You Are On Search Going For Broke In Shale (Tight) Oil Boom Or Bust Page

As 2026 Progresses - Reality Is Great - Oil Prices Are (Were) Rising

The Sense Of The Sadness Has Dissipated - Taxes Are Coming Down

With "New Bold Leadership In The White House And In Bismarck" The Numbers Can Only Get Better

The Phrase Was Coined By Now North Dakota GOP Governor Doug Burgum - The Only Candidate For Governor To Endorse Trump

| This Page's Layout Guide L to R - Top To Bottom |

2026 |

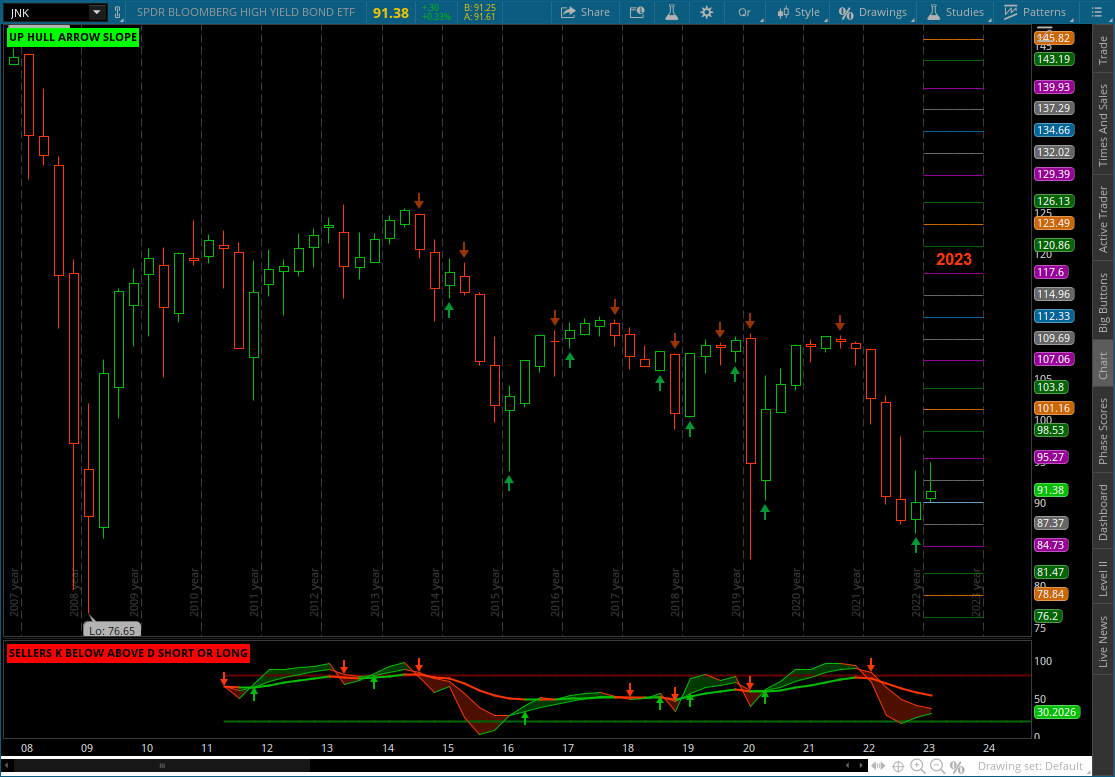

2015 | Junk - JNK | Bankruptcies De-Listings |

Willful Blindness |

| Pension Fund Broke | The Un-Godly Debt's | Iran

- Saudi Arabia The Petro Dollar |

Iran - Boom Or Bust | Saudi Arabia Ghawar Boom Or Bust |

Deja

Vu - 1982 |

Flashback "If I were president, you'd have $30 oil right now," Trump said. "I would call up Saudi Arabia ... and I would say,

'That f***ing price is coming down, and it's coming down now.' And you know what? They'd lower that price so quickly, and it would be so easy."

The Con Man - Trump In 2008 Interview - Now There Friend's - They Have To Be - They Have The Oil & The IPO

$30 Oil crushes the Frackers - Then & Now - If anyone has the phone number to call & have Markets Raised & Lowered - Please publish that number so everyone has it - Or Is It 1-800 - The FOMC

Papers In The Roadside Tell of Suffering and Greed Fear Today, Forgot Tomorrow Besides the News of Holy War and Holy Need Ours Is Just a Little Sorrowed Talk

Ordinary World

| Return

To Index Home Page - bakkenboomorbust.com |

Return To Bakken - Shale (Tight) Oil Play Page |

| 2026 Return To Top Of Page |

| USA Oil Companies Filing For Bankruptcy | North Dakota Oil Companies Filing For

Bankruptcy |

| USA Oil Company Lay Offs | North Dakota Oil Company Lay Offs |

Even In 2018 Billions Lost In Trading Energy

| optionsellers.com They didn't capsize the boat - They sank it! - Loaded with other peoples Cash |

optionsellers.com - Captured On The

Way Back Machine Minimum Account Size $250K |

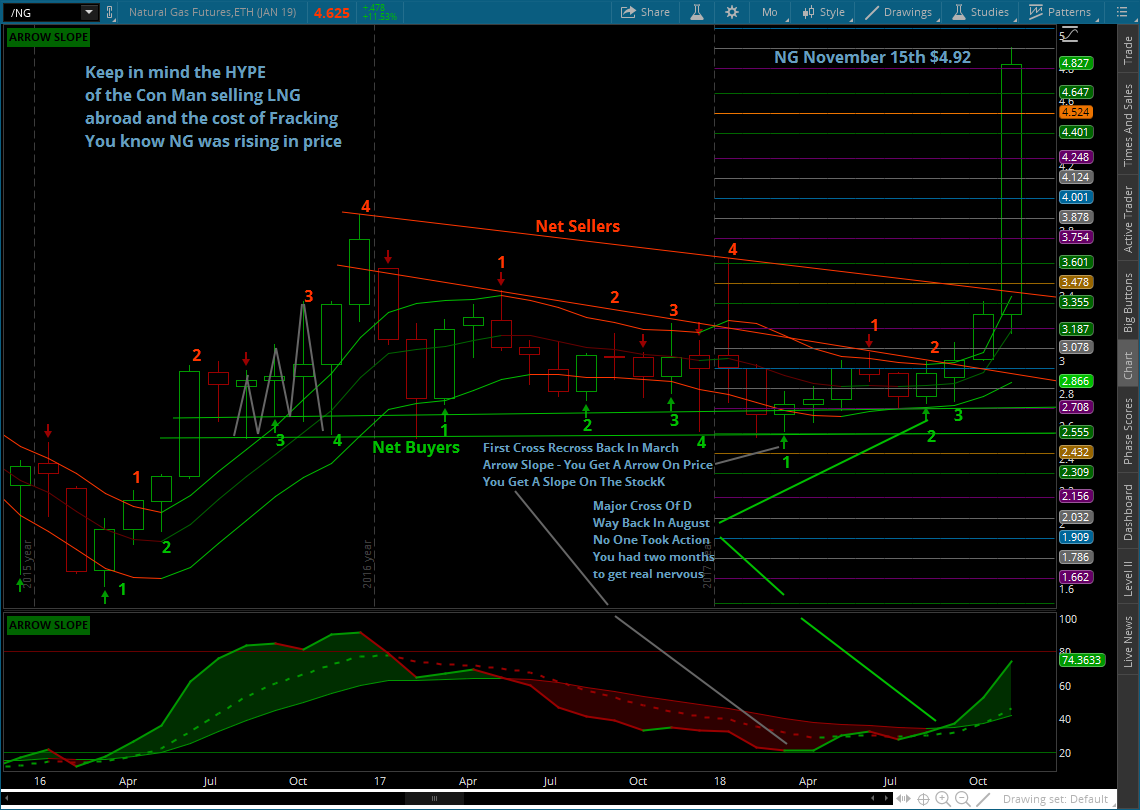

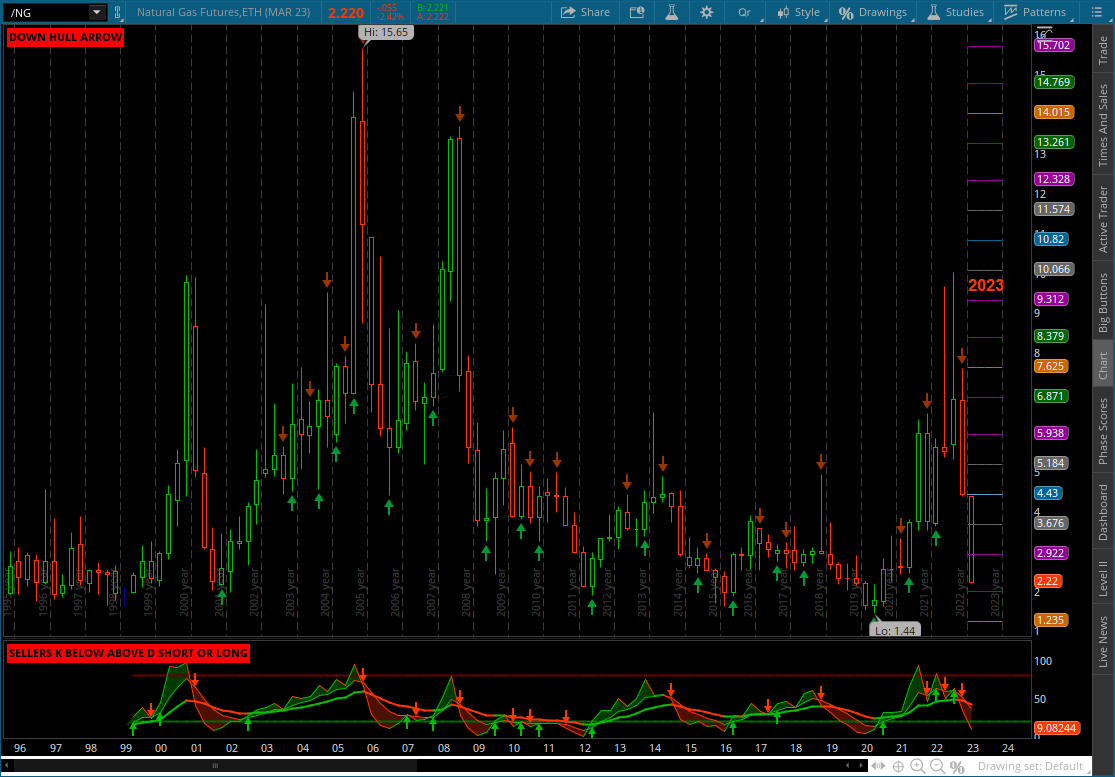

If your going to trade Futures you should at least know how or hire someone who can read a chart - NG has been rising for the past three years.

Shorting it for a counter trade for a couple of weeks maybe. It had been breaking out for four months prior to optionsellers.com capsizing the boat.

It was diverging - five waves to the bottom of the StockK. Price made a touch of the StockK band back in July - you find buyers - off to the Moon.

September would have made you nervous, cross, recross, sentiment had changed to the upside, the StockK and StockK band were on your side.

The Market gave you a chance on the cross, recross in September to exit your shorts and go long, these are one month candles, not 5 minute candles to decide.

If you were shorting NG from August on you were trading against the trend. They didn't use a stop loss, or hedge their options - they traded naked - unlimited losses

Your managing hundreds of millions and you don't have a frickin clue of what your doing

NG traded the Fivots to the exact line - 50% up and 100% down and 250% up - Sellers gave it up when the StockK, K crossed the D, 7 and 14

They weren't waiting at the top band anymore, they were in at the bottom band buying

/NG Futures November 2018

You should not be letting other people trade Naked Options with your Money - Never Ever

This is the teaser on the homepage of optionsellers.com - There is nothing about Naked Options - Just an unexplained remark about spread options

Vertical Spreads - At least one side is always making money and you can create a huge spread and get rid of the loosing side

One Month After The Boat Sank - /NG Returned To The Lows Of September - Rule One In Trading - Use A Stop Loss - Rule Two - See Rule One

So I say I say welcome, welcome to the boom town Pick a habit We got plenty to go around Welcome, welcome to the boom town

All that money makes such a succulent sound Welcome to the boom town

| 2015 Return To Top Of Page |

October 2015 - Playing Pass The Risk In The (Tight Oil) Shale Patch

Oil Patch Braces For Day Of Reckoning 09/15/2015

"The inability of Denver-based Whiting Petroleum to sell itself is an example. The board of the North Dakota-focused company

Was forced to issue new shares, reducing the company’s value by 20 percent, and take on more expensive debt".

Retreating In Disarray 03/29/2015

| Saudi Aramco Is Hiring |

Websites With Job Postings In Saudi Arabia |

| ND Recession In 2015 ! | ND 20,000 Layoffs By June 2015 |

| The First Shale Casualty | Some Of The Latest |

A New Chapter |

| Payment - What Payment | The Struggle |

Junk |

| Just Another Day | Stressed |

Fracker Extinction |

| Saratoga Resources - Bankrupt | Hercules - Bankrupt |

Tight Oil - Being Swallowed By Its Own Debt

"In one example, Continental Resources Inc., the company credited with making North Dakota’s Bakken Shale

One of the biggest oil-producing regions in the world, (18th Largest Producing Region)

Spent almost as much (on interest payments) as Exxon Mobil Corp., a company 20 times its size."

| 75,000 Lay Offs & Counting | Titan Closes Stores | Leaving Town |

| Palmer Lays

Off |

Chaparral Cuts Jobs | Helmerich & Payne Cut Jobs |

Oxy Exits The Bakken 10/16/2015 For $500 Million

How Many Billions Did They Spend ?

The Man Who Started Oxy

Armand Hammer

Oxy Has A Long History

| Oxy History | Hooker Chemical | Love Canal |

They Seem To Spend A Lot Of Money

Irani's salary was considered excessive and not truly performance based for decades by a number of corporate governance authorities who noted that Irani's compensation

Hhad exceeded that of the head of energy giant Exxon Mobil, Rex Tillerson, who leads a company that has a market cap that is five times larger than Occidental Petroleum.

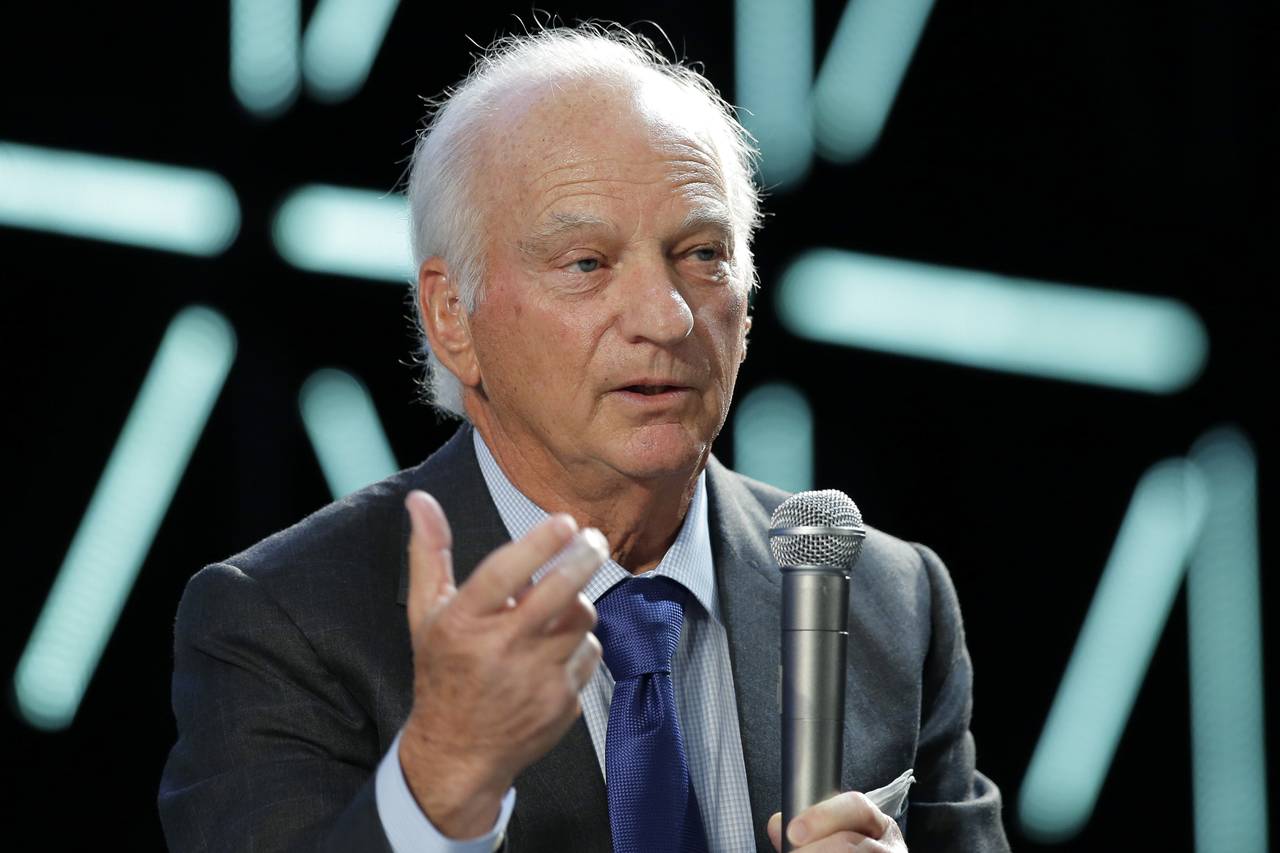

Ray Irani

Portal Service Company

| News Announcement | Portal Service Company | Google The Deal |

Chesapeake Energy Layoffs 09/29/2015

"I Need A Job" Yells One Employee

Baker Hughes Layoffs At Dickinson Facility 09/27/2015

Pumpco Closes Minot Operation 09/05/2015

| Baker Hughes Layoffs |

Pumpco Layoffs - Close Minot Store |

Like so many others why did you build some 65 to 100 miles from the sweet spots ?

Millions wasted on trucks and pickups and fuel.

February2013 Hype

Halliburton Layoffs At Williston Facility 09/22/2015

| Haliburton Williston Layoffs |

Haliburton Layoffs Williston Paper 09/22/15 |

Haliburton - thelayoff.com |

| Haliburton Layoffs Williston Paper 09/29/15 100 Laid Off & More Coming |

Halliburton Closing Minot Facility 03/25/2015

| Halliburton Leaving Minot - Washington Times | Haliburton Leaving Town |

A Lot Of People In Minot Believe Or Still Believe Halliburton To Be A Oil Company

They Are Not A E&P Exploration & Production Company - They Are A Worldwide Hydrocarbon Well Service Company.

Flashback To February 2015

Oilfield service provider Halliburton has told its roughly 1,500 North Dakota employees that job cuts are not coming, for now.

The update came in a letter to staff from Brent Eslinger, senior district manager for Halliburton in Williston.

Halliburton spokeswoman Susie McMichael added that the company

"will continue to monitor the business environment" and cut costs as needed.

No Lay Offs

| Halliburton | Started By Erle P.Halliburton |

On November 17, 2014 Halliburton and Baker Hughes jointly announced a definitive agreement under which Halliburton will,

subject to the conditions set forth in the agreement, acquire Baker Hughes in a stock and cash transaction valued at $34.6 billion.

Impact On Minot & ND

Cached on Google

| Its Always About Cash - 10 Billion

Asset Sale -03/23/2015 |

Is The Deal Poisoned - Whats Next? |

Flashback To 2010

"At the time of the announcement, Halliburton spokesman Brent Eslinger said that Minot looked "like a good spot" to locate."

| Minot The Gateway In 2010 | 2010 -Halliburton & Big Oil Moving

To Minot |

| Brent Eslinger Halliburton |

From left, Minot Mayor Curt Zimbelman, North Dakota Commerce Commissioner Shane Goettle and Brent Eslinger,

Halliburton, took part in a press conference held Tuesday morning at City Hall where Halliburton unveiled plans for a $15 million facility to be constructed in Minot.

Former Vice President Dick Cheney, who previously served as Halliburton’s CEO, was instrumental in getting the so-called

‘Halliburton Loophole’ inserted deep within the pages of "The Infamous 2005 Energy Bill". This loophole stripped the EPA of its regulatory

oversight of hydraulic fracturing in natural gas development, a technique pioneered by Halliburton.

In 2005, the oil and gas industry was granted an exemption from the Safe Drinking Water Act,

Allowing the injection of toxic fluids directly into groundwater without oversight by the U.S. Environmental Protection Agency (EPA).

| Hydraulic Fracking - Going To Far | "The Halliburton Loophole"- Politics - Oversight |

Halliburton Yard In Minot

Target Logistics, a global provider of workforce housing and one of the largest operators of turnkey solutions in North America, announced today

it has secured key contract renewals with two global oil field service companies totaling approximately $50 million over the next three years.

"Target Logistics operates 19 properties in the United States and Canada with more than 8,000 total beds."

Take and Do The Math.

$50,000,000.00 Divided By 3 Years Is 1095 Days = $45,662,00 A Day

$45,662.00 Divided By 8000 Beds = $5.70 A Day

$45,662.00 Divided By 19 Properties = $2,403.26 A Day

Great Price For A Place To Rest

| Target - The Deal |

Target Lands Contract |

| Junk - JNK Return To Top Of Page |

Bought Any JNK Lately - The ETF For HIGH YIELD Bonds

| Barred Redemption's - Mutual Fund Gone Rogue | What Is JNK |

| Bankruptcies

& Delistings Return To Top Of Page |

Dakota Plains Holdings

Dakota Plains Holdings Files For Bankruptcy Protection 12/2016

Then their indicted for fraud

Indictment

Then their convicted of fraud

Conviction

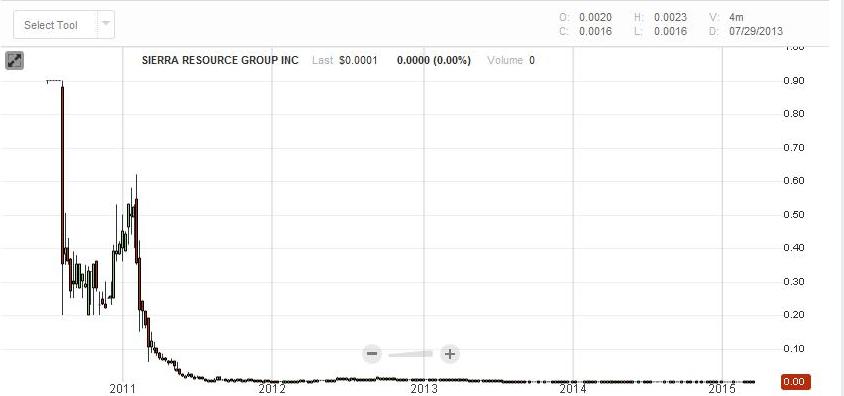

Stock traded at $12.00 in 2012 Down to $0.00 in January 2018 - Stopped Trading

Energy XXI Files For Bankruptcy Protection 04/2016

Stock traded at $38.65 in 2012 Down to $0.19 in April 2016

Goodrich Petroleum Files For Bankruptcy Protection 04/2016

Stock traded at $86.18 in 2008 Down to $0.04 in April 2016

Peabody Energy Files For Bankruptcy Protection 04/2016

Stock traded at $1330.00 in 2008 Down to $2.07 in April 2016

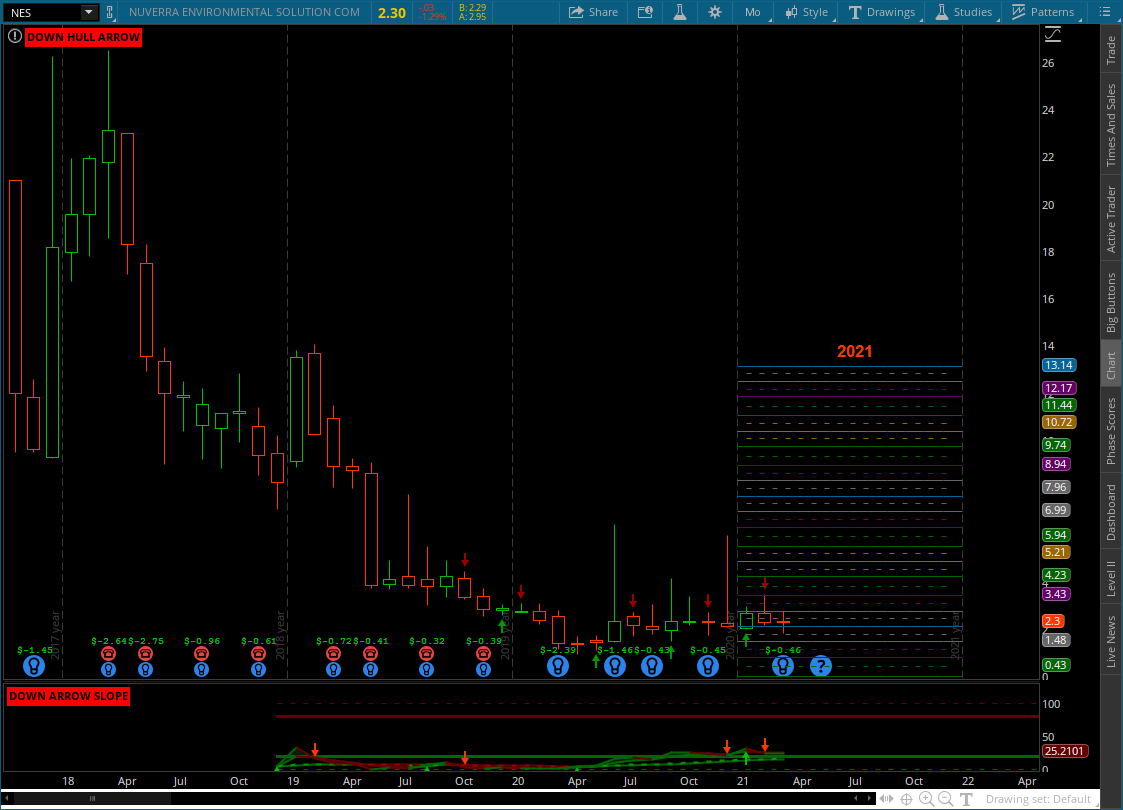

Nuverra - DBA Power Fuels Filed Bankruptcy 05-2017 Some $500 Million In Debt

Nuverra - Bankrupt - 01/2017

Nuverra - Restructuring Debt - 01/2016

Power Fuels - DBA As Nuverra - Symbol NES - Delisted 01/2016

NES Stock 10 to 1 Merger In 12/2013 - $21.29 In 2014 to $0.26 Cents On January 19th 2016 When It Was Delisted

Nuverra Now Trading As A Penny Stock As Symbol NESC - Bankruptcy 05-2017 Stock Was At $00.04 Cents A Share

NUVERRA is back trading as NES after coming out of bankruptcy in the fall of 2017 - sharp move up and down and into 2019 down.

Emerald Oil Files For Bankruptcy Protection 03/2016

Stock traded at $184.00 in 2013 Down to $1.37 on March 23

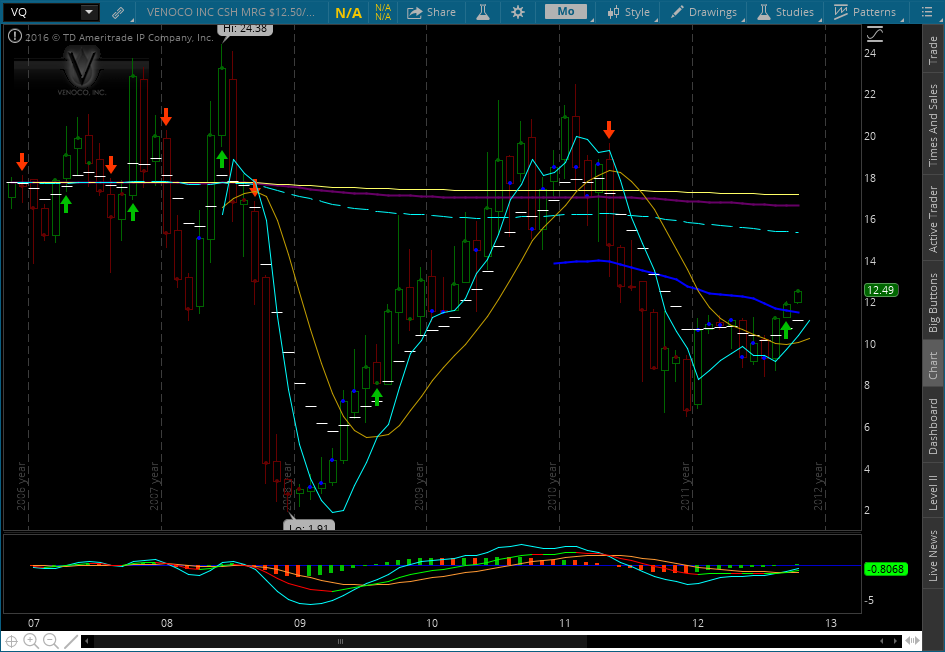

Venco Inc. Files For Bankruptcy Protection 03/2016

Venco Had Been Taken Private In 2012

Venco Inc. Stock - $12.49 In 2012 When Taken Private - $1 Billion In Debt As Of The Filing 2016

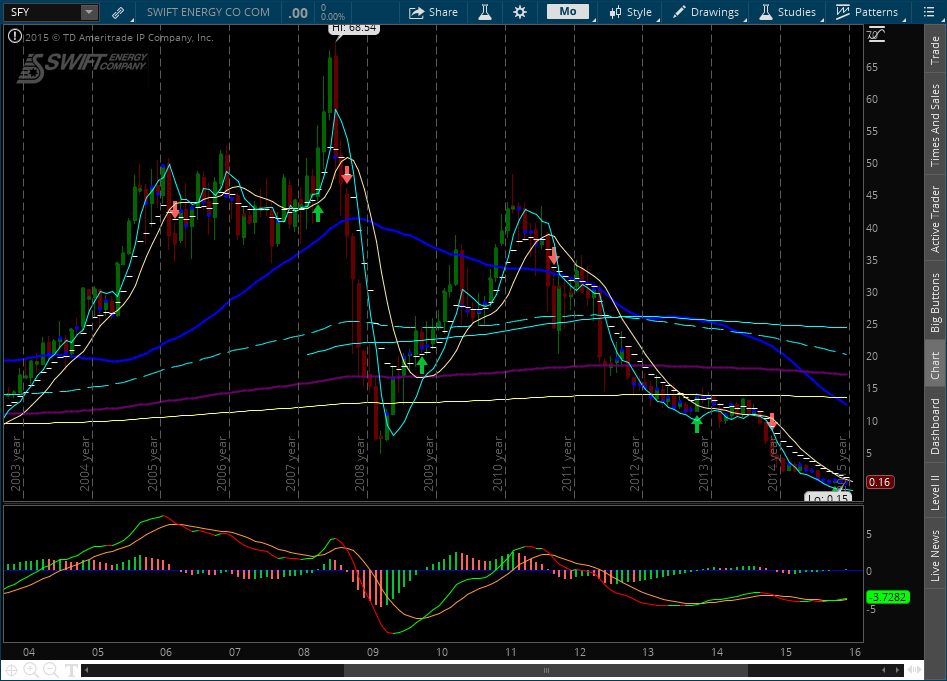

Swift Energy Files For Bankruptcy Protection

Sad Situation - Swift Had Been In Business Since 1979

Swift Energy Stock - $68.54 In 2008 to $0.16 Cents On December 18th 2015 When It Was Delisted

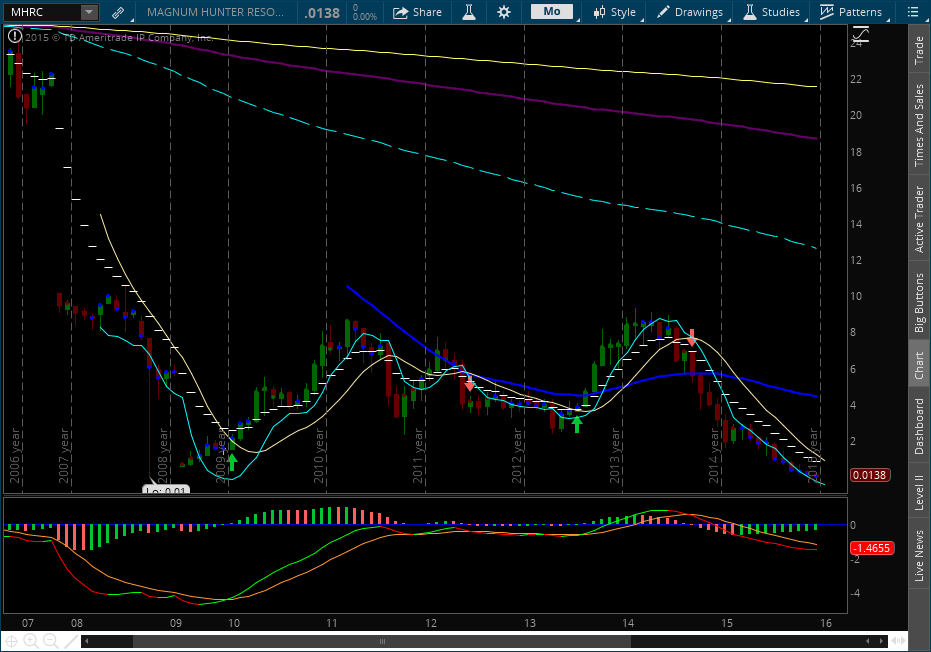

Magnum Hunter Files For Bankruptcy Protection

Magnum Hunter Resources Stock - $23.65 In 2006 to $0.01 Cents On December 17th 2015 When It Was Delisted

$4.1 To $7.2 Billion - Poof

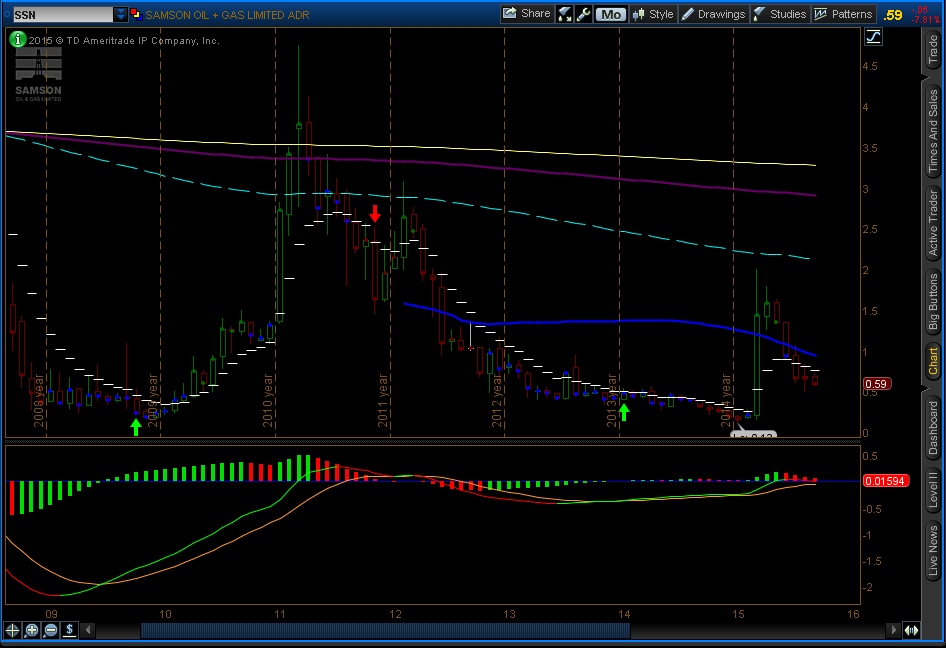

KKR - Samson Files Bankruptcy 09/17/2015

Yes, It Must Get Old Having The Same People In Your Court

"I am operating in a somewhat altered universe than the one I was operating in when I took the bench this morning,"

said U.S. Bankruptcy Judge Christopher Sontchi, after learning of the new treatment of the bonds."

| Furious Judge Rebukes Banks | Judge Sontchi | Judge Warns - "Energy Future" |

| KKR Acquire's Samson | Samson Layoffs | KKR & Samson In 2015 |

drillers in recent years rushed to tap new oil-and-gas deposits across the country—and contributed to the collapse in prices for both fuels.

Samson’s woes have been exacerbated by the very tools private-equity firms use to juice their returns:

Samson carries debt used to fund its own purchase and pays fees to its owners. Last week, Moody’s Investors Service

downgraded Samson’s credit rating while taking the unusual step of simultaneously flagging the company for further downgrade."

KKR Stumbles 12/2014

Samson Stock - $199.89 in 2008 to $0.40 cents on 12/31/2015

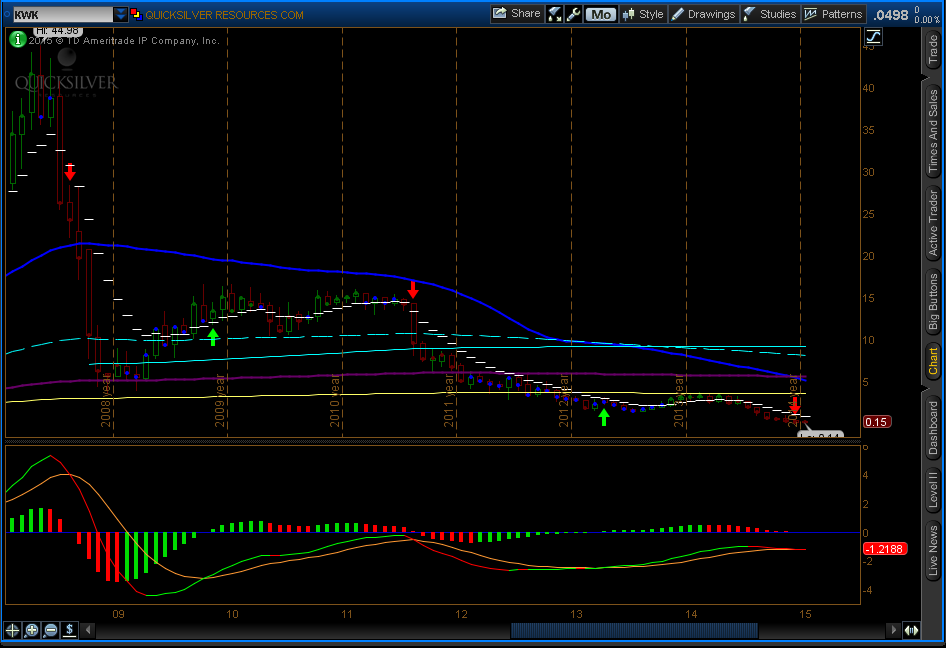

Quicksilver Files For Bankruptcy Protection

Quicksilver Resources Stock - $44.98 In 2008 to $0.15 Cents In January 2015 When It Was Delisted

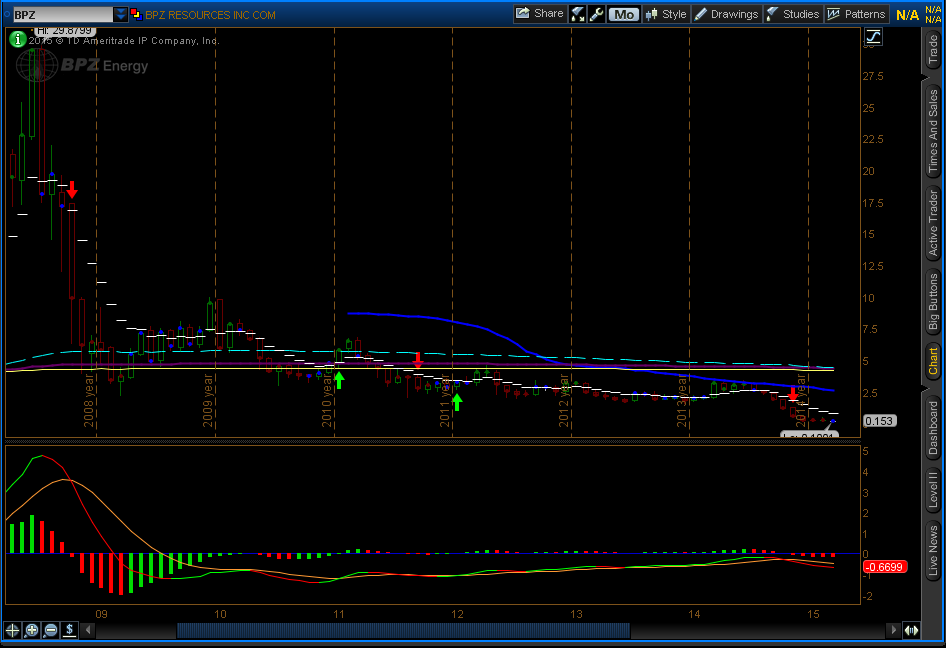

BPZ Files For Bankruptcy Protection

BPZ Resources Stock - $29.87 In 2008 to $0.15 Cents In March 2015 When It Was Delisted

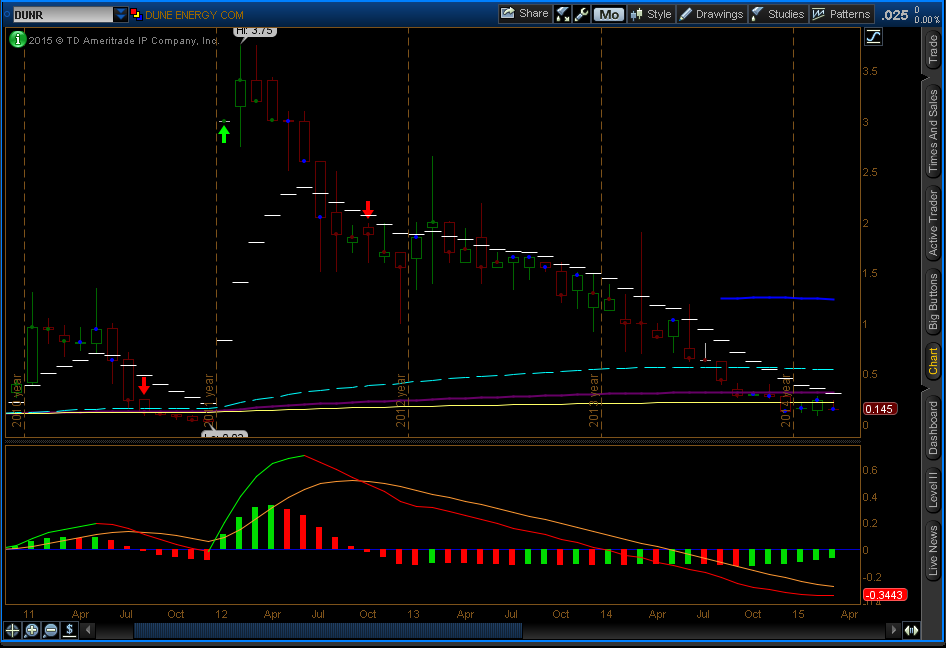

Dune Files For Bankruptcy Protection

Dune Energy Stock - $3.75 In 2012 to $0.14 Cents In March 2015 When It Was Delisted

Cal Dive Files For Bankruptcy Protection

Cal Dive Stock - $18.62 In 2007 to $0.11 Cents In March 2015 When It Was Delisted

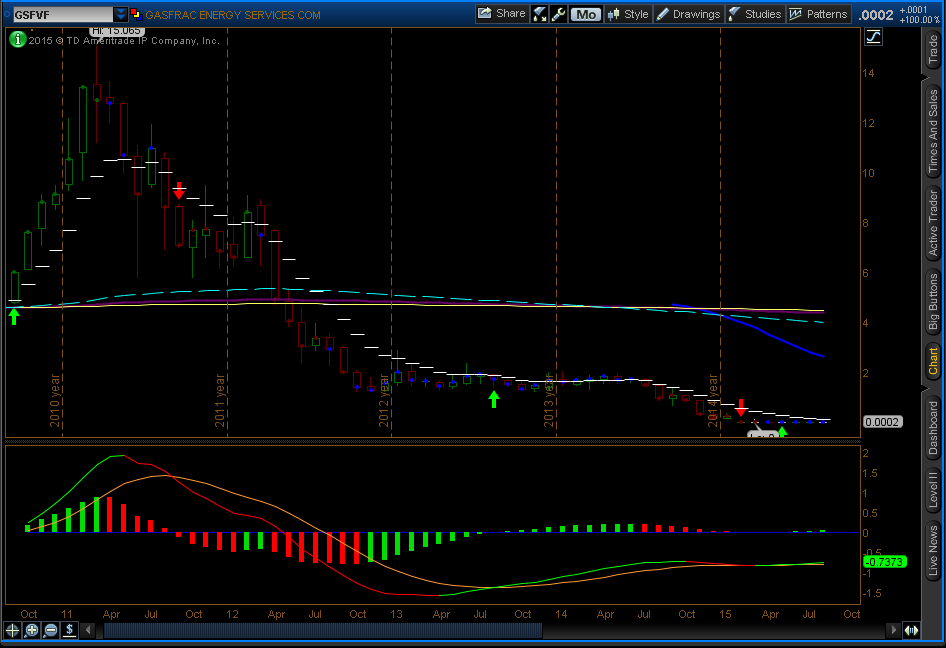

Gas Frac Files For Bankruptcy Protection

Private Company Buys Gas Frac Assets

Gas Frac Stock - $15.06 In 2011 to $0.002 Cents In September 2015 - It Is Ceased

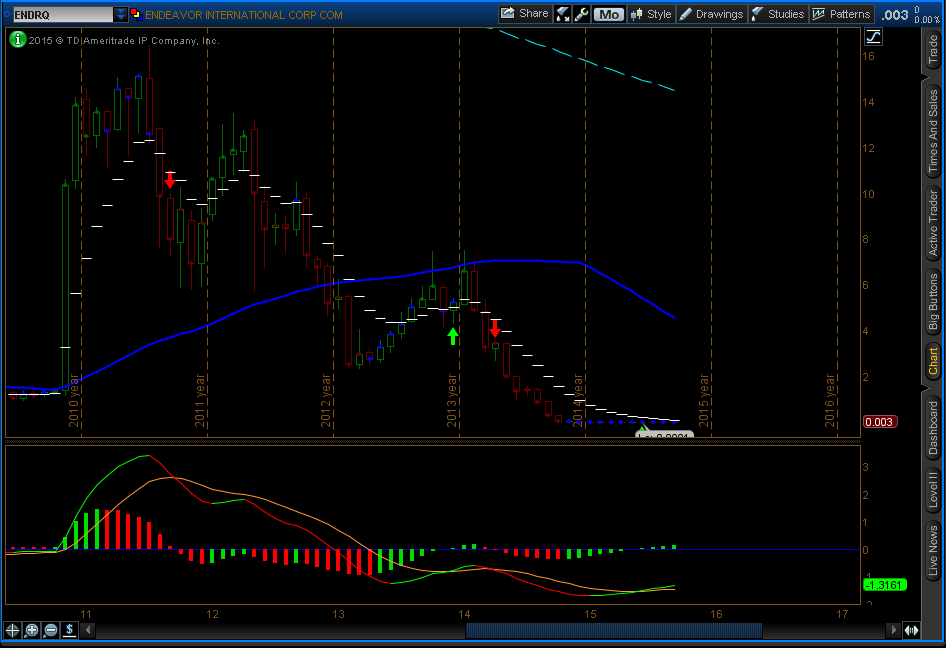

Endeavor International Files For Bankruptcy Protection

Endeavor International Stock - $72.00 In 2002 to $0.003 Cents In September 2015 - It Is Ceased

Sierra Resources Group Files For Bankruptcy Protection

Sierra Resources Stock - $1.05 In 2010 to $0.00 Cents In March 2015 When It Was Delisted

Lexico Resources Intl. Files For Bankruptcy Protection

Lexico Resources Stock - $0.20 In 2012 to $0.06 Cents In February 2015 When It Was Delisted

American Eagle Energy Files Bankruptcy - 05/11/2015

American Eagle Energy Misses Interest Payment

American Eagle Energy Gets More Time To Strike A Deal

American Eagle Stock - $12.00 In 2013 to $0.19 Cents In May 2015 - It Is Ceased

Bakken Resources Inc

These Folks Have Major Issues

"The results of my investigation are clear and the evidence indicates that Mr. Holms breached his duties

to BRI by causing BRI to overpay for certain oil and gas leases, and then took a kickback/payment

from the seller of those leases. There are other very questionable matters that also came to my attention."

"The fraud perpetrated upon BRI by Mr. Holms raises serious concerns about the efficacy of BRI’s internal controls and processes."

W. EDWARD NICHOLS' RESIGNATION LETTER

Its All In The 8K Filing Dated 03/17/2015

| BRI - SEC 8K Filings |

Mr Holms Is Taking A Paid Leave | Mr Holms Was Getting Paid Good Money |

Bakken Resources Inc. - $1.25 In 2011 to $0.09 Cents In September 2015 - It Is Still Trading 12/31/15

Who's to know if your soul will fade at all The one you sold to fool the world You lost your self-esteem along the way

Fake It

Oklahoma Feels The Pain

Its Going To Take More Then One Finger To Plug Your Budget Gap

Oklahoma Now Has More Earthquakes Then California

Oklahoma - Little Oil Pressured Scientists

| Willful

Blindness Return To Top Of Page |

Willful blindness (sometimes called ignorance of law, willful ignorance or contrived ignorance or Nelsonian knowledge) Is a term used in law to describe a situation in which

A person seeks to avoid civil or criminal liability for a wrongful act. By intentionally keeping himself or herself unaware of facts that would render him or her liable.

It Goes Way Beyond A Legal Standard - It Is A Human Circumstance That Knows No Bounds

Gayla Benefield was just doing her job — until she uncovered an awful secret about her hometown that meant its mortality rate was 80 times higher than anywhere else in the U.S.

But when she tried to tell people about it, she learned an even more shocking truth: People didn’t want to know. In a talk that’s part history lesson, part call-to-action,

Margaret Heffernan demonstrates the danger of "willful blindness" and praises ordinary people like Benefield who are willing to speak up. (Filmed at TEDxDanubia.)

An Amazing 14 Minute Film Into The Dangers Of Willful Blindness - A Worldwide Circumstance

Margaret Heffernan - The Dangers Of Willful Blindness - Talk on ted.com

| Gayla Benefield | Libby Mt. & Asbestos | Margaret Heffernan |

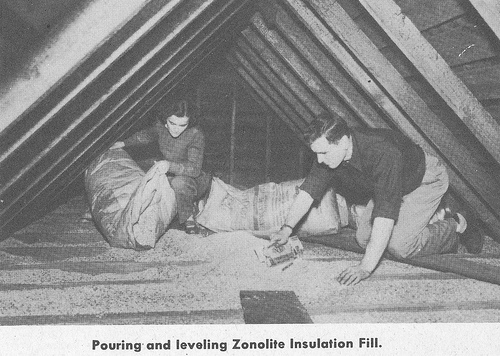

If You Are Unaware Of What Zonolite & Or Vermiculite Is & Or If You Have It In Your Building

Visit zonoliteatticinsulation.com To See What It Looks Like

The Zonolite Company

These Poor Poor People - As Many as 35 Million Buildings In The USA Have Asbestos In Them

asbestos.net

If You Have Not Watched Margaret's Film - Please Take 14 Minutes & Do So Now

Asbestos Advertisements

| Central

States Pension Fund Broke Return To Top Of Page |

| mycentralstatespension.org | Why Are They Broke? | North Dakotans Screwed |

Some of these days, and it won't be long Gonna drive back down where you once belonged In the back of a dream car twenty foot long

Don't cry my sweet, don't break my heart Doing all right, but you gotta get smart Wish upon, wish upon, day upon day, I believe oh Lord

I believe all the way Come get up my baby

Golden Years

Question Is

Bakken Decline - Production Chart

We're setting sail To the place on the map from which no one has ever returned

Drawn by the promise of the joker and the fool By the light of the crosses that burn

Oh, save me. Save me from tomorrow I don't want to sail with this ship of fools

Ship Of Fools

To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information provided on this website,

or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information we provide to any person or entity

(including, but not limited to, lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or incompleteness of this information).

We encourage you to invest carefully and read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.finra.org.

IF YOU DO NOT AGREE

WITH THE TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE

IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE

OF THIS SITE

OR THE INFORMATION PROVIDED HEREIN SHALL INDICATE YOUR

CONSENT AND AGREEMENT TO THESE TERMS.

Honor - Respect - Freedom - Country