You Are On Search Bakken - $4 Billion (1st) Plant Announced - 10/2014 Boom Or Bust Page

This Page Was Created October 2014 In Response To The Announcement & The Viability Of Said Promotion

| This Page's Layout Guide L to R - Top To Bottom |

It Would Be Great | It Could Be Done | 2015 Updates -

News 2nd Plant Announced |

2016 Updates -

News 3rd Plant Announced |

| Badlands NGL | Iron Sands | Bill Gilliam | Rexene |

Nova |

| The Industry | Forecast

& Decline |

NG Futures | |

|

October 2014 - This Plant Was Announced

It Is Now 2026 - No Plant - Plant's

Ten Plus Years Have Passed & Nothing Has Been Done - As It Probably Never Will Be

Yet Alone Two More Plants Were Announced - June 2015 & Sept. 2016

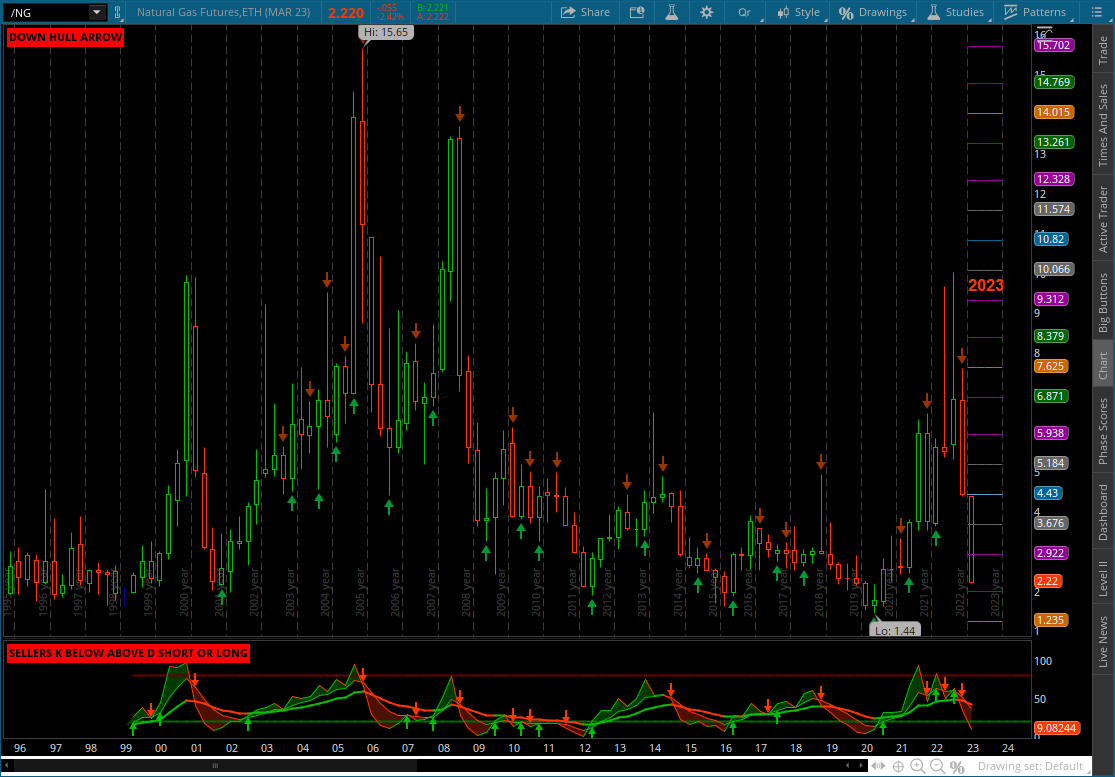

WTI Oil Was At $85.00 Then - Bakken Oil Was $67.00 Then - NG Futures Were $3.92 Then - Futures Declined Since Then - Good News For A Plastic Factory

Problem Is These Producer's Came For Oil - Not Gas. No Support For Oil - No Drilling - No Gas

Apparently Based On Form D Updated Filing Dec. 30th 2014 - $11,023,871 Has Been Offered & Sold To 87 Investor's - Is $126,711.16 Per.

Only $ three billion nine hundred eighty eight million, nine hundred sixty seven thousand, one hundred twenty-nine dollar's to coming online. The First Plant.

The Years Come & Go & ND Still Does Not Have a Cracker

Badlands Files Bankruptcy

The State & Others have removed their hype studies as the un-vetted project died.

In This Same Time Frame Saudi Aramco & Dow Chemical Have Built & Bringing Online The $20 Billion Dollar Sadar Chemical Complex

With the production capacity to produce more than 3 million tons of diversified chemicals and plastics per year. Saudi Arabia - Boom Or Bust

| It Would Be Great Return To Top Of Page |

| "Why North Dakota" /

10-13-14 $4 Billion Plant Announced |

"The company has not

specified the capacity of the ethylene cracker or how much ethane the facility will require for feed stock. The company also has yet to choose the technology it will use for the project and has not received required permits to build the plant. Regardless, Badlands expects it to come online by 2017." / 10-17-14 |

Expect to invest $4 billion /

10-13-14 Community Leaders As Investors |

| Badlands NGL

Spoksperson / 10-22-14 Marketing Begins |

He added, with regard to his record on economic development, that he took the job at Commerce because “I was the only one I trusted to do it.” He expressed to me skepticism of these sort of economic development policies, and said that it wasn’t always fair to judge him by the job he did for his bosses | Obamanomics

! ND Constitution |

Article X, Section 18 of the state constitution reads:

The state, any county or city may make internal improvements and may engage in any industry, enterprise or business,

not prohibited by article XX of the constitution, but neither the state nor any political subdivision thereof shall otherwise loan or give

its credit or make donations to or in aid of any individual, association or corporation except for reasonable support of the poor,

nor subscribe to or become the owner of capital stock in any association or corporation.

| It Could Be

Done Return To Top Of Page |

It Could Have Been Done - It Should Have Been Done - It Will Probably Never Be Done

A Year has gone by and there is no plan, no numbers, nothing from no one that shows what numbers are involved, are needed, what the cost is, is it probable, is it profitable?

Come on, wouldn't one take current production and how much gas is needed to liquid to plastic, from that production.

You Wouldn't Go In Front Of The Sharks Without A Plan

| 2014 Value Added Study ND ngl and ethanol value added study - Quick Read |

Gas Conversion Chart | NGL - 101 - The Basics EIA NGL Work Shop Study - Quick Read |

| ND Primed For

NGL's |

Alaska Governor Wants In The NGL Business Alaska Special Session Called For |

But Were Exporting It |

Why Doesn't The State Or Fed Get Behind This & Offer The Capek VIA The Public

John Hoeven Is Always Saying We Have Energy Independence & Lets Do For The Country What We Have Done For North Dakota

2014 Value Added Study - The Non Confidential Version - quick read

What did the confidential version say?

For The Billions Worth Of Natural Gas That Has Been Burned Off - The Boat Could Have Been Floated Many Times Over

Billions Worth Of Gas Up In Smoke

| 2015 Updates

- News Return To Top Of Page |

October 2015 - Badlands Signs License Of Univation Technology

The Story

September 2015 - Badlands enters a "precedent agreement" with CLR

"Shane Goettle of the Bismarck-based firm Odney, a consultant on the project, said Badlands

Won't be able to draw on Continental's ethane until the plant is completed, hopefully in three to five years."

"A Continental spokeswoman said the company had no comment beyond the news release."

| Press Story | Define Precedent Agreement | Goettle Press Release |

Once again where are the numbers, to do this to do that, how many cubic feet, how many gallons, how much to build out to get the gas from CLR?

In the Past Year's CLR Has Had Its Own Issues To Contend With - Cutting Capex - Cutting Hedges

August 2015 - Badlands Plans To Have Two World Scale PE Facilities.

The first one is called "Shangri-La" and will be located on the water (site selected, but unannounced). This facility will consist of 1.5 million ton design and modular construction.

The second facility will be in North Dakota (site narrowed down). This facility will consist of a 2 million ton single train cracker and 135 Mb/d ethane.

Once "Shangri-La" is up and running, the North Dakota plant will be established as quickly as sufficient binding ethane agreements are signed.

Define Shangri-La

"With a decline in oil prices, Badlands makes future plans with a "Base Case" of $70/BBL WTI in 2020. Although it won't be for a few more years,

When this manufacturing plant is established in North Dakota - it's going to transform the economy and open many doors of opportunities." Gilliam.

WTI Has Only Traded Above $60.00 A barrel - 10 Out Of The Last 21 Years - Bakken Oil - 4 Out Of The Past 21 Years

August 2015 - CHS Drops Plan For North Dakota Plant

Instead Takes $2.8 Billion Stake In Existing Plant

May 2015 - Even Minot ND Was Getting On The Bandwagon For A Gas Plant.

Minot & NGLs

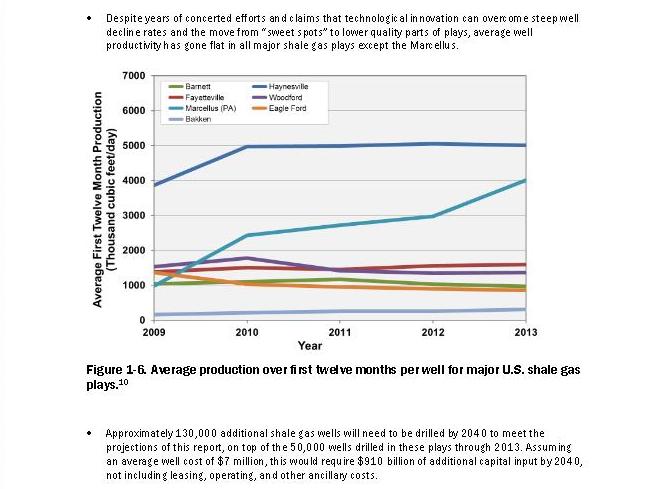

August 2015 - Has Shale (Tight Oil) Gas Production Already Stalled?

No Joy In Mudville - Shale (Tight Oil) Gas Stalls - LNG, Export Dead On Arrival

June 2015- Now A Second Plant Is To Be Built - Before The First One?

“We are committed to building the North Dakota facility as quickly and as large as is commensurate with ethane commitments we receive,”

He (Gilliam) said. “At this point, we don’t have any ethane commitments.”

| Story In The Jamestown Sun Is Jamestown The Location ? |

Badlands NGL "Proposed" ND Plant Looking At Second Plant |

PSC Hearings Set For Vantage

March 2015 - News On The Future Of The Plant - It Is To Be Delayed

“We want to add value to one of the least valuable components in the liquid natural gas stream.”

Badlands intended to reach a decision on a location by the first quarter of 2015.

| Badlands NGL Plant Delayed |

Plant Delayed Google Search |

Badlands NGL Plant Delayed |

March 2015 - Cracker Developers Nervous

About Building More Crackers

February 2015 - More Reflection Is Needed

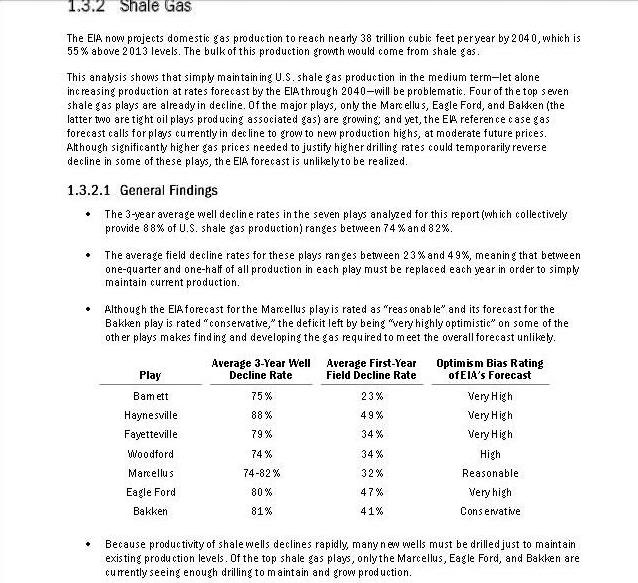

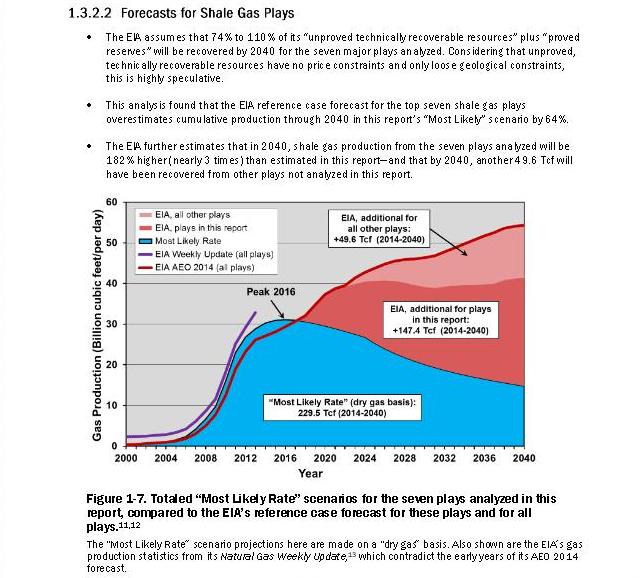

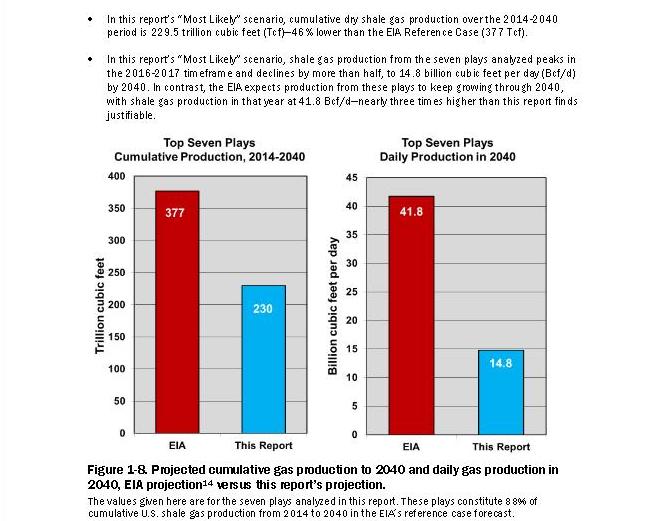

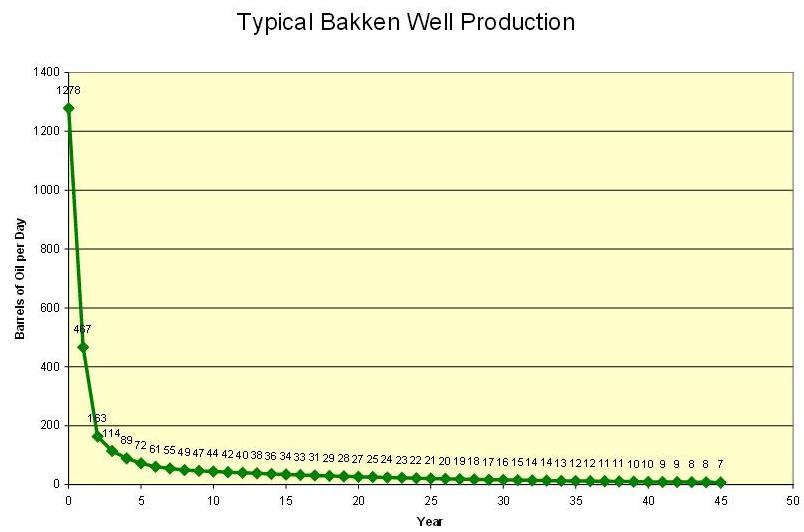

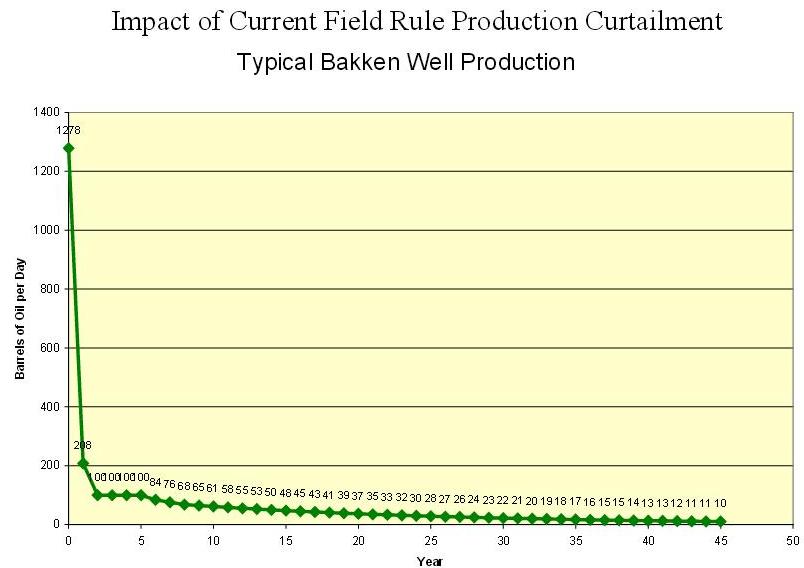

Shale Plays Have Years - Not Decades Of Reserves

Return To Index Home Page - bakkenboomorbust.com

| As An Investor One Should

Always Do Due Diligence |

"It's Not My Monkey - It's Not My Circus" Leslie A. |

| 2016 Updates

- News Return To Top Of Page |

Gilliam still sees the Bakken as a viable location for Badlands NGL, but there are some business climate issue to iron out.

“There are challenges to building this in North Dakota, if you stick built this polyethylene plant just like you would on the gulf coast,

the peak employment would be 9,000 people,” Gilliam said. “Now we may not reach 9,000 but there are counties we are considering

that do not even have 2,000 people living in them. So there are going to be some very formidable challenges. But we feel it has to get built.”

The Disparity

Badlands NGLs, LLC announces Development of Gulf Coast Merchant Alpha Olefins Facility 09-2016

It doesn't say where it will be built, what it will cost, who will provide licensed technology to due the process!

This will be the third plant since 2014 announced by Badlands - the first two have never been built.

The Announcement

Also it appears it is not the first plant or expansion of it's kind in the USA!

| Linear

Alpha Olefin |

Proprietary Ethylene Metathesis |

| Louisiana

Plant Expansion |

INEOS To

Build USA Plant |

| ND Is In A Recession ? | Going For Broke |

| Badlands NGL Return To Top Of Page |

Announcement on you tube

Bill Gilliam Press

October 2014 - The Website Was Parked On Go-Daddy - If Your Going To Build A $4 Billion Dollar Plant

Wouldn't You Have A Website With Something Other Then Psychic Readings & Health Insurance Adds? Before A Press Conference!

December 2014 - It's A Website That Is About Tourism & ND Trivia

It Is Now About Badlands - December 2016

In 2019 It Is A Website With Some Guy Arm Wrestling A Beaver

badlandssngls.com

December 2015 - Apparently Based On Form D Updated Filing $11,023,871 Has Been Offered & Sold To 87 Investor's - Is $126,711.16 Per.

| badlandssngls

on linked in.com "The enclosed describes the context for our final $10M pre–public capital raise now underway, including all current status, and speaks for itself. The material is a short read. " Page Has Been Removed 11/2014 |

badlandssngls

Actual Form Read Lines 13, 14, 15, 16. Do The Math As Of This Filing Total Sold $550,001 - C omission's $550,000 = $1.00 The material is a short read. |

Iron Sands Corp. Filings At The SEC |

Badlands NGLs Filings At The SEC |

Governor Jack Dalrymple - Bill Gilliam & Associate - Doug Goehring - Wayne Stenehjem - John Hoeven

Did Any Of Them Vett Gilliam & What They Were Being Told That October Day - NO

As A Human & Or An Investor One Should Always Do Due Diligence To Protect Oneself - One Should Always Do Vetting Before Living Or Investing - Not Hype Crap

"Tipping Point"

(Despite the name, ethane rejection could also be considered ethane inclusion: the ethane stays in the natural gas stream

Because its BTU content is more valuable in the gas than extracted, primarily because of low ethane prices.

So it’s referred to as rejection because it’s rejected as standalone ethane)

No wise man has the power to reason away What seems to be

What A Fool Believes

The song lyrics tell a story of a man who is reunited with an old love interest and

Attempts to rekindle a romantic relationship with her before discovering that one never really existed. What An Irony

Define Irony - a state of affairs or an event that seems deliberately contrary to what one expects and is often amusing as a result.

| Iron Sands Return To Top Of Page |

Then Google

Iron Sands Corp.

Press On plasticstoday.com

There wasn't much information on Badlands NGL in the release. According to the company's LinkedIn page,

Badlands NGL is public affiliated with Iron Sands Corp., which is a company "organized as a vehicle to investigate and,

if such investigation warrants, acquire a target company or business seeking the perceived advantages of being a publicly held corporation."

Press On icis.com

Iron Sands was created to acquire a company and, as such, is described as a blank-check company,

according to its annual report. The CEO of Iron Sands is Samir Masri, who is also the founding partner

of Masri & Masri, a tax and accounting services company in Great Neck, New York.

A call to Masri & Masri was forwarded to its operating partner for the Badlands NGL project. The call was not returned.

| Iron Sands Corp. - 10Q Filing - 2014 To The SEC | Iron Sands Corp. - All Filings To The SEC |

Liquidity and Capital Resources

As of June 30, 2014, the

Company had assets equal to $89, comprised exclusively of

cash.

This compares with assets equal to $2,672 as of March

31, 2014, comprised exclusively of cash.

The Company’s current liabilities as of June 30, 2014 totaled

$100,687 comprised of amounts due to related parties and

accounts payable and accrued expenses.

This compares to the Company’s current liabilities as of March

31, 2014 of $90,594, comprised of accounts payable, accrued

expenses and amounts due to related parties.

The Company can provide

no assurance that it can continue to satisfy its cash

requirements for at least the next twelve months.

| Iron Sands

Corp. salary.com |

Iron Sands Corp. is Masri & Masri |

They Look Like Really Nice Guys. Wonder If They've Ever Been To North Dakota

But Look's Can Be Deceiving

Beating Up The Mayor

Sounds Like A Bakken Town - The Mayor Insulted His Mom!

They Sure Have Alot Of Blank Check Companies - TRENTON ACQUISITION CORP - Fern Holdings Corp. - Iron Sands

| Bill Gilliam Return To Top Of Page |

Google Search

| CEO Bill

Gilliam |

William

Jeffery Gilliam |

| Then Check zoominfo.com |

Then

There Is PANA & AVEC PANA & AVEC |

| Then There Is AVEC AVEC |

Then There Is The AVEC Website AVEC |

Their Stock Traded From 2003 to 2011 - $116.00 Down to $0.04 Cents

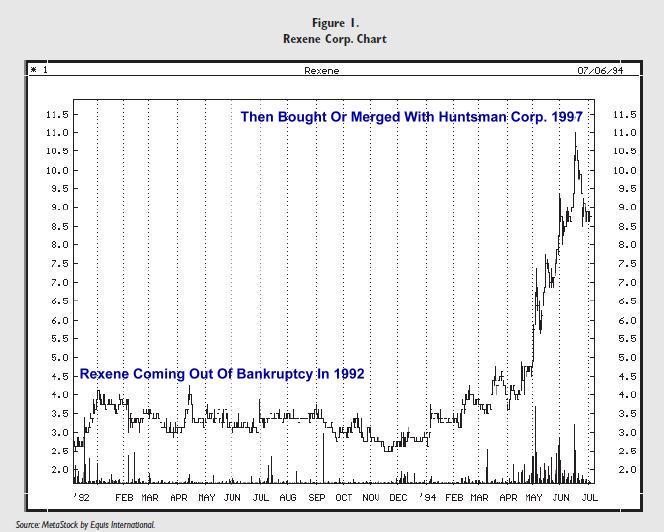

| Then There Is Rexene Corp. Return To Top Of Page |

Google Search

Rexene Corp.

That's how he said he operated Rexene, which Gilliam said went from bringing in $7 million in 1986

to $78 million in 1987 to more than $130 million in 1988.

Then Chapter 11 in 1991.

Former CEO Looks To Reopen Rexene Plant - Sept. - 2009

While he would settle for purchasing just the Odessa plant, Gilliam said he is interested in buying all of Flint Hills'

polymers division, which includes plants in Longview and Marysville, Mich.

Flint Hills Purchase

Owned By Koch Industries - 2012 Revenue Of 115 Billion

Because of the size of the project, Gilliam said the new company should be able to immediately be posted on the New York Stock Exchange.

Gilliam intends to take the company public and has identified a number of "shell" companies with no assets other than cash that could invest.

Richard From, chief executive officer of Peyton, Chandler & Sullivan, a broker and dealer company, said he has located a number of public vehicles

with between $25 million to $150 million in cash on their balance sheets that are looking for a public company.

Peyton Chandler Sullivan - Captured On The Way Back Machine

| Then

There Is Rexene Bankruptcy & Golf Rexene Awash In Debt |

Then There Is The

Long Sorted History Of Rexene Corp. Back From The Brink |

| And

The Unemployed Rexene Employee Association |

And In 1987 Humble Beginnings |

| And In 2014 The Plant Is Still Closed |

And Now In 2014 They Are Demolishing It |

| Then

There Is This Short But Sweet - 1989 |

Then There Is

This - Google

Search Gilliam - Joesph - Littlejohn |

| "This is what is great about

capitalism in America," - Bill Gilliam 6 to 500 million - Drexel - Micheal - 1989 |

Divorce Wall Street Style Short But Sweet - 1989 |

Mr. Gilliam has left behind a trail of broken relationships and infighting, Role In Rexene Feuds - 1991 |

Mr. Gilliam had been forced out by some of his hand-picked directors Chairman Quits |

The January Effect After Bankruptcy

Who's to know if your soul will fade at all

The one you sold to fool the world

You lost your self-esteem along the way

Fake It

Rexene Plant Being Tore Down - 2014 - What A Waste

Don't say that, don't say that, don't say that

I know you're not mine anymore, anyway, anytime

Tell me how come

I Keep Forgettin

" Iam More Interested With The Return Of My Money, Then Iam In The Return On My Money " - Mark Twain

| The

Rough Road Traveled By NOVA Chemicals Return To Top Of Page |

| Once Mighty Nova Needs Rescuer | After The Fall Former CEO |

Nova History |

I P I Company |

| The Petro Chemical Industry & Shale Gas

(Tight Oil) Return To Top Of Page |

What Is A Cracker & Why Should I Care ?

By the time the plants start operating in 2017, the numbers may not look so rosy.

Exports are poised to absorb the country’s excess ethane, a natural gas liquid that’s become the main

raw material for U.S. chemical makers as increased drilling in shale formations makes it abundant and cheap.

“Ethane exports have the potential to get really big,” Ben Nolan, a Chicago-based shipping analyst at Stifel, Nicolaus & Co., said Sept. 4.

“What people are assuming will be a lot of petrochemical manufacturing growth in the back end of the decade may not materialize.”

Chemical Factory Boom At Risk

| Chemical Boom & Over Building | Tipping Point |

| NGL 1.

Dirty Deeds Done Dirt Cheap |

NGL 2. She Dont Lie She Dont Lie | NGL 3. No Particular Place To Go |

The Ethane Asylum |

Ethylene Who Will Benefit ? |

The Gas Is Hot Tonight |

Is Unconventional Unproven Leading To Gas Condensate Not Oil ?

"Given that the plant will have the capacity to produce enough PE

For every citizen of North Dakota to take home more than 4500 pounds annually"

Frackers & Crackers Every Where !

Return To Index Home Page - bakkenboomorbust.com

The following lists some of the projects.

|

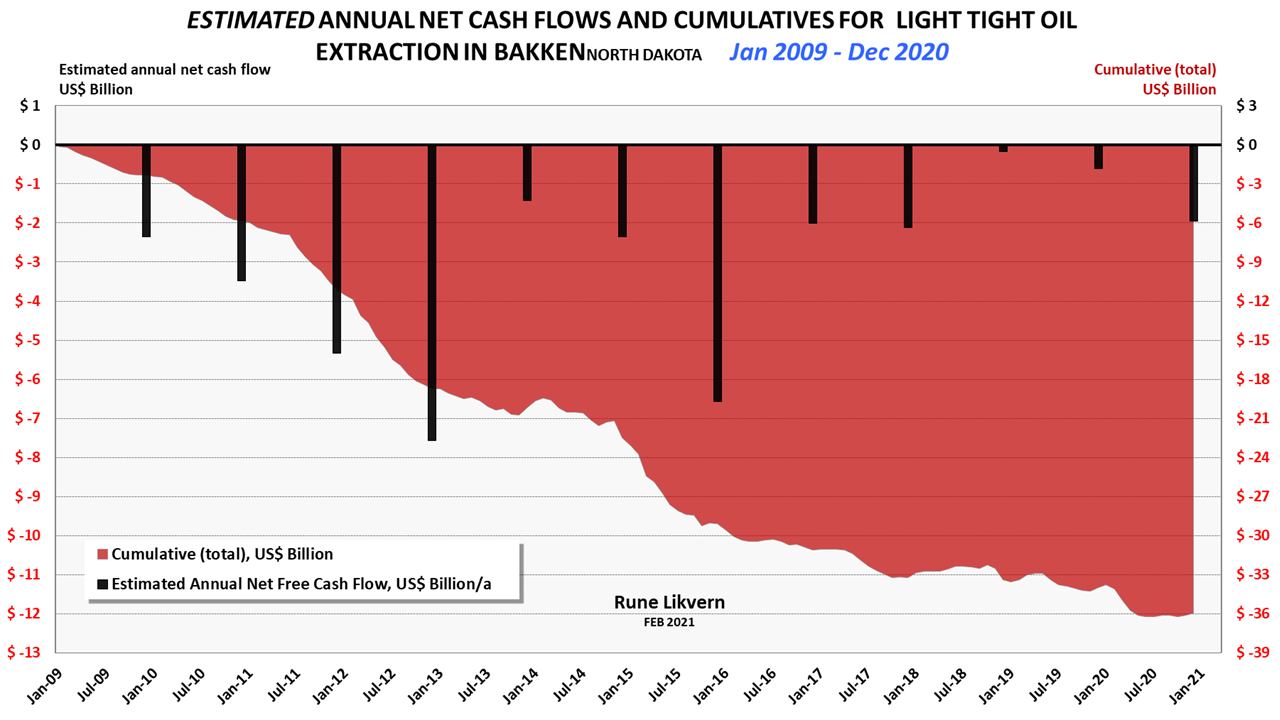

| Forecast & Decline Return To Top Of Page |

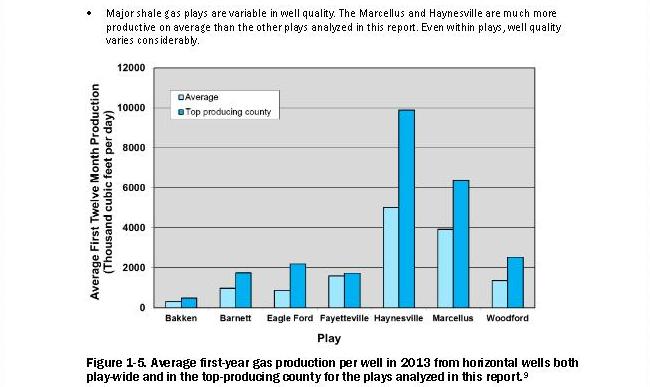

Drilling Deeper

Just Released - October 2014

A REALITY CHECK ON U.S. GOVERNMENT FORECASTS FOR A LASTING TIGHT OIL & SHALE GAS BOOM - J David Hughes

Drilling Deeper - 2015

Even as we've become less hooked on crude, we've become more addicted to drilling

-- Randy Udall ( 1951 - 2013 )

| Voice's Gone But Not Forgotten | Don't Fear The Reaper |

Flairing Task Force Report 03/2014

Ethane Future's Price Chart & Plant Completion Time Table

“ Be Fearful When Others Are Greedy and Greedy When Others Are Fearful ” - Warren Buffett

Question Is

We're setting sail To the place on the map from which no one has ever returned

Drawn by the promise of the joker and the fool By the light of the crosses that burn

Oh, save me. Save me from tomorrow I don't want to sail with this ship of fools

Ship Of Fools

| NG Futures Return To Top Of Page |

NG Futures Chart

To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information provided on this website,

or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information we provide to any person or entity

(including, but not limited to, lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or incompleteness of this information).

We encourage you to invest carefully and read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.finra.org.

IF YOU DO NOT AGREE

WITH THE TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE

IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE

OF THIS SITE

OR THE INFORMATION PROVIDED HEREIN SHALL INDICATE YOUR

CONSENT AND AGREEMENT TO THESE TERMS.

Honor - Respect - Freedom - Country - USA