You Are On Search North Dakota Development Group LLC Boom Or Bust page

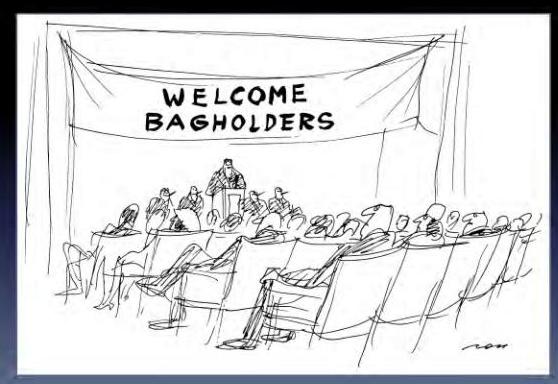

This Boondoggle Came To Light In May 2015 - Poof Some $62 Million Gone - Good Times

| Layout Guide L to R - Top To Bottom |

Cease

& Desist |

The NDDG

LLC The Endless Websites |

SEC

& Lawyer Contacts |

Deeper & Deeper | Gavin

& Wife |

| PHGL

& The FCA The Inaction |

The Award | Good Times | The Bolkan Volcano | The Site Location | My Overseas |

| The Highlands | When It All Goes Bad | Dickinson Hotel | Receiver

& Recovery |

Chasseur-Immo The Bismarck Law Firm |

Commissions |

| TH Apartments | Strike Force |

October 2016 - The assets held within the Receivership ($650,000.00 - Before Fees) have very little value when compared against the approximately $60 million contributed by

investors and the approximately $5.5 million claimed by creditors of the Receivership entities. We expect any ultimate recovery by investors and creditors to be only an

extremely small percentage of their investments or claims. See Receiver & Recovery Link Above.

It Was May Of 2015 When This Came To Light - It Is Now 2022 - There Are Hundreds If Not Thousands Of Pages - Websites - PDF Files

Face Book Pages - Video's - etc. Still On The Internet Relating To This Entity - It Would Take Months If Not Years To Shut It Down.

There Is Page After Page Still Hyping It And Ready To Contact You & Have You Invest.

As The Months Have Passed Sites Have Been Taken Down And A Lot Of Sites Remain

Certainly in the year's 2012, 2013 and into 2014 anyone could have been led to believe this was all very real. In 2013 the red lights kept coming on, oil well site's where half

the tanks had never been used, the massive one year decline rates of new wells, producers not even wanting to market there own oil, producers shorting there oil in the future.

The numbers that go against the hype of more oil in the USA, then in Saudi. The average price of oil never trading above $60.00 a barrel, the debt being amassed. The data was

available then for anyone to cut to the chase and do due diligence. On the flip side of that for the brazen, bold, giant billboards in your face operation of this scam and all the

officials that saw it and officials that were aware of it by interaction of community and construction processes, plus media and hype and lawyers as officers of the court who cant

operate in a Perry Mason fundamental mindset that didn't even recall basic securities law. No one ever asked are these guys for real, are they doing this in my town,

in my state in step with the law? Certainly Not Of Course! For in those same years as this year and probably years to come the interest is self serving, they live for the hype.

They sell the hype. They do not buy the hype, they sell the hype, and sell the hype and sell the hype and who gets burned along the way, to bad.

In essence they were shorting the hype they were selling you on your long term bet of hysteria without diligence and you bought it.

So buyer be aware when you hear the words, Boom, North Dakota, Housing, Unbelievable, Oil and Income come out of someone's mouth. Especially In One Sentence!

"Yes They Are Having A Oil and Housing Boom in North Dakota & The Income Is Unbelievable"

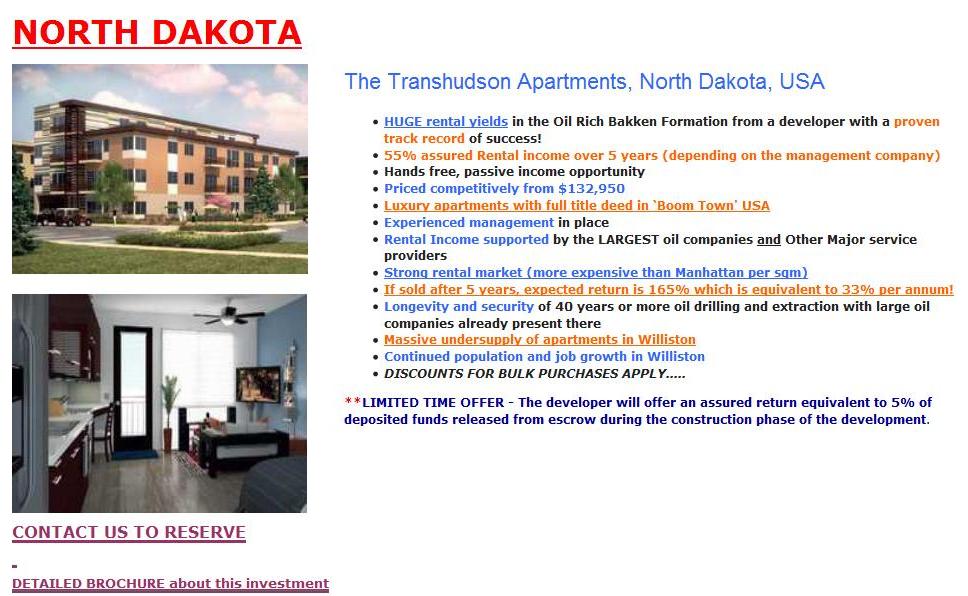

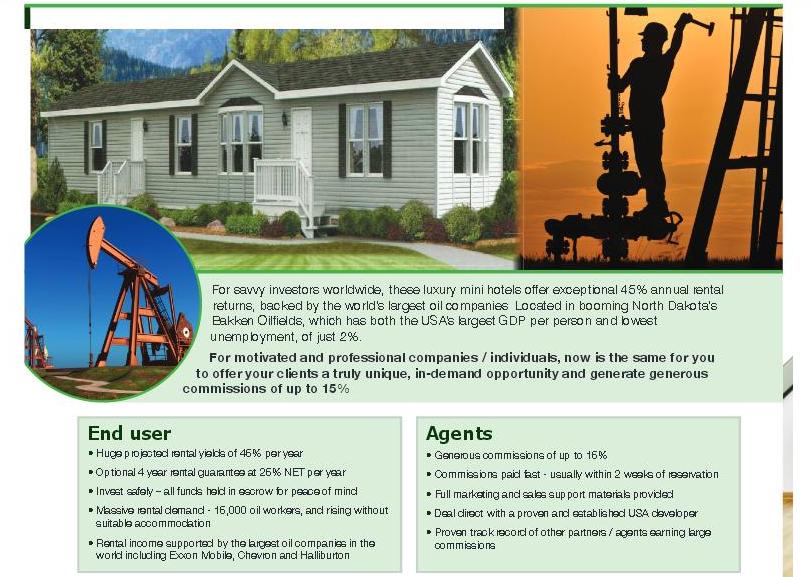

Here Is The Hype Being Sold In One Of Their Many Sales Brochures

"Credibility The Largest Oil Field in the USA With an estimated 24 billion barrels of recoverable oil using today’s technology (out of around 650 billion available) and more oil than Saudi Arabia and

the UAE combined, the Bakken Formation is generating incredible wealth and creating job opportunities for the next 60-80 years. This means your investment will provide long term passive income."

Really - The Human Race Has Produced & Burned Around One Trillion Barrels & North Dakota Has 650 Billion Barrels Available - They Sold It - You Bought It - Hype!

Why Investors Should Beware Of The Bakken - March 2017

| Bakken

& North Dakota - Real Estate Boom Or

Bust Real Actual Data For Bakken Cities - Permits - Sales |

The

Counterfit Shale (Tight) Oil Revolution Always Know Your Driver - Always Know Your Catalyst |

| Cease

& Desist Return To Top Of Page |

| ND

SEC Cease & Desist Order |

ND

Century Code - 10-04 |

An order given by a government administrative agency or the courts to stop any suspicious or illegal activities.

Falling under the Financial Institutions Regulator Act of 1978, a cease-and-desist order places

An injunction on a company or person, prohibiting the activities that are deemed suspect.

As A Human & Or An Investor One Should Always Do Due Diligence To Protect Oneself - One Should Always Do Vetting Before Living Or Investing - Not Hype Crap

Besides That Why Would Anyone Legitimate Not Have A Third Party Hold The Investments To Keep Everything On The Up & Up - No Progress No Money

Pigs Get Fat, Hogs Get Slaughtered

This idiom is used to express being satisfied with enough, that being greedy or too ambitious will be your ruin.

“The world will not be destroyed by those who do evil, but by those who watch them without doing anything” Albert Einstein

Return To Index Home Page - bakkenboomorbust.com

| The NDDG LLC Return To Top Of Page |

05/13/2015 They Have Removed The Website

But you can view it on the wayback machine - Snapshots At December 2014 Still Remain

nddgroup.com - on the way back machine

They Had A Wonderful Website nddgroup.com It Is Parked On godaddy

How Many Websites Do They Have or Had or Still Have & The Websites Still Offering Investment In NDDG

| transhudsonhotel-dakota.com Google Image Search - Site Removed |

Trans

Hudson Hotel - Parshall ND Google Search |

Trans

Hudson Apartments - Williston ND Google Search |

| nddgroup.com All Images Captured In Google Search |

northdakotadevelopments.com As Captured On The Way Back Machine |

northdakotadevelopments.com All Images Captured In Google Search |

| cashflownorthdakota.com As Captured On The Way Back Machine |

cashflownorthdakota.com Google Search |

cashflownorthdakota.com All Images Captured In Google Search |

| Lou

Harty Selling "Hicksville ND" Starts at 48:00 - So Very Disinformative |

21stcenturyeducation.com As Captured On The Way Back Machine |

21stcenturyeducation.com Still Have The Sales Brochure Online |

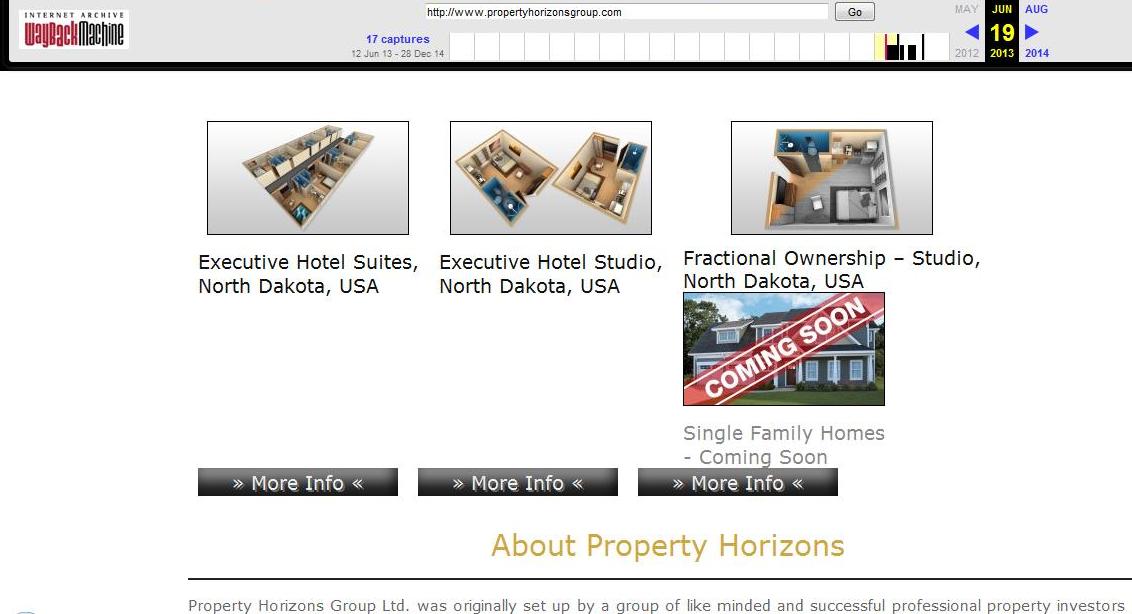

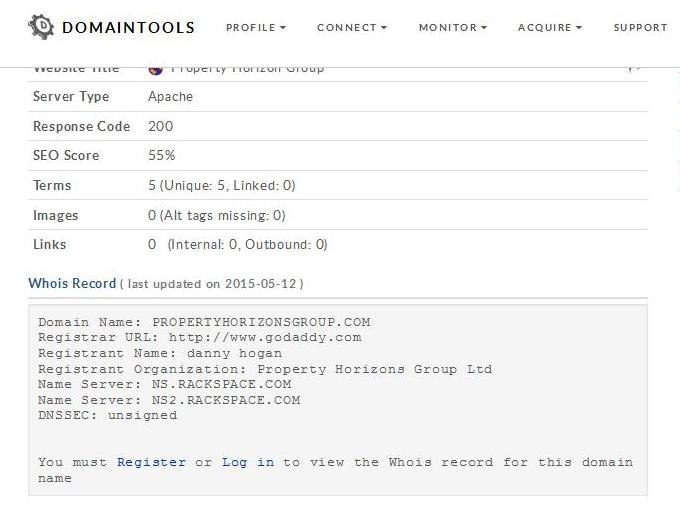

| propertyhorizonsgroup.com As Captured On The Way Back Machine |

propertyhorizonsgroup.com Google Search |

propertyhorizonsgroup.com All Images Captured In Google Search |

| greatamericanlodge.com As Captured On The Way Back Machine |

Great

American Lodge Watford West Google Search |

Great

American Lodge Watford West All Images Captured In Google Search |

| proclient.ca & Then Their PDF Sales File |

Then

There is Horizon Ridge It Was Auctioned In 2014 |

| SEC

& Lawyer Contacts Return To Top Of Page |

SEC Halts Bakken Oil and Gas-Related Investment Scheme - 05/06/2015

| Federal SEC Litigation Release | ND SEC Cease & Desist | ND SEC Cease & Desist Order | ND Century Code - 10-04 |

A Ponzi scheme that promised investors high rates of return on North Dakota oilfield housing defrauded hundreds of investors worldwide

Out of $62 million, the U.S. Securities and Exchange Commission said in documents filed Tuesday.

Rates Of Return As High As 42% In The First Year

It Will Never Cease To Amaze That People Give Their Money To People Like This That They Dont Know

When They Could Take Their Money - This $62 Million & Trade Oil, Trade The Spy, Trade The /ES - /YM e-mini

Know Where Their Money Is At Night - The Biggest Hedge Funds On The Planet Play Hell To Earn 3% to 5 %

The Best Momentum Traders Live By 5%, 10%, Rinse & Repeat Day In & Day Out. Grow Up!

The Loss Of Assets To Good Faith Is A Terrible Thing - Diligence & Vigilance Are Your Duty - Not That Of The House

| The U.S. Securities and

Exchange Commission's Office of the Investor

Advocate can be found at online - sec.gov/investorad |

The North Dakota Securities

Department can be reached at (701) 328-2910 or (800)

297-5124. online - nd.gov.securities |

Complain to the UK authorities by filing a complaint at action fraud, online - actionfraud.police.uk |

Countries Worldwide Securities Commissions & Regulatory Agencies

| Securities Commission In France - In French amf-france.org - In French |

Securities Commission In France - In English amf-france.org - In English |

Worldwide Securities Contacts World Wide Regulators |

DO DUE DILIGENCE

Because a number of these companies and the investors they are soliciting reside outside North Dakota and the United States,

it may place them beyond the jurisdiction of the North Dakota Securities Department, regardless of the location of the real estate being developed.

Based on our investigations thus far, none of the entities inquired upon have submitted any type of securities registration filings in the

state of North Dakota, with other state securities regulators, or with the U.S. Securities and Exchange Commission. The Department encourages investors

to be thorough in conducting their own due diligence, including contacting the securities regulator in their home jurisdiction.

ND SEC Bakken Bulletin

These Law Firms Popped Up In Keyword Searches For ND Developments Property Management LLC

"If you are an investor that purchased real estate from North Dakota Developments, LLC (NDD Group) in North Dakota,

USA, you may be able to recover some of your investment losses through securities litigation."

They Will Be Added As They Pop Up In Keyword Searches

| Brenda Lee Hamilton at securitieslawyer101.com | securitieslawyer.com - Post On

05/18/2015 |

| securitieslawyer.com - Post On

05/19/2015 |

Russel L. Forkey at floridastockfraudblog.com |

| Joshua B. Kons at

investmentlossattorney.com |

John S Chapman at johnschapman.com |

| Deeper

& Deeper Return To Top Of Page |

This Just Gets Deeper & Deeper & Deeper

They Funded And Or Fronted A Company In Williston Called - Ames Engineering & Development Services LLC

| ameseng.com As Captured On The Way Back Machine |

google search ameseng |

article on bakken.com

the file name of the photo of Jacob Porter is very strange

2014/09/fucking-upload.jpg

They Funded And Or Fronted A Company Called - Augusta Exploration LLC

augusta exploration - google search

They even gave $500 dollars to the Mayoral Race in Williston

Mayoral Race May 2014

| Robert Gavin NDD LLC | Asians

Beware |

Daniel

Hogan NDD LLC |

| Robert

Gavin Nov. 2014 "ND Developments , which is 100% owned by Gavin, is bringing in around $6 million in sales per month." |

NDDG October 2013 | |

| NDDG

On Twitter |

NDDG

On Twitter As Captured On The Way Back Machine |

| Gavin & Wife Return To Top Of Page |

"NDDG transferred money to Gavin at an overseas Malaysian bank account in the name of his wife, Stephanie Prabaharan"

You can find her in a google search

Stephanie

They Look Very Happy - Many Happy Photos On Her FB Page (Page Removed)

And if you google them together

Gavin & Stephanie

Then You Will Find Property Horizons Group Limited

| Property Horizons

Group Limited & The FCA Return To Top Of Page |

Property Horizons Group Limited

There was a website - all it is - is a blank page that says - This website is now closed.

propertyhorizonsgroup.com

The website expired on 05/27/2015 - It Is For Sale On godaddy.com

But you can view it on the wayback machine

propertyhorizonsgroup.com - on the way back machine

The FCA Knew Of This In Early 2014

Whats The FCA

"So what went so badly wrong that the FCA stepped in and ordered the two bosses to offer everyone their money back?

The answer is that North Dakota was an unlicensed unit trust. In legal terms, it was a ‘Collective Investment Scheme"

Pulling A Fast One 05/24/2014

Why Didn't This Ever Get To The SEC In The USA

Pulling A Fast One 05/16/2015

Screenshot of the site - June 2013

Domain Register

| The Award Return To Top Of Page |

Robert Gavin - He Even Won An Award For Something He Never Even Built

Bernard Madoff Would Be Proud

The Glitzy Award 12/2014

The two men holding awards appear to be Stuart Johnson & Robert Gavin

Stuart Was the Head of UK Operations at NDD Group and American Property Developer

Stuart On Linked In

Stuart Had Taken Down His Linked In Profile Week Of 05/27/2015 - It Is Again Posted

It Was Captured In Digital For Any Future Reference

Hush now, baby, baby, don't you cry Mama's gonna make all of your nightmares come true Mama's gonna put all of her fears into you

Mama's gonna keep you right here under her wing She won't let you fly but she might let you sing Mama's gonna keep baby cosy and warm

Ooooh, babe, ooooh, babe, ooooh, babe

Of course Mama's gonna help build the wall

Mother

| Good Times Return To Top Of Page |

The meaning of the word BOLKAN Is Volcano! Maybe They Misspelled Bakken

What!

Look At What They Were Hypeing To Investors - Its To Good To Be True

The file name $89,950.pdf

Sales Brochure Used For The

Transhudson Hotel

Due Diligence Would Have Told You This Was A Hype Job

That would mean North Dakota would have 250 to 1000 billion barrels of oil - about half the world has ever produced!

Page 4 - The oil boom in North

Dakota is allowing them to defy the laws of economics

during the current climate. With larger oil reserves than

Saudi Arabia and

the UAE combined, the pressures from this rapid growth are evident. According to recent reports, there could be as much as 24 billion barrels of oil

in the Bakken Formation, more than double the amount originally thought.

the UAE combined, the pressures from this rapid growth are evident. According to recent reports, there could be as much as 24 billion barrels of oil

in the Bakken Formation, more than double the amount originally thought.

The Drawing Alone Is Wrong, Florida Plants & Grass & A Flat Roof Hotel In ND

| The (Bakken) Bolkan

Plaza Volcano Return To Top Of Page |

Google BOLKAN PLAZA - Unreal

| The Site Location Return To Top Of Page |

Site Is Located On Highway 23 Just North of Parshall North Dakota

The Full Scope Of Projects

Western Edge Of Site - There Is That Container - 05/09/2015

Eastern Edge Of Site - 05/09/2015 - Grade Work Was Done In Late Fall Of 2014

The Heavy Equipment Was Parked There Over The Winter - It Has All Been Removed Except For One Scraper

Center Of Site - 05/09/2015 - It Would Cost A Lot Of Money To Put That Field Back

Come On Guys Their Address In Williston Is In a Industrial Park

| My Overseas Return To Top Of Page |

As Published On myoverseasproperty.com

As Captured On The Way Back Machine

Site & Brochure Removed Honoring Cease & Desist

The Brochure Was To Good To Be True

Transhudson Brochure

| The Highlands Return To Top Of Page |

What Is It Or Was It With Parshall Being This Epicenter Of Development - Here is Another That Was Hyped

"One Trillion Barrels Of Oil"

The Highlands Of Parshall

| When It All Goes Bad Return To Top Of Page |

| When

It All Goes Wrong - May 2015 |

Investors

Warned - March 2015 |

More

Come Forward - March 2015 |

| Lawyer

Speaks Out - April 2015 |

CEO

Hits Back - April 2015 |

Assets

Frozen - May 2015 |

| Dickinson Hotel Return To Top Of Page |

| UK

Company Buys Hotel - 02/2013 |

Hotel Up For Sale Again - 01/2014 | Jordheim Plaza Complex |

The One On The Left Is The Old Ivanhoe Hotel In Dickinson

The One On The Right Is What Was Offered By ND Developments LLC

See The Add They Still Have Running For Unit Sales & The Add On looppnet.com Below

The Sign On Top Is Very Ironic

Hotel Room's For Sale

Here Is Another Add Still Offering Sale Of The Unit's

loopnet Add Not Taken Down

Hard Copy of Add - Dickinson To Become Largest City In ND By 2017

WOW Dickinson The Size Of Fargo, Some 200,000 People

And The Net Return - 25% Or 15% Guaranteed

| Receiver &

Recovery Return To Top Of Page |

See The Full Text Of The Complaint Filings At The Links Below - Easier To Read

| Michael Cates Declaration | SEC Complaint | Annie Romero

Declaration |

Restraining Order |

You will also find at this time NDDG has left its Face Book page up

With their last posts on May 13 2015

"We will keep this page open for everyone who has a genuine grievance against NDDG. We can't publicly state why on this forum

But as is the case with others many suppliers have been left unpaid. Please read between the lines here. Good luck to you all."

"Also, if you require contact details for the senior management, please message us directly."

| NDDG Face Book Page | The Investor Community Face Book |

Media Coverage On May 19th.

"Receiver Appointed In Ponzi Scheme"

Lawyer Brenda Lee Hamilton at securitieslawyer.com - Post On 05/19/2015

Gary Hansen Appointed Receiver

Website By The Receiver & Updated Information From The Receiver

northdakotadevelopmentsreceiver.weekly.com

October 2016 - The Receivership currently holds approximately $650,000 in cash. Though the Receiver has been providing services for over

17 months and has incurred costs and fees of approximately $465,000, the Receiver has not sought Court approval for payment of those fees.

Wishing to preserve sufficient cash to maintain Receivership assets while they were being marketed.

Bismarck Tribune Reported

"Hovland extended the preliminary injunction requested by the SEC until the case is decided.

He said he would appoint a receiver Tuesday to protect the assets and determine whether

Great American Lodge should reopen and, if it does, who should operate it."

e-mail from the ND-SEC

The court hearing occurred yesterday without the attendance of Danny Hogan, Robert Gavin, or counsel for North Dakota Developments. Several creditors were in attendance. The SEC made arguments for the appointment of a receiver and for the release of the escrow accounts to allow the escrow agents the ability to return investor funds to owners of those funds that remain in escrow. The judge understood the urgency of the situation and continued the restraining order and asset freeze. I believe a receiver will be appointed by the judge to take control of North Dakota Developments assets either today or tomorrow. I do not know if the judge will release the escrow funds immediately or have the receiver administer that activity. I do not know at this time what will occur with each of NDD’s projects. The only project that was up and running was the Great American Lodge – Watford West (GAL-West) and that one was not even complete. The GAL-West was closed down late last week when the power and water were cut-off due to months of non-payments. It will be the receiver to determine the treatment of this project along with the other NDD projects. At this point the court is taking action and once the receiver is in place it will be the receiver directing a majority of the over site with NDD, including investor contact. Again thank you for your patience and await further instructions from this office or from the receive |

Photo Of Watford West - Sitting Shut Down 05/15/2015

If You Sense A Lack of Good Law Enforcement And A Sense Of Lawlessness - You Should - Your Not Alone - Murder - Drugs - Gangs - No Knocks

Search Bakken Crime - Law Enforcement Boom Or Bust Page Awareness - Not Location Is Key To Self Preservation & Self Defense

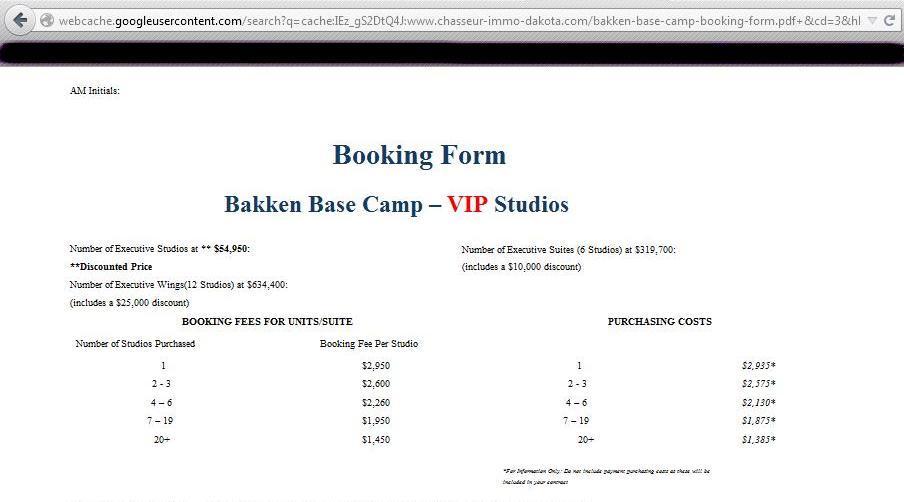

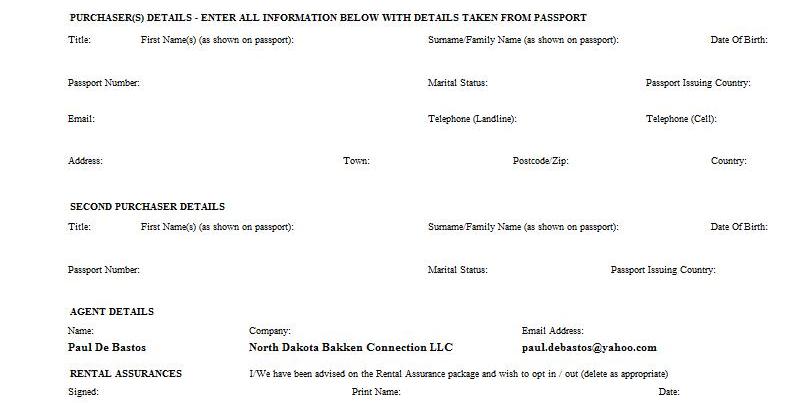

| Chasseur - Immo Return To Top Of Page |

They Were Issued A Cease & Desist

06/17/2015

The State Of ND Shows In The Order That Paul Made $1,000,000.00 In Commission's - Page 2.

Chasseur Immo - Translated Appears To Be Property Hunter

You Dont Need To Speak French To Interpret The Videos On This Website - He Had Many Videos - They Are All Gone

This Guy Made The Rounds - He Did His Job Selling The Hype With The Hypemasters - Having Seen The Videos

It Was Like Two Violins Playing Each Other - From City Leaders To Economic Directors - The Music (SCAM) Flowed

chasseur-immo-dakota.com

The Site Was Taken Down 05/27/2015 - With The Message

"Following the proceedings initiated by the SEC and the North Dakota Securities Commission against North Dakota Developments LLC

and others, we have voluntarily blocked access to our main website to not appear in a position to offer units potential buyers.

This page information, however, will remain available for our customers."

If You Go On The Wayback Machine They Are The Nord Dakota Bakken Connection LLC

chasseur-immo-dakota.com

As Captured On The Wayback Machine

"thinking of having a stiff drink, I might invent a cocktail called the NDDGROUP,

one measure of Robert Gavin, poured over enormous quantities of Bullshit,

stirred with a Danny Hogan, shake and throw all your money away…."

Page Has Been Taken Down

comment on a blog about NDDG & The Bismarck Law Firm

As Cached On Google

Locals Tell Of Danny Hogan & His Entourage Would Hang Out At The Williston & Drink Top Shelf Scotch - God Knows They Could Afford It!

The Williston

Video Of The French Guy At The Bismarck Law Firm office

It Is Believed To Be Paul De Bastos

You Will See Them At The Culbertson Site Filming Their Associate Urinating

You Got A Love It - The Theme Music From Dallas Playing

Dallas TV Show Theme Music

How Does This Prominent Law Firm Allow This Activity In Their Office

The Lawsuits

"The class said any attorney with even “basic knowledge of securities law” could have sussed out the fraudulent nature of NDD’s investment proposal."

| Facing

Lawsuits Over The Scam |

Lawsuit One |

| Lawsuit Two | $5

Million Settlement For A $62 Million Scam $3.5 Million After Attorney Fees - About Five Cents On A Dollar |

Here is One on justanswer.com asking if the Bismarck Law Firm Exists - In Reference to the NDDG

question being answered on justanswer.com

The end comment is some really great vetting

"It appears that the project that you have referenced is a legitimate project. See"

http://www.construction-today.com/index.php/sections/residential/1357-north-dakota-developments-llc

Not One Word About Due Diligence

Who Is Paul De Bastos?

| Paul

- Google Search |

Paul & NDDG - Google Search | Paul

On - Youtube Videos Removed |

| Paul

On Face Book Site Removed - No Capture |

pauldebastos.com Site As Captured On Wayback Machine pauldebastos.com |

Chasseur Immo On Face Book |

Paul Had A Lot Of Links On This Face Book Page - Very Very Strong Interest In Nord Dakota Real Estate - Some 50 Different Sites

Paul Real Estate

Site Removed - No Capture

Most Of The Links Lead To A Page With The Domain Name Link - .com, etc - They Have All Been Shut Down - Even His Wonderful Miami Site

Then There is North Dakota Bakken Connection LLC

Has The Same Address As Chasseur Immo In Williston

| chambermaster.com NDBCLLC Registered With Williston Chamber Paul Registered With Alot Of The Chambers |

north-dakota-investments.com The Link On That Page Took You To This Page As Captured On The Wayback Machine |

Paul At The Williston Chamber Of Commerce - Under Investment Services & Real Estate

Then This Link Will Take You To The Pleadings & Show You The Commissions That Were Paid

For Their Hard Work And Interest In Nord Dakota Real Estate

NDBCLLC Listed In Pleadings

Roughly Some $400,000.00 - With The Publicity Help All The Way From Photos To Interviews With Prominent Sources - Cha Ching

The State Of ND Shows In The Court Order That Paul Made $1,000,000.00 In Commission's - Page 2.

They Were Issued A Cease & Desist

06/17/2015

A Wonderful Compliment Posted Online At NDDG Google Page

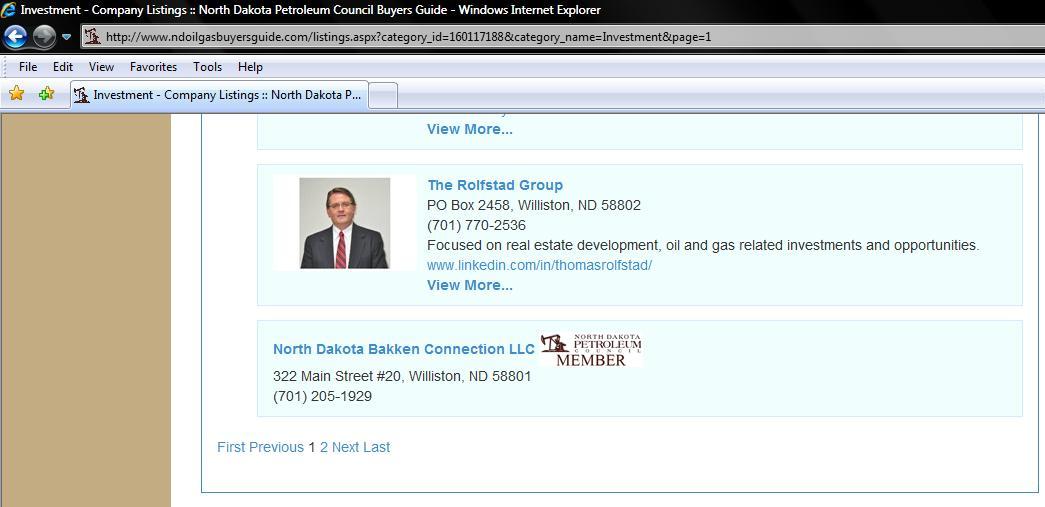

Paul Was A Memeber Of The ND Petroleum Council - Right Under Tom Rolfstad - Former Williston Economic Director

Whom Paul Had Done A U Tube Video With - No One Ever Ever Vetted Paul Or NDDG

Paul Had Even Done A Video With Tom Rolfstad - It Is Out There Somewhere In Some Cyber Cache

As Still Displayed On chasseur-immo-dakota.com

If You Go On The Wayback Machine They Are The Nord Dakota Bakken Connection LLC

The Video Is Unavailable

chasseur-immo-dakota.com

As Captured On The Wayback Machine

| Commissions Return To Top Of Page |

| Candice Ritchie - Over Seas Property Professional |

WOW They Have A Office In Sioux Falls

| northwestinvest.com |

“The world will not be destroyed by those who do evil, but by those who watch them without doing anything” Albert Einstein

| Transhudson

Apartments - Williston Heights Return To Top Of Page |

You can still find sites and videos and article's still selling the project.

| Sales

Brochure |

Google

Search |

| Bakken

Organized Crime Strike Force - It's About Time Return To Top Of Page |

"Though It Comes With No New Funding Or Staff,"

Unfunded Crime Fighting

The Legislature Has & Had Access To All The Data In The World & Choose To Ignore It - They Went With Hype - The Money

Some Of The Most Expensive Production Of Oil In The World & They Played It As Going On Forever - Oil Price Has Returned To The Mean

They Choose To Ignore When It All Went bam - boom - bubble - bust - bump - bang

| Billions

Collected |

County

Concerns - 2011 |

Unprepared

Fiscal Policy 2012 |

| Bakken

Organized Crime Strike Force Google News Search |

Bakken

Organized Crime Strike Force Google Web Search |

Bakken

Organized Crime Strike Force Google Image Search |

The United States Department Of Justice

| Dept

Of Justice Immediate Release 06/03/2015 |

Dept

Of Justice - USAO District Of Montana |

Dept

Of Justice - USAO District Of North Dakota |

| Dept

Of Justice - Report A Crime All Contacts - FBI - ATF - US Marshall s - DEA - ViCAP |

Dept

Of Justice - Most Wanted FBI - ATF - US Marshall s - DEA - ViCAP |

The Montana Attorney General

Website & Contact

The North Dakota Attorney General

Website & Contact

AG Stenehjem passed away January 2022 - no charges were ever brought against anyone involved with NDDG

North Dakota Attorney General Wayne Stenehjem, right, announced the formation of the Bakken Organized Crime Strike Force

with, from left, Bruce Ohr, with the U.S. Department of Justice, Montana U.S. Attorney Mike Cotter and acting

North Dakota U.S. Attorney Chris Myers during a press conference held Wednesday 06/03/2015 at the state Capitol in Bismarck.

| Micheal

Cates Declaration Return To Filings |