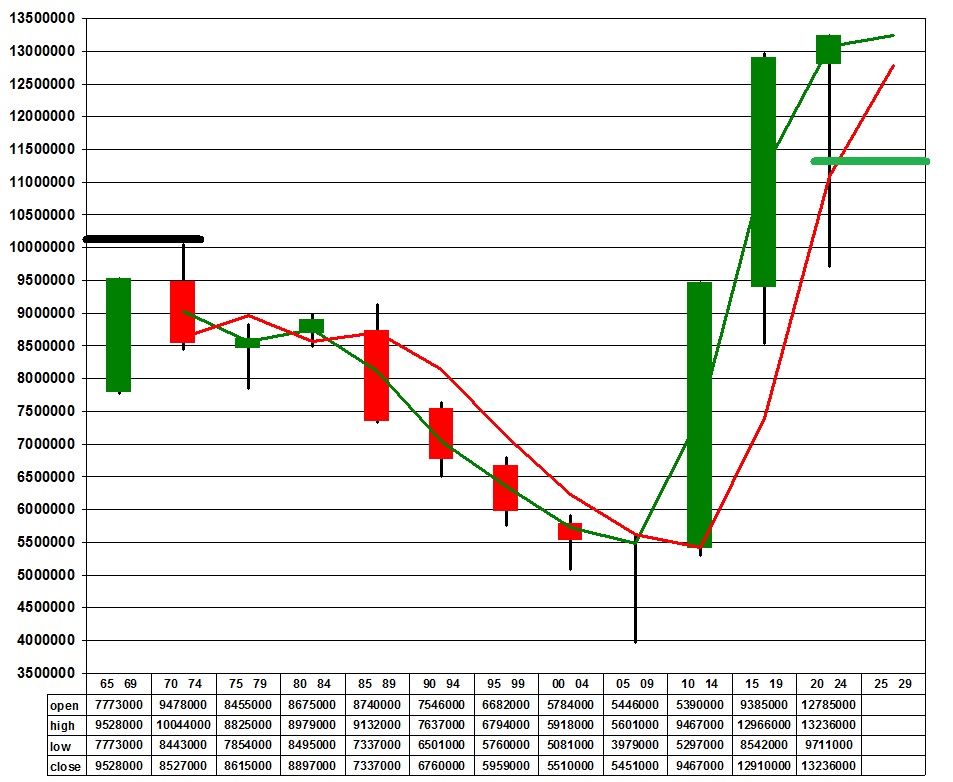

Marion King Hubbert Was Correct In 1956 & Stands Correct Today

Hubbert Was Aware Of The Tar Sands & Shale (Tight) Oil Being Exploited One Day When He Made His Calculation

Voices Gone But Not Forgotten

USA Peaked In 1970 10,044,000 - Red Line - 1988 Peak With Alaska 7,900,000 - Black Line - 2023 Tight Oil Peak 13,236,000 - Blue Line

2009 To Current 2023 bbl's Per Day

Texas State Actual Reported Crude Oil Production - EIA Texas Reported Production Includes Condensate -

Minus The Difference - EIA Reported USA Production - USA Actual Production Minus The Difference

Time Frame One Year - Barrels Per Day - Current Sept. 2023

The USA Daily Production Is Off By 1,843,404 bbl's A Day Sept. 2023 - With Texas Condensate Alone

The USA Produces A Lot Of Condensate

EIA Condensate Production By API Gravity Rating

| TRRC Monthly Oil

& Gas Production 3,729,596 bbl's a day. |

EIA - USA

Current Production Is 13,236,000 bbl's a day. Actual Crude Oil Is 11,392,496 bbl's a day. |

| EIA - Texas Current Production Is 5,573,000 bbl's a day - EIA Includes Condensate |

Unconventional Unproven Leading To Gas

- Not Oil ? Use Translate Button - Top Right |

All The Equity Threw At Tight Oil & The Peak Of 1970 Just Can Not Be Reached

It Has Been Reached At A Unbelievable Debt - Financially & Environmentally - Can It Be Maintained?

50 Years Later (Minus Texas Condensate) Crude Oil Production Is Up 1,348,596 bbl's Per Day

Even With Texas Condensate - Production Is Up 3,192,000 bbl's Per Day

From 1970 Peak Of 10,044,000 bbl's Per Day

If You Take Out The Texas Condensate (Chart Above) That The EIA Counts As Oil Every Month - The Picture Requires More Equity!

The Time Frame Is Five Year Candles - Math, Nature, Equity Debt & Marion King Hubbert Are Priceless

Black Line Is 1970 Peak - Green Line Is Minus Texas Condensate - Actual USA Crude Oil Production In 2023

USA Production - 1965 To Current Sept. 2023 - Five Year Candles

EIA - All Crude Oil Production By State

| The World Return To Top Of Page |

| Iran - Boom Or Bust |

Saudi Arabia - Ghawar Field Boom Or

Bust |

The Coming Bust In World Fossil Fuels

| Falling Rig Count Return To Top Of Page |

Bakken/ND - Year Over Year

To Date - Sept. 1 - 2023 - Down 7 Rigs - Current Count 31 - Last Year 38

Baker Hughes Rig Counts

How Many Wells Will You Drill Until You Just Run Out Of Equity

The Number Of Wells Keeps Climbing & Oil Production Bangs Sideways & Down

Bakken/North Dakota - Boom Or Bust

| They Say

It's So! Return To Top Of Page |

October 2015 - Playing Pass The Risk In The (Tight Oil) Shale Patch

"The Saudis and OPEC haven't killed American oil...haven't killed American shale.

What they've done is make it faster, stronger, better and more ready to compete with them going forward,” said Dan Eberhart CEO, of Canary LLC, North Dakota."

| Frackers Undeterred | John Mauldin Confirms | Failing Economics 101 |

Some Have Become So Efficient They Have Had To Seek Equity Protection To Protect There Efficiency

Going For Broke

Billions Of Barrels Of Oil Gone In A Puff 12/2015

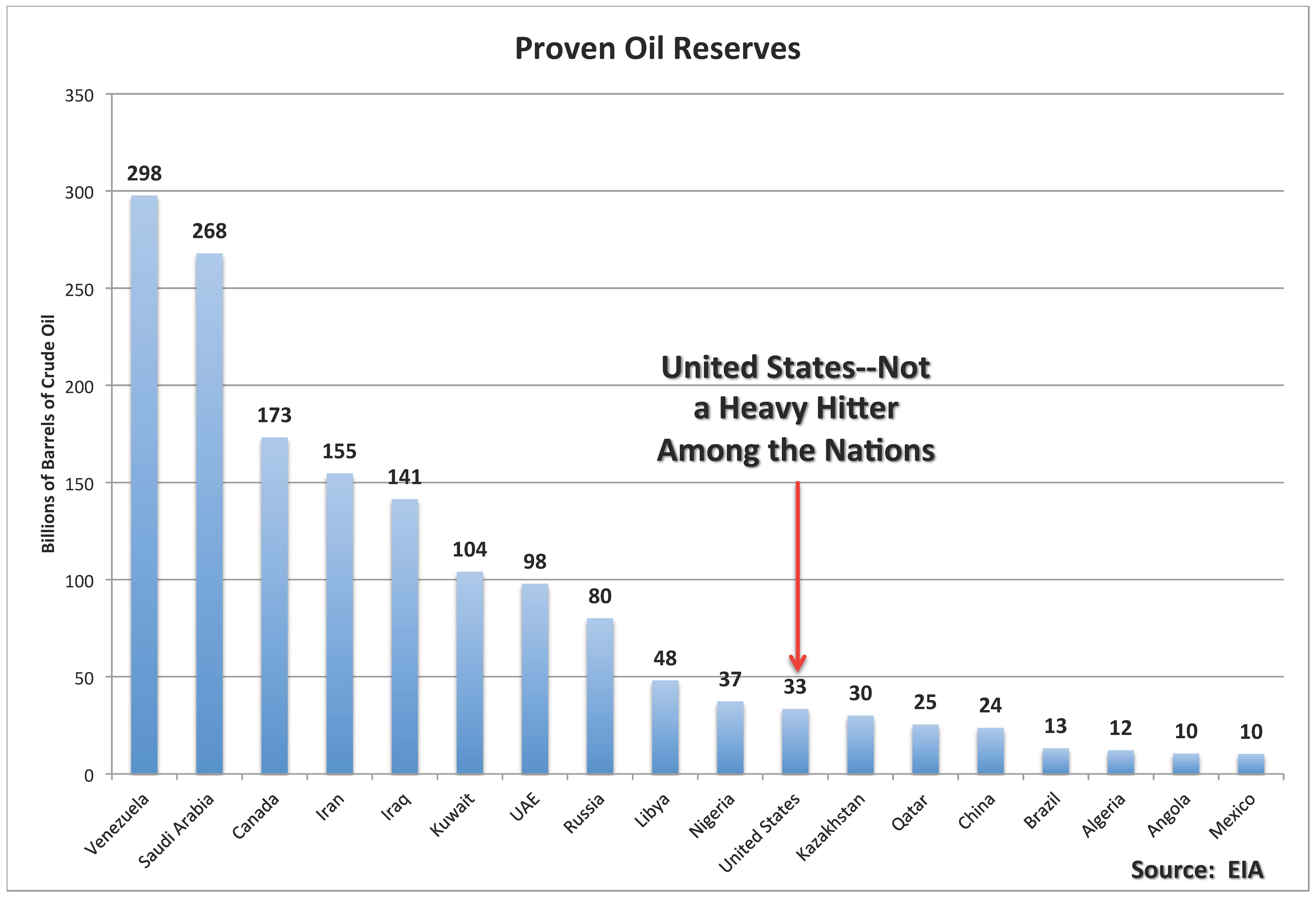

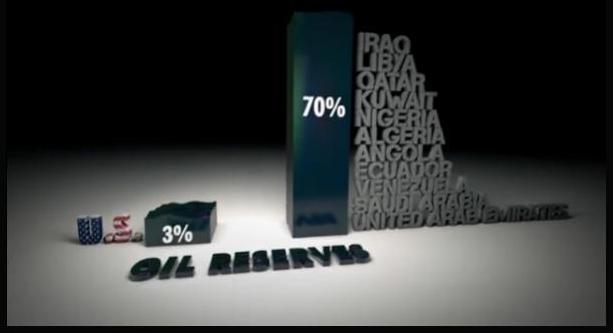

It Is So So So Refreshing To Hear Locals Argue That The USA Has More Reserves

(Not Resources) Then Saudi. Then They Tell You To Go Look It Up On The Internet!

Well The Graph Below Is From The EIA Itself. & The One Below That From BP

& The Link To The Most Current BP 2020 Statistical Review

The U.S. does not have significant oil reserves in spite of what we read and hear in the mainstream media.

It is true that we are producing a lot of oil today, more liquids than Saudi Arabia.

That does not mean that we will have enough for ourselves in a few years.

In fact, the U.S. is only 11th in world for proven reserves

With 33 billion barrels compared with Saudi Arabia’s 268 billion barrels.

The USA & Its Oil Abundance

The Info Told To Locals

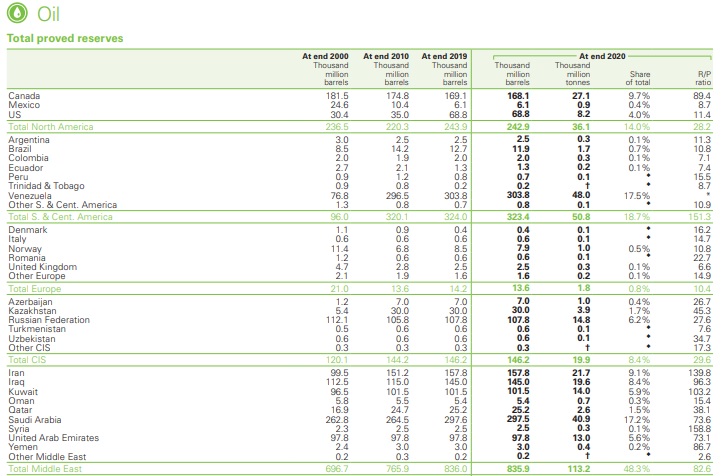

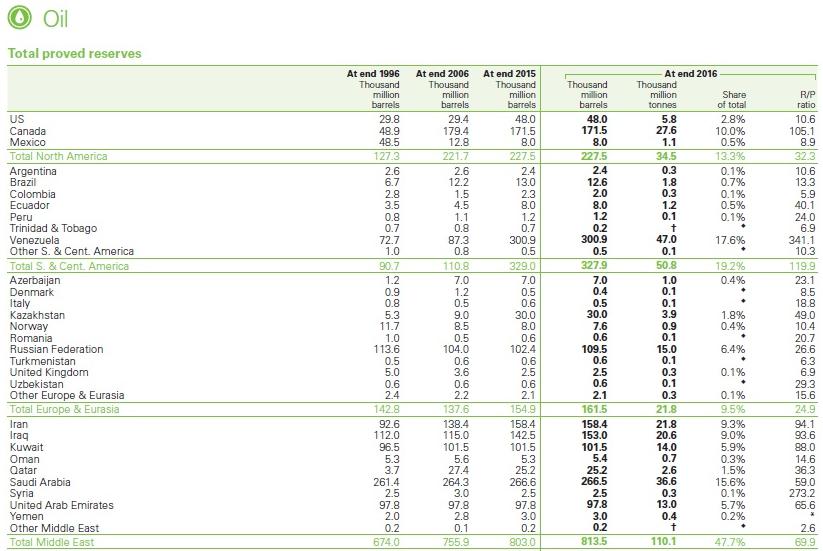

BP 2020 Statistical Review

Proved Reserves 2020

How did BP go from 48 Billion Barrels 2016 to 68 Billion Barrels 2020?

Proved Reserves 2016

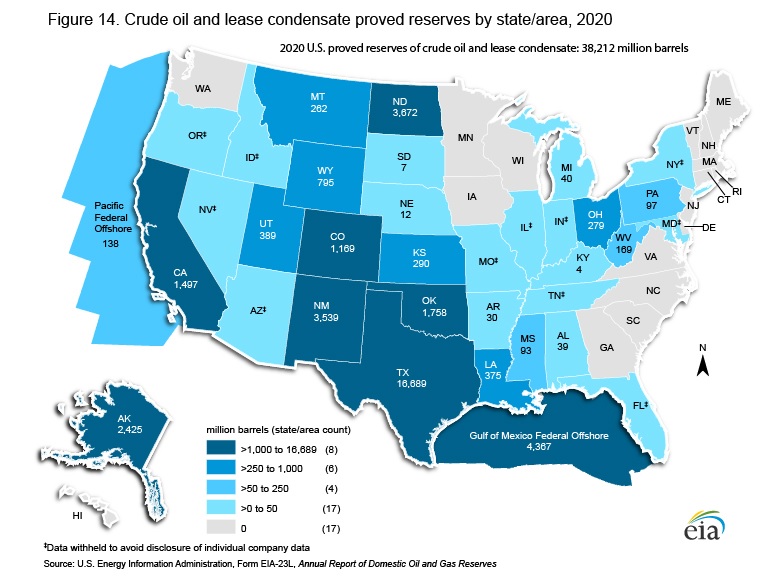

When EIA 2020 Has 38 Billion Barrels

EIA Proven Reserves

The US Military Gets It - The Burden - Fossil Fuel Wars

| Big Debt Return To Top Of Page |

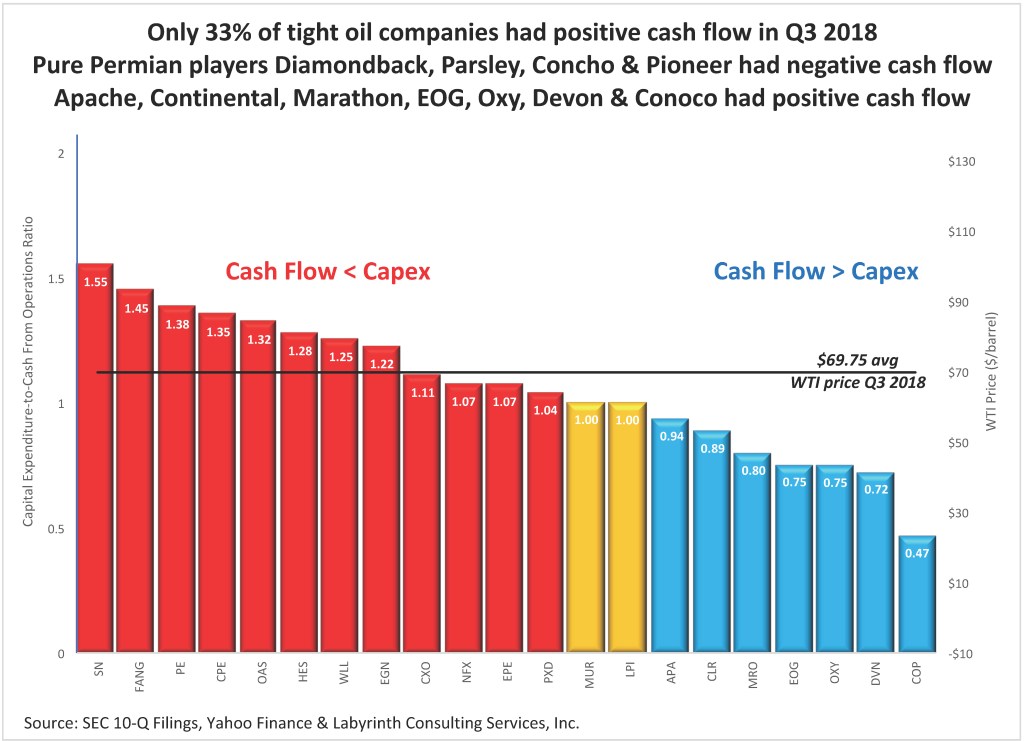

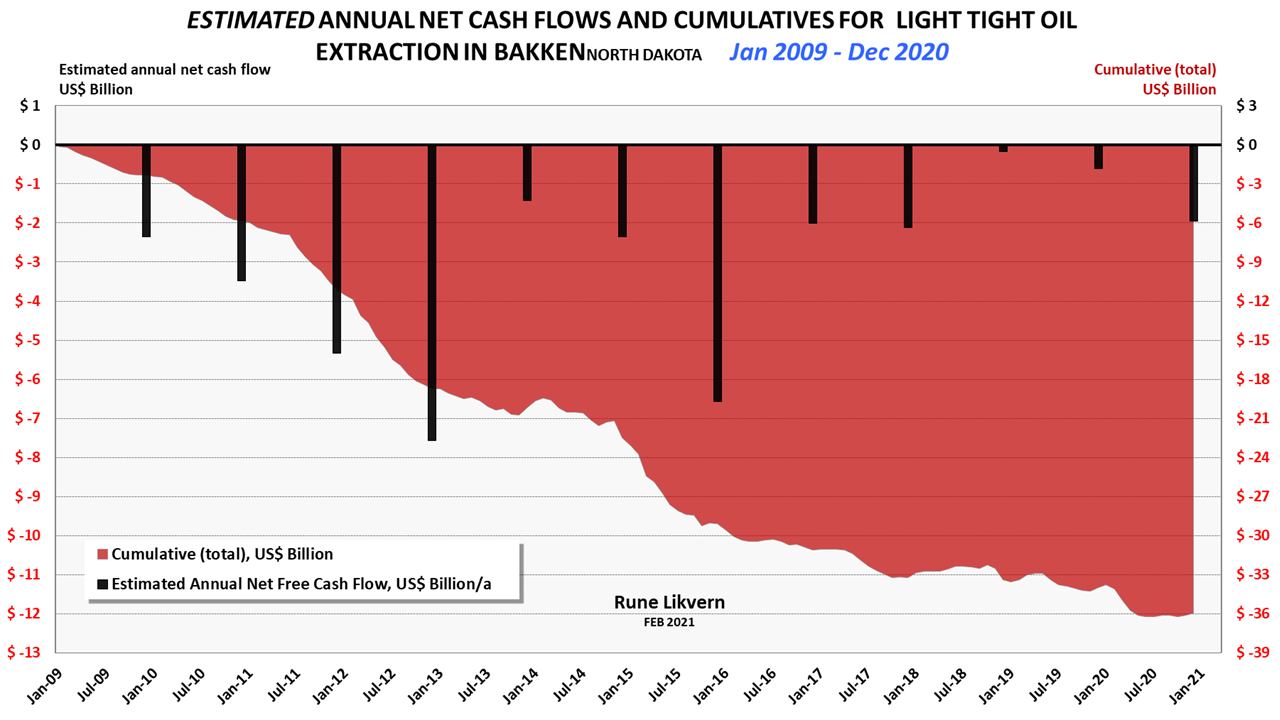

"How dumb is it to increase oil production when you are losing money on every added barrel?"

Alternative Facts - How America Broke OPEC

Bakken Economics

A Great Thank You To Rune Likvern At runelikvern.com - For The Amazing Data He Compiles

A Great Thank You To Art Berman At artberman.com - For The Insight Of His Data

A Great Thank You To Enno Peters At shaleprofile.com - Visualizing US Shale (Tight Oil) Production

| Then

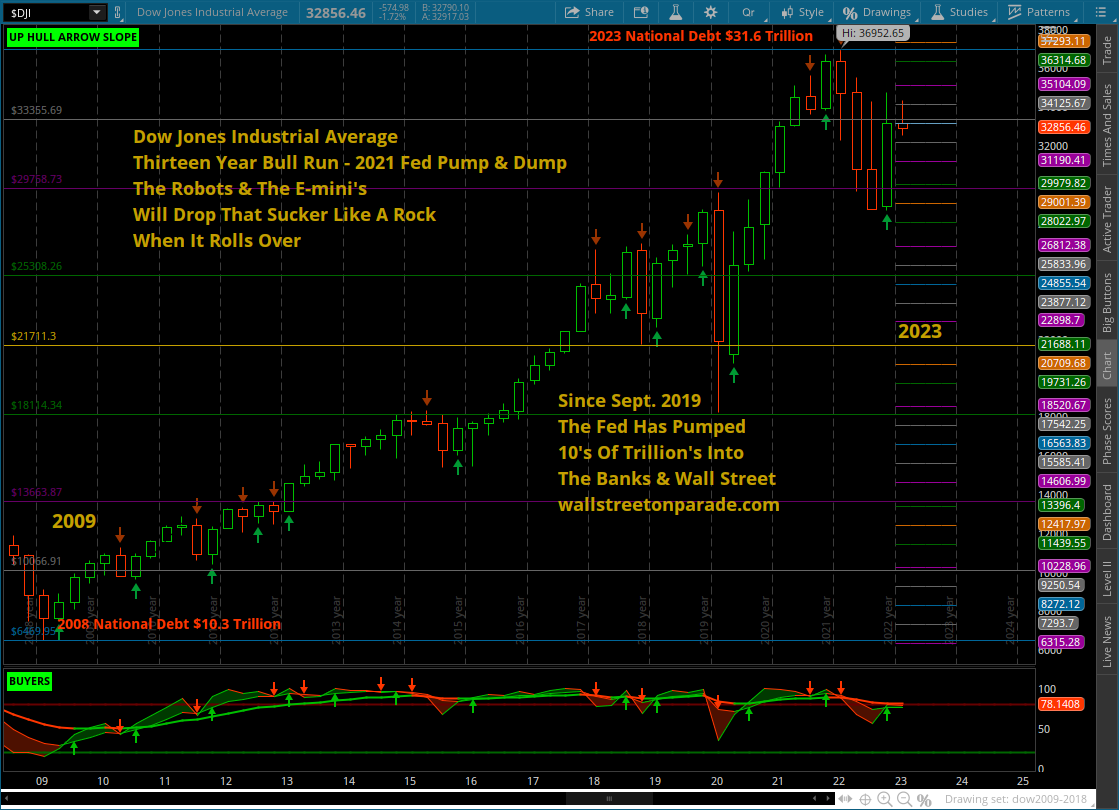

& Now - The Dow Return To Top Of Page |

Those Who Cannot Remember The Past Are Condemned To Repeat It Geroge Santayana So Are Those Who Do Not Study Their History

In Recent Past The USA Went Into The Worst Financial Crisis Since The 1930's Dow Crash - Just A Short Ten Years Ago - Those Equity Debt Issues Still Exist

With Bold New Leadership In Washington & Bismarck - There Is Just No Way This Can Happen Again - Is There?

You Cant Help But Give Equity To The Charts - The Comparisons Are Startling - The Roaring Teens Of Now - Never Ending Equity & Debt

The Nation In A Opioid Epidemic - At War & The Rumblings Of More War

Dow - 2023

The Feds (Pump & Dump) Rally Is Unstoppable - It Goes Against Underlying Fundamentals - It Has Got To Be Bold New Government Driving It - Building Equity

You Cant Help But Give Equity To The Charts - The Comparisons Are Startling - The Roaring 1920's Of Then - Never Ending Equity & Debt

The Nation In A Opioid Epidemic - Yes - Yet Alone You Had A Constitutional Prohibition On Alcohol From 1920 To 1933

The USA Entered WW1 In 1917 & Some 20 Years Later WW2 Started - The USA Engaged In 1941

From Teddy To Trump - Big Pharma - Epidemic Then - Epidemic Now

Big Pharma Then & Now Plays & Played A Role

Big Pharma Then

The U.S. government’s investigation of all the factors leading to the Second World War in 1946 came to the conclusion that without IG Farben the Second World War would simply not have been possible.

We have to come to grips with the fact that it was not the psychopath, Adolph Hitler, or bad genes of the German people that brought about the Second World War.

Economic greed by companies like Bayer, BASF and Hoechst was the key factor in bringing about the Holocaust.

The Dow In The 1920's - Price Would Retrace 123% Before It Found Bottom & Start A Depression That Lasted Until & Into WW2

The Stock Market Underwent Rapid Expansion, After A Period Of Wild Speculation - Sounds Like Now - Crash Started Oct.1929

| What Are The E-mini's | What Are Trading Robots |

What Are Fibonacci Retracement's ?

2023 Fibonacci Fivots - The Robots Have Gone To Them Like A Magnet

Born in shackles, livin' in a hold You gotta let the bad times roll When daddy left mama, it broke her heart and soul You gotta let the bad times roll

If life's a bowl of cherries, you gotta break the bowl You're standing in the fire, wishin' it was cold When you ride with the devil, you gotta pay the toll You gotta let the bad times roll

Oh my lord, oh my lord There's a train a comin' You gotta jump on board

Oh My Lord

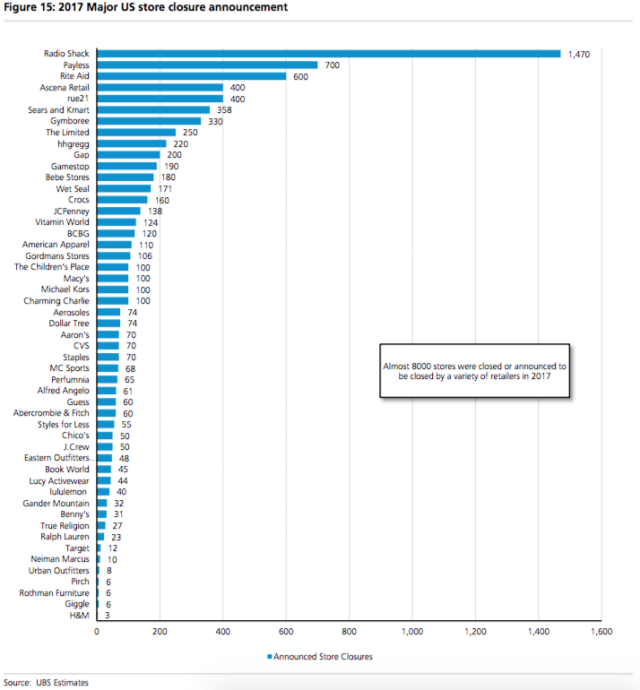

America Is So Great Again In 2017 You Had To Close 8000 Stores

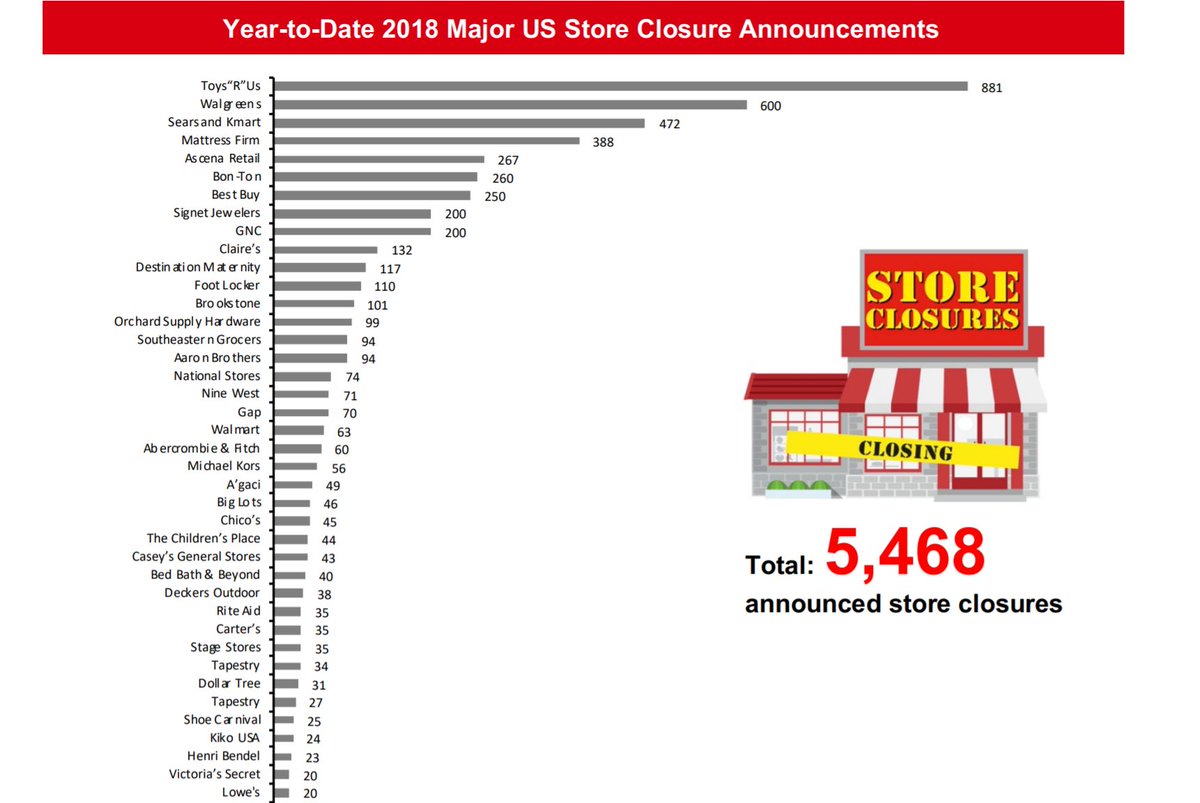

America Is So Great Again In 2018 You Had To Close 5000 Stores

America Is So Great Again In 2019 You Had To Close 4000 Stores -Already

| America's

Pledge Return To Top Of Page |

Across America, states, cities, businesses, universities, and citizens are taking action to fight climate change, grow the economy, and protect public health.

America’s Pledge brings together private and public sector leaders to ensure the United States remains a global leader

In reducing emissions and delivers the country’s ambitious climate goals of the Paris Agreement.

This Is Bold New Leadership - Without Government

For A Dying Planet

Do You Really Want To Have Your Kids Pay The Premium Of Not Doing Anything Now

Even Ronald Reagan Had Enough Brains To Take A Hedge On Ozone Depleting Chemicals - A Real Leader & Statesman

A Energy Revolution Is Needed - What Was Florida Power & Light Is Now NextEra Energy - They Even Operate In North Dakota Brady Wind Farm Now That Is Bold. 1

| americaspledgeonclimate.com1 | China Gets It & Pulls Away1 | bloombergphilanthropies |

Bakken Decline - Production - Reserves - Price - Equity - Chart

Return To Top Of Page

To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information provided on this website,

or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information we provide to any person or entity

(including, but not limited to, lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or incompleteness of this information).

We encourage you to invest carefully and read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.finra.org.

Equity Is Used In It's Definition - The Quality Of Being Fair & Impartial & The Value Of That Fairness & Impartiality - As In Well Managed Business Equity Debt - As In Well Managed Public Equity Debt Created By Local, State & Federal Leaders

The Democracy That Gives Taxpayers A Say In That Equity Debt. As In New Airports, New Public Structures, New Schools, New Jails, Healthcare, Law Enforcement, Addiction Recovery, Tax Reduction, Private Investing, More Government & Bureaucrat Waste.

Thank God For Bold New Leadership That Is Of A Equity State Of Mind. No More Money Squanders, No More Career Politicians, No More Good Old Boys, No More Tilting At Windmills Whose Foundations Are Anchored In Swamps.

Just then they came in sight of thirty or forty windmills that rise from that plain. And no sooner did Don Quixote see them that he said to his squire,

"Fortune is guiding our affairs better than we ourselves could have wished. Do you see over yonder, friend Sancho, thirty or forty hulking giants? I intend to do battle with them and slay them.

With their spoils we shall begin to be rich for this is a righteous war and the removal of so foul a brood from off the face of the earth is a service God will bless."

"New Bold Leadership In The White House And In Bismarck"

The Phrase Was Coined By Now North Dakota GOP Governor Doug Burgum

IF YOU DO NOT AGREE

WITH THE TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE

IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE

OF THIS SITE

OR THE INFORMATION PROVIDED HEREIN SHALL INDICATE YOUR

CONSENT AND AGREEMENT TO THESE TERMS.

Honor -

Respect - Freedom - Country - New Bold Leadership

2018 New Well

Average Of The Big Three Of 35.9 bbl's Per Well - You Would

Need To Add 224 Wells Today To Arrest Eagle Ford Decline -

(-8,032)

If You Could

Bring Them Online Today - 224 x $8.5 Million A Well Is $1.9

Billion