You Are On Search Bakken - $500 Million Dollar - The Williston Crossing Project Boom Or Bust Page

By the International Real Estate Company Stropiq - Announced 04/09/2015 - Completion 2018 - Shelved In 2017

With "New Bold Leadership In The White House And In Bismarck" The Numbers Can Only Get Better

The Phrase Was Coined By Now North Dakota GOP Governor Doug Burgum - The Only Candidate For Governor To Endorse Trump

What Was It Doug Burgum Said They Are To Get Elected? - Money Squanders, Career Politicians & Good Old Boys

Yep, "New Bold Leadership" - Burgum Doesn't Say Or Do A Thing Since He Became One Of Them

| This Page's Layout Guide L to R - Top To Bottom |

The Project | Suits - Swiss - Fracking | Fortune - 2015 | Big Box Wars |

Further |

| Oil Cost Efficiency | "Stupid

Money" |

Arresting The Decline | Malls

- Life & Death |

Bakken Oil Prices | Deja Vu - 1982 |

Return To Bakken / ND - Real Estate Boom Or Bust

2017 - The Project Has Been Shelved

"You have all heard it before — 'I could not get my family to live here because it's missing something,'" he said.

"You know what that something is? It's retail and entertainment." - Terry Olin 2015

Olin made this statement and now he is going to build single family homes in Williston.

Bakken's gas water ratios increase, oil declines, E&P debts increase. Houston Geological Society - Sept. 2017 - Bakken at 18:00

| The 2017 Plan | The Meadows | They Upped The Permit Count By 100% |

The Permits Are Under The Trade Name McGarry Stropiq Construction LLC - Patrick McGarry Seems To Be Or Has Been Involved In Everything Bakken

“If we all really thought deeply about it, how often are all of us here in Williston doing our shopping on our computer, as opposed to going to the retail that does exist here and asking them to

order it for us?” he asked. If you don’t buy everything from retailers we have or ask them to order it for you, you are validating what looks like an inevitable future.

We have become creatures who (would) just as soon have things brought to us as opposed to driving to the shop to see if they have it there.” Terry Olin 2017

That Handwriting Was Dripping Off The Walls Years Ago - Imagine If Stupid Money Had Bought The Hype! You Would Have A $500,000,000.00 Men's Suit - Enough Money For 62 More Wells!

In Minot Sears Closed, Herbergers Closed, Food Services Of America Closed - Home Depot Closed In Bismarck & Williston - Hundred's Of Available Commercial Locations In Minot, Williston & Dickinson

The Meadows North Of Williston - Seems To Have Had Several Different Players - MVCI - Conner Murphy - Now Stropiq - Apparently Started In 2013

| The

Williston Crossing Project 2014 - 2015 - It Would Be Great Return To Top Of Page |

Williston Crossing - 2014

The area’s population is also growing at a swift pace – nearly nine percent per year through 2017 – and will continue to grow to 159,000 over the next 10 years.

Williston Area Population 2015 - 32000

"140,000 more wells to be drilled" over 40 years" According to Rolfstad, ( at $8,500,000.00 a well that is 1.2 trillion dollars, without inflation)

At The Current Rig Count of 54 - 01/29/2019 - At 8 Wells A Year Per Rig That Will Take 324 Years

140,000 More Wells

| Pre Marketing | Kuwait On The Prairie! | Kuwait Production |

Kuwait Produces 3,000,000 bbl's Per Day From Some 2100 Wells

Bakken / ND Produces 1,162,071 bbl's per day From Some 14,457 Wells - Mar. 2018

Williston Crossing - 2015

Hold The Phone 04/11/2015 - The City Wants Control

"It would be very disappointing, not only to us, but to the citizens of Williston and the much broader region Williston Crossing would serve,

if the idea is to kill our project solely for the protection of a small number of land developers with too much unsold inventory,” Olin said.

“We like to believe our city officials are above that and our recent entitlement is not challenged."

Dont Those Keywords Speak Volumes. "To Much Unsold Inventory"

| City Moves

For The Extra Mile |

1 Mile Zone To Go On |

| The Murphy Park Is Approved | Another Development |

"To Much Unsold Inventory"

And Reality On The Ground

| Williston

On realtor.com |

Williston

On loopnet.com |

Williston Crossing - 2015

It Would Be Great - A Lot Of If's From Both Sides

Where do you find and house the labor to man these stores? Where can they afford to live?

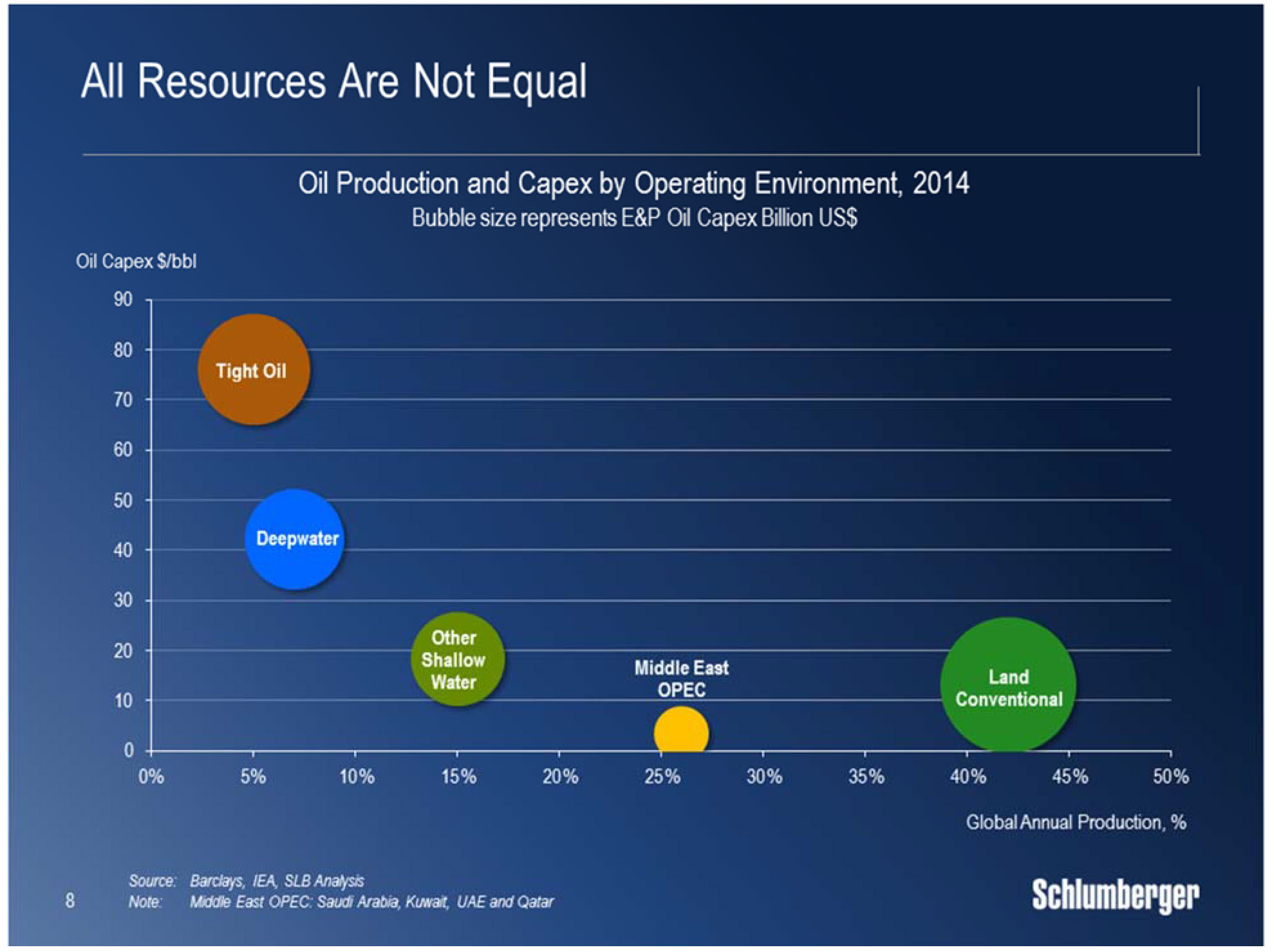

Short Of Deep Water - The Bakken is some of the most costly oil mankind has ever gone after.

"We're the ones who will have to deal with this if it fails," Commissioner Martin Hanson said.

"It's a pie in the sky. And I don't think it's nearly as visionary as it is delusional."

Very strong words from the commissioner and delusion seems to have played a large role in the development of tight oil

There are so many types of delusion - Heavens to Betsy - Define Delusion

Olin said the location was

picked by experts to give the development the best chance of

success,

and that Williston Crossing will make the region a

"cooler place to live."

"You have all heard it before — 'I could not get my family to live here because it's

missing something,'" he said.

"You know what that something is? It's retail and

entertainment."

Kind Of A Strange Knock

That Ones Family Will Not Move To Williston.

The majority of people who

came to the Bakken didn't come for retail and entertainment.

They came because of money

and jobs. Its About Hydrocarbons.

Its not like you built a

Freightliner or Apple Factory In Williston.

stropiq.com

| What Oil Slump - County OK's 500 Mil. Retail | Williston Crossing |

Who Is Terry Olin & Ellen Simone Weyrauch

| Terry Olin |

Ellen Simone Weyrauch |

| Terry Olin

on zoominfo.com |

Ellen Simone Weyrauch on zoominfo.com |

| Terry Olin

at eastern property holdings |

Ellen Simone Weyrauch at eastern property holding |

| The Suit

& The Swiss & Fracking Return To Top Of Page |

“How it is even possible that the 30,000 residents of Williston – the Bakken Shale’s de facto capital –

have literally one store in which a men’s suit can be bought within 125 miles?” said Stropiq’s other Principal, Ellen Simone Weyrauch.

“In a region the size of Switzerland, Williston Crossing will make an immediate impact for residents, expanding their retail horizons exponentially.”

There is not alot of men that wear suits to work with hydrocarbons

Pre Affirm Market

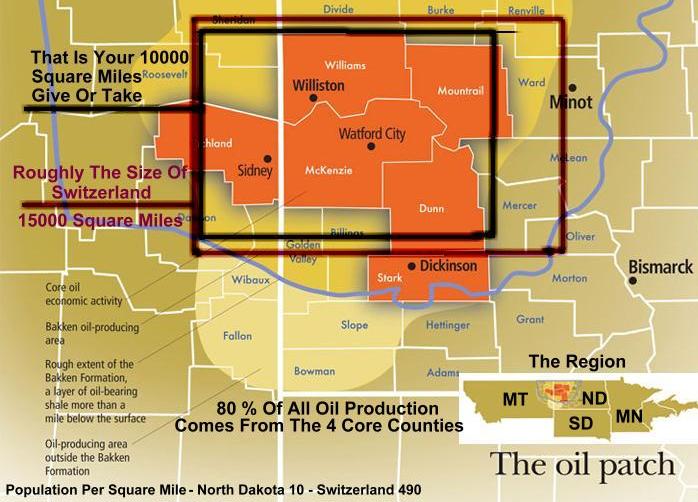

The Bakken Is About 4 Core Counties For Production Lets Say 100 By 100 miles Is = 10000 Square Miles

They keep using the 100 mile barrier to Minot or Dickinson Half That & In that 10000 Square Miles Lets say 70000 people.

Which would be a reach considering what the US census bureau says - Williston 32000 - Continued Growth

In Switzerland their is 15940 Square Miles and 8 million people. Good Place To Sell Suits.

Switzerland - Data

| They Produce Oil 3613 bbls a day |

They Have Roughly 35 wells |

Home Of Transocean |

Deepwater Horizon Explosion Accident |

And Apparently They Have Banned Fracking

| Switzerland - No Fracking | European Countries Banning Fracking |

What Is The Mindset Of Switzerland

Swiss People

What Is It With Williston & Suits ? They Have A Walmart & You Can Order Suits Online From Walmart

Walmart Online Men's Suit Shop

& Online From Target

Target Online Men's Suit Shop

The Nearest Target Is Minot - So If Target In Minot Has Suits & JC Penney In Minot Has Suits

Then Williston JC Penney Has Suits & You Can Buy Suits Online & Second Hand Stores

Then It Would Seem The Suit Market Is Saturated

google search - number of men's suits being sold in North Dakota

Where Is There 50000 People In Williston ? Yes Jamestown ND Would Compare - No Target There

Williston Has A JC Penny & Walmart & Menard's Super Stores - What More Do You Need?

Stutsman County Population

2013 Census - Minot 46000 - Bismarck 67000 - Williston 20850 - Dickinson 26000

“This is a temporary hurdle, and eventually (oil) prices go back up. It’s a question of when and how much and the rate,” he said.

“It’s not this sense that people are heading out the door.” ND To 800,000 by 2020 Kevin Iverson, manager of the North Dakota Census Office

Fargo Is Revised To 228,000 In This Story Continued Growth

| Greater Minot

Population 73000 |

Greater

Bismarck Population 126000 |

Greater

Williston Population 32000 |

Greater

Dickinson Population 30000 |

| Fortune -

It Would Be

Great Return To Top Of Page |

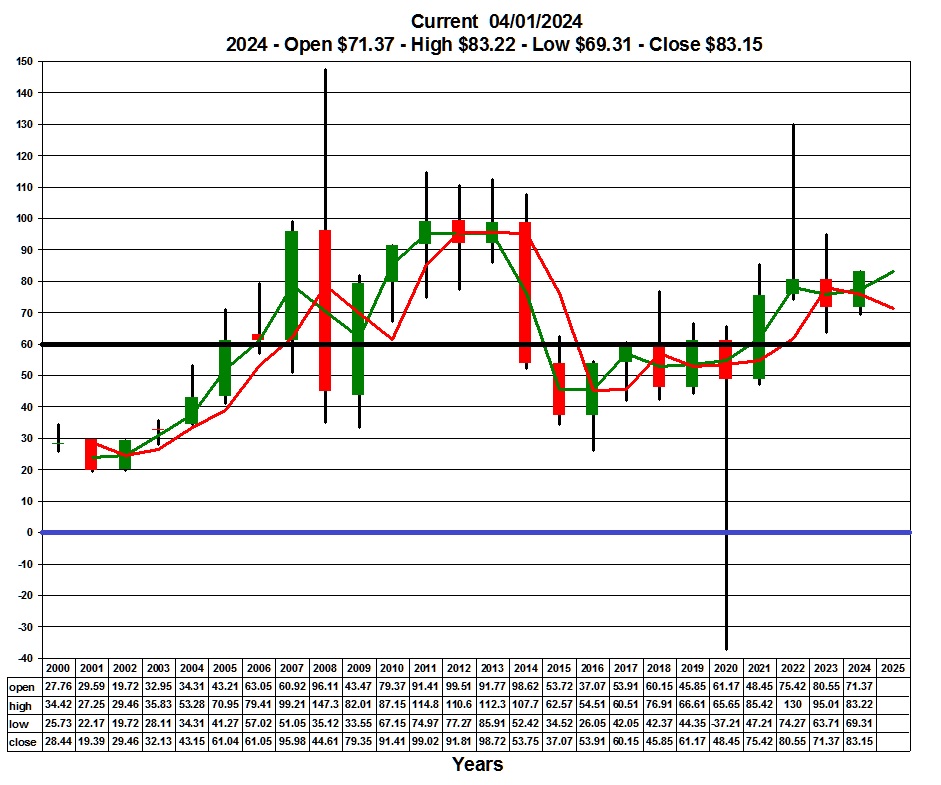

Olin, the developer, says he’s undeterred by recent events: “Should we stop and wait until [the price of oil] is $60?

Is there some scenario in which it makes no sense? I think not.” He insists that his investors remain confident.

But if they get nervous, Williston Crossing will likely never be built.

Terry Olin and Ellen Simone Weyrauch on the site of Williston Crossing

Fortune March 2015

The Stropiq & JLL Teams on the 219-acre site of Williston Crossing

This Is Their Promo Photo & Words

| Big Retailers Return To Top Of Page |

John Menard May Be 3rd In Size To Home Depot & Lowe's - But He Is #1 In ND

He Choose To Stay In The Thick & The Thin. And He Has Cash

He Is A Private Held Company - Not Publicly Traded

His New Store In Williston Opened The Summer Of 2015

Menard opened his first hardware store in 1972. As of 2014, his company owned 287 Menard's stores.

As of 2014 Menard's grossed an estimated $8.3 billion in sales. Menard had a net worth of $8.6 billion in 2013,

according to the Forbes 400, and is the richest person in Wisconsin.

Net Worth Of John Menard

| Home Depot Opens Williston ND 2014 | Home Depot

Closes Williston ND 2016 |

| Home Town Not Home Depot | homedepotsucks.org |

On Hold No Longer

Development Tabled

How Home Improvement Store Founder John Menard Became The Richest Man In Wisconsin

And What He Sacrificed To Do It

Big Money & The Big Box Wars

| Further Return To Top Of Page |

It Just Gets Further & Further Spread Out

| Oil Cost Efficiency Return To Top Of Page |

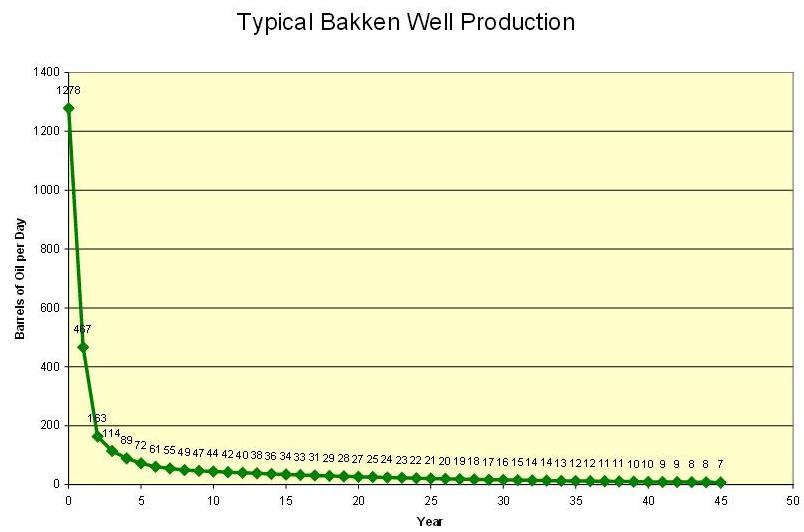

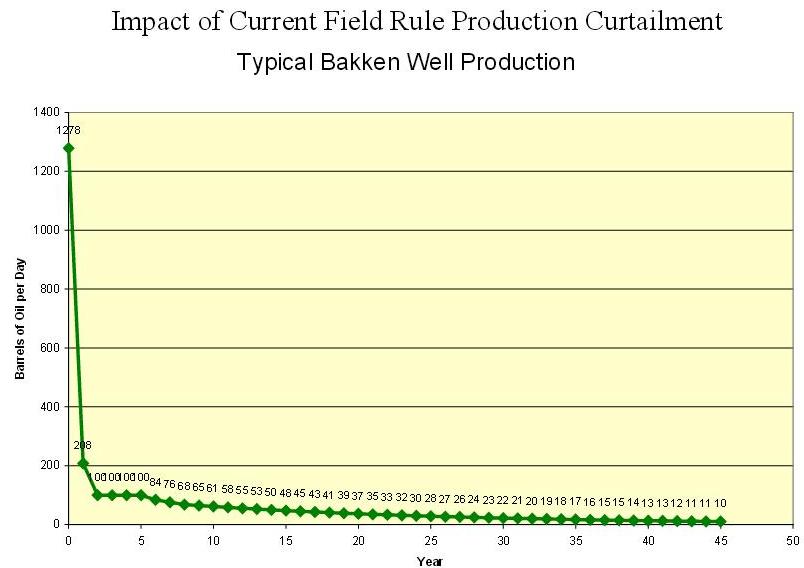

Bakken's gas water ratios increase, oil declines, E&P debts increase. Houston Geological Society - Sept. 2017 - Bakken at 18:00

“While oil prices may cause temporary caution, there is a "cost efficiency of oil production"

in this region along with sheer supply that makes investments sustainable."

The Ebb & Flow

Arthur Berman: Why Today's Shale Era Is The Retirement Party For Oil Production

At 11:45 - "Recent Study For A Client In The Core - The Sweet Spot Of The Bakken - You Need About $83.00 BOE To Break Even"

February7th - 2015

The artificial shale boom, slumping iron ore prices, and the political importance of chicken

Interview With Arthur Berman On The Business News Network 4/10/2015

The first step to price recovery is the severing of capital supply to companies that could not fund their operations

from cash flow when oil prices were more than $90 per barrel. If this does not happen, we could be in for a long period of low prices.

The Oil Price

Collapse Is Because Of Expensive Tight Oil

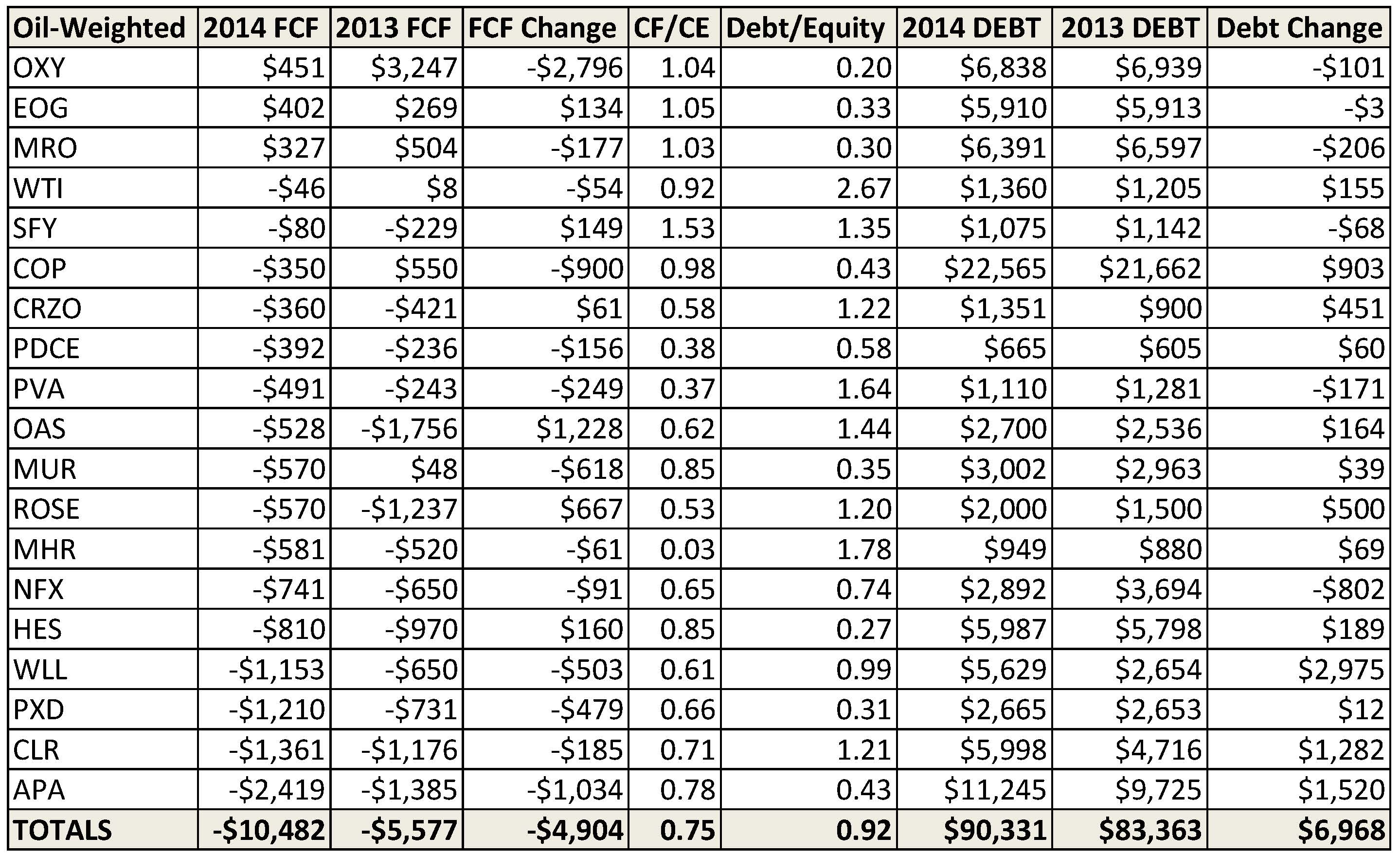

These

companies out-spent cash flow by 25%, spending $1.25 for

every $1.00 earned from operations. Only 3 companies

–OXY, EOG and Marathon– had positive free cash flow. Total

debt increased from $83.4 to $90.3 billion from 2013 to

2014.

Debt must be continually re-financed on increasingly

poorer terms because it can never be repaid from cash flow

by many of these companies. The U.S. E&P business

has, in effect, become financialized: investment in this

class

of company has become the sub-prime derivative of the

post-Financial Crisis period. There is no performance

requirement by

investors other than the implicit need to maintain net asset

values above debt covenant trigger thresholds.

These terrible

financial results reflect a year when average WTI oil prices

were more than $93 per barrel.

First quarter 2015 earnings will make these results look

good.

Table 1. Full-year 2014 earnings data for representative tight oil exploration and production companies.

Dollar amounts in millions of U.S. dollars. FCF=free cash flow; CF=cash flow; CE=capital expenditures.

Source: 2014 10-K filings, Google Finance and Labyrinth Consulting Services, Inc.

A Great thanks to Arthur Berman & His Experience & Insight Into The Hydrocarbon Industry

artberman.com

| "Stupid Money" Return To Top Of Page |

Saudi Arabia's Oil-Price War Is With Stupid Money

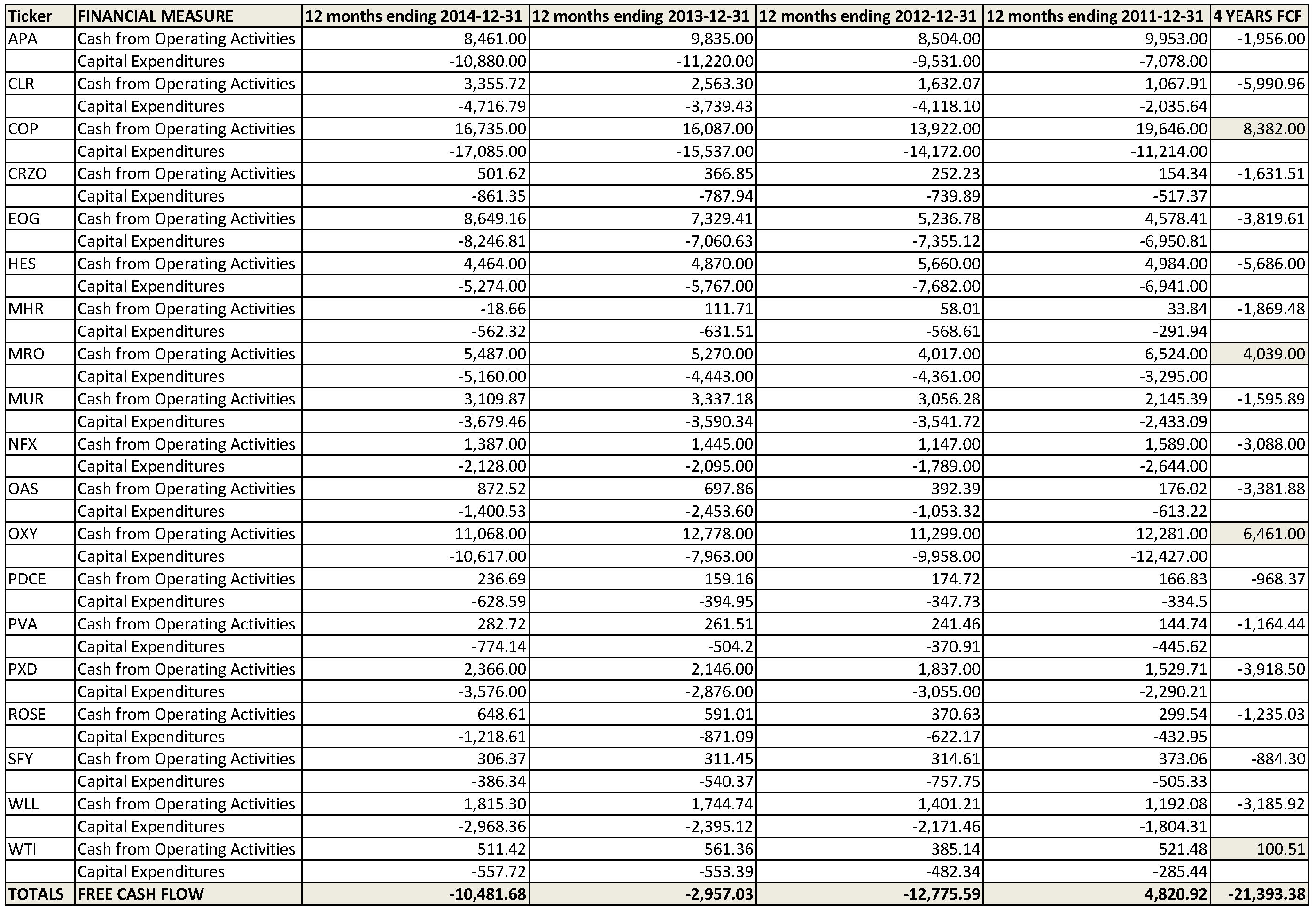

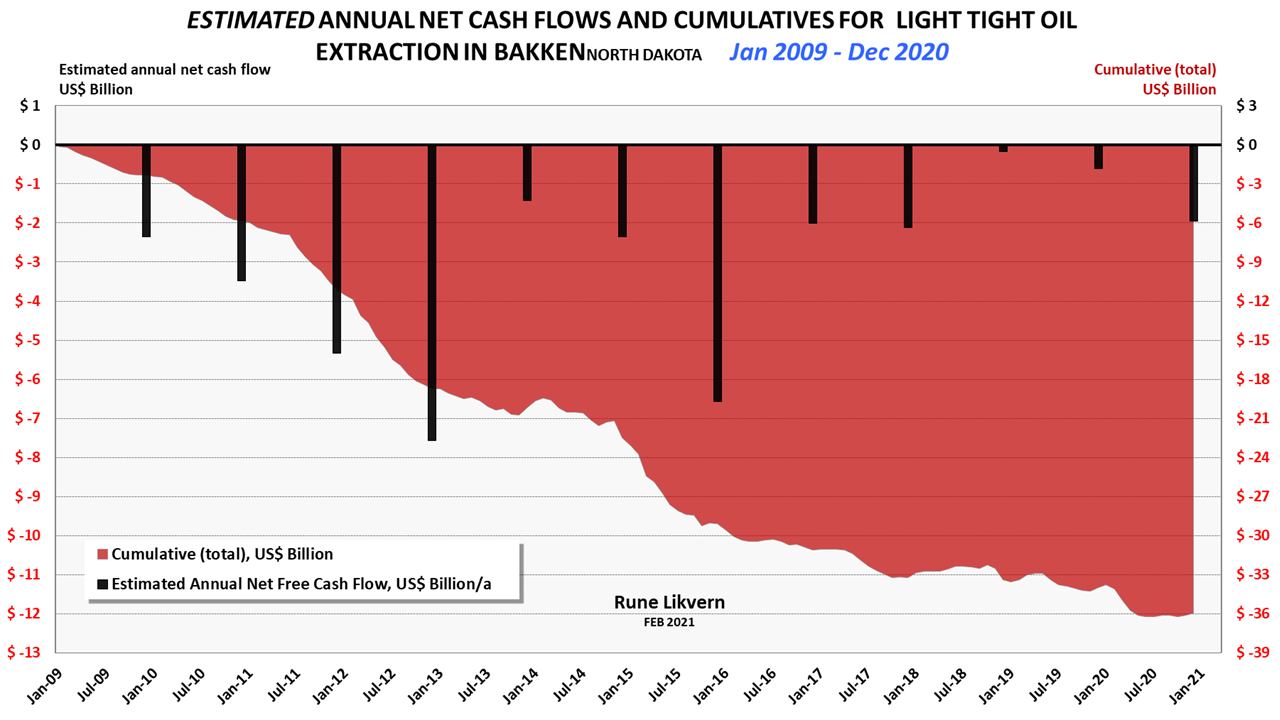

Some rationalize the negative free cash flow as an expansion of capital base that will result in future profits.

The following table shows that over the past 4 years, tight oil negative cash flow increased and has reached a cumulative of

more than -$21 billion for the representative companies. Almost half of that negative cash flow took place in 2014.

How many times do you hear it? It goes on all day long Everyone knows everything

And no one's ever wrong Until later...

Show Me Dont Tell Me

Half of the 41 fracking companies operating in the U.S. will be dead or sold by year-end

Because of slashed spending by oil companies, an executive with Weatherford International Plc said.

Dead Or Sold

| Schlumberger 20,000 Laid Off Schlumberger Layoffs |

Halliburton 9,000 Laid Off Halliburton Layoffs |

Baker Hughes 10,500 Laid Off Baker Hughes Layoffs |

Slide from Schlumberger CEO Paal Kibsgaard’s at the Scotia Howard Weil 2015 Energy Conference.

Schlumberger Presentation - March 2015

| Arresting The Decline Return To Top Of Page |

"The hard reality is this: propping up zombie oil companies is only going to make the downturn last longer."

Who Should You Call To Arrest Decline

What A Irony. Arresting The Decline. Long before oil price went in the toilet, Decline was everywhere. No one spoke much about her.

They seemed to deny that she was everywhere. They just kept feeding her and giving her more and more to decline.

They shrugged her off in quarterly conference calls. Experts and everyday people with calculators warned of her. Wrote of her, charted her.

Respected her. Warned of the day she would overtake their enabling addiction of drilling. Tried to come up with ways to shut her down,

That just don't work in tight oil. So to have her arrested, who do you call? The police, the E&P's, the FBI, the NDIC, the TRRC, the media,

the banks, Wall Street. Probably all of the above. It will be difficult, very difficult to bring her in, she is lurking at every lease, behind every

pump, in every production tank. She is in the paper work, the permits, the earnings, she is the thought that crosses the mind and is brushed off.

Updated When All Three Report Same Month Data

Bare In Mind - Increased Production Only Seems To Decrease Price

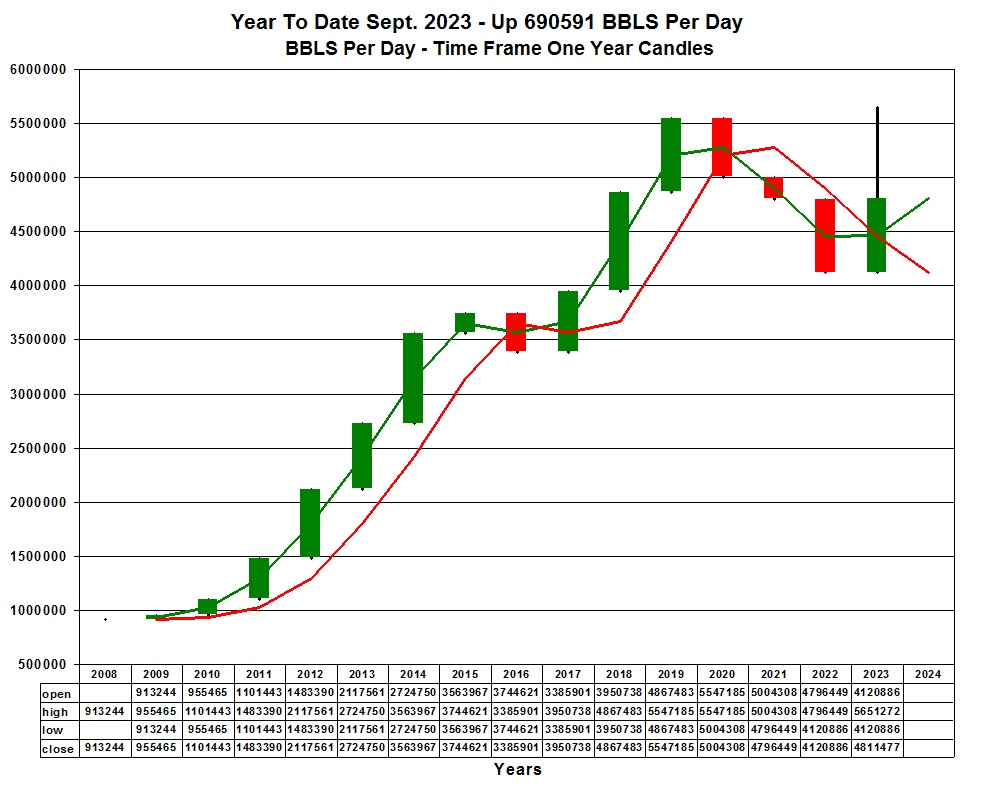

The Combined Production Of The Three Largest Play's - Bakken - Eagle Ford - Permian Basin - Current June. 2025

5,083,152 bbl's oil a day - Divided by (2008 to Current June. 2025) 166,981 Wells - Is 30.4 bbl's oil a day per well. 166,981 Wells Times An Estimated $8.5 Million Per Well Is $1.4 Trillion Dollars

2025 Combined Production Of The Big Three - Bakken / ND - Permian Texas - Eagle Ford Texas - YTD June. 2025 - Up 158,035 Barrels A Day

Year To Date - Bakken Production Is Down 39,891 bbl's Per Day - 377 New Wells

Year To Date - Permian Production Is Up 91,352 bbl's Per Day - 2701 New Wells

Year To Date - Eagle Ford Production Is Up 106,574 bbl's Per Day - 584 New Wells

As Of June. 2025 - A Combined Count Of 3,662 New Wells x $8.5 Million A Well Is $31.2 Billion

A Average BBL Per Day Well Production Of 43.2 bbl's Per Day - Not Good

3,662 Wells x $8.5 Million Is $31.2 Billion - Is $172.1 Million A Day - Divided By 158,035 Barrel's A Day - Is $1088.20 A Barrel

What Are They Thinking !

The Problem With Oil Prices - They Are Not Low Enough

| Bakken/North Dakota Average1 | Permian Basin Average1 | Eagle Ford Average |

Bakken/ND - Permian - Eagle Ford - Combined Production - 2008 To Current 2025

In 2015 You Did Not See Candle Over Candle Growth - Nothing But Cross - Recross - Test - Of The 3.4 - 3.6 Mark - Doji - Doji - Vroooooooooooooom

2015 Ended As A Hammer - 2016 Ended As A Engulfing Bear Candle - 2017 Is A Engulfing Bull Candle - 2018 Headed Back Up? - 2019 Banging Sideways

2020 - Covid-19 Takes a Bite out of the Frackers - 2021 Biden Sends Inflation Through The Roof - 2022 Biden Drains the SPR - 2023 Biden Drains It More

2024 Same Old, Same Old - 2025 The "Golden Age Of America" Has Returned

| The Life & Death Of

The American Shopping Mall Return To Top Of Page |

To critics, investing millions of dollars in a shopping center during the 21st century may seem like a loser's bet.

Since 2010, more than two dozen enclosed malls have shuttered and 75 others are on the brink of failure, according to Green Street Advisors.

Other industry calculations estimate that about one-third of the 1,200 enclosed malls built in the U.S. are dead or endangered.

| The

Life & Death |

Doubling Down |

| Plains Marketing - Oil Prices | Market Price - Bakken Sweet - WTI Crude Return To Top Of Page |

Flint Hills Resources - Oil Price |

| Why Shale (Tight) Oil's Safety Net Is About To Expire | Regulator Warns Of Lending To E&P's |

Olin, the developer, says he’s undeterred by recent events: "Should we stop and wait until the price of oil is $60?"

Thats A Really Big & Good Question! - Maybe At Least Till Bakken Oil Stays Above $60.00

Saudi Arabia Has a Solution to the Global Oil Glut Problem - 04/24/15

"Raise output to near-record levels and then pump even more."

The Solution

| Five Year Average 2016 to 2020 - Low $6.89 - High $53.70 |

Ten Year Average 2011 to 2020 - Low $29.03 - High $69.65 |

Fifteen Year Average 2006 to 2020 - Low $28.68 - High $72.55 |

Bakken Sweet Crude Futures - Flint Hills Resources Futures - Years 2000 To 2022

Bakken Sweet Has Only Traded & Closed In A Year Time Frame Above $60.00 - Four Of The Past Twenty One Years

Price Per BBL - Time Frame One Year Candles

Olin, the developer, says he’s undeterred by recent events: "Should we stop and wait until the price of oil is $60?"

Thats A Really Big & Good Question! - Maybe At Least Till NYMEX - WTI Oil Stays Above $60.00

| Five Year Average 2016 to 2020 - Low $23.52 - High $64.83 |

Ten Year Average 2011 to 2020 - Low $44.27 - High $83.21 |

Fifteen Year Average 2006 to 2020 - Low $45.70 - High $77.09 |

NYMEX - WTI - /QM - Light Sweet Crude Futures - Years 2000 To 2022

WTI Has Only Traded & Closed In A Year Time Frame Above $60.00 - Ten Of The Past Twenty One Years

Price Per BBL - Time Frame One Year Candles

Bakken Decline Production & Price Chart For The Past 10 Years

“ Be Fearful When Others Are Greedy and Greedy When Others Are Fearful ” - Warren Buffett

A Great Thank You To Rune Likvern At fractionalflow.com - For The Amazing Data He Compiles

A Great Thank You To Art Berman At artberman.com - For The Insight Of His Data

A Great Thank You To Enno Peters At shaleprofile.com - Visualizing US Shale (Tight Oil) Production

Question Is

We're setting sail To the place on the map from which no one has ever returned

Drawn by the promise of the joker and the fool By the light of the crosses that burn

Oh, save me. Save me from tomorrow I don't want to sail with this ship of fools

Ship Of Fools

To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information provided on this website,

or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information we provide to any person or entity

(including, but not limited to, lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or incompleteness of this information).

We encourage you to invest carefully and read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.finra.org.

IF YOU DO NOT AGREE

WITH THE TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE

IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE

OF THIS SITE

OR THE INFORMATION PROVIDED HEREIN SHALL INDICATE YOUR

CONSENT AND AGREEMENT TO THESE TERMS.

Honor - Respect - Freedom - Country - USA