bakkenboomorbust.com

bam boom

bubble bust bump bang

You Are On

Search Bakken/North

Dakota Equity Taxes & Gimmicks & Fake Facts Boom Or

Bust Page

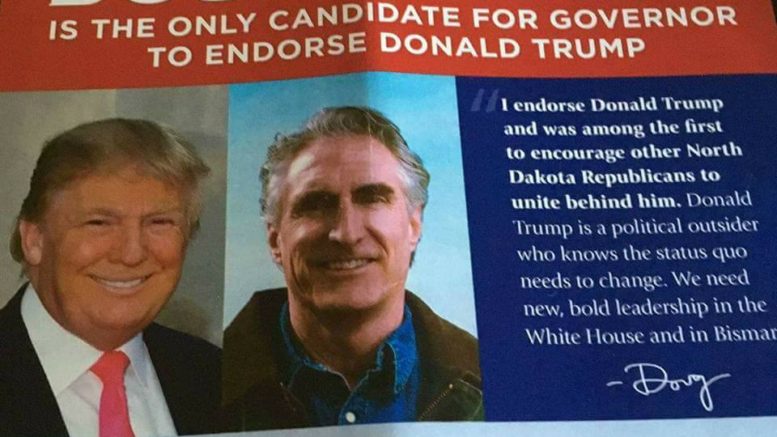

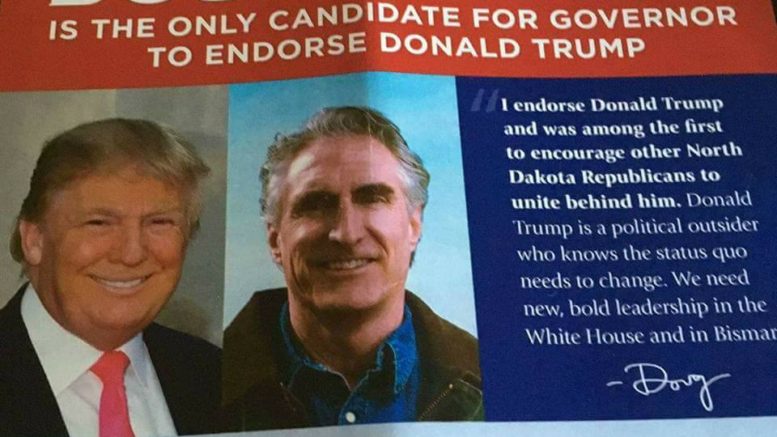

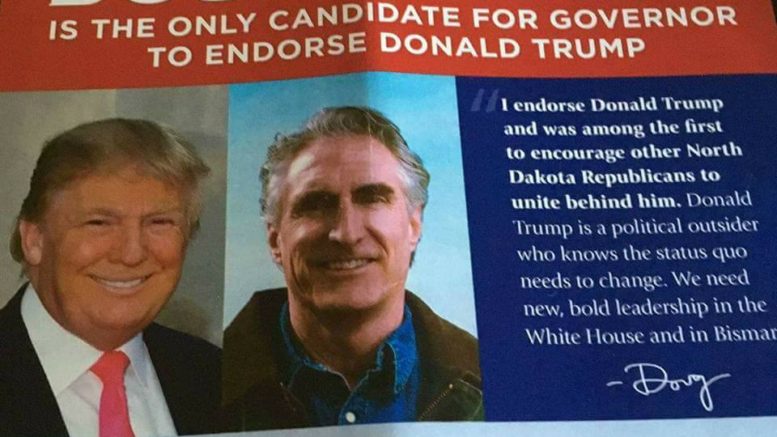

"New

Bold

Leadership In

The White

House And In

Bismarck"

The Phrase Was

Coined By Now

North Dakota

GOP Governor

Doug Burgum -

The Only

Candidate For

Governor To

Endorse Trump

What Was It Doug Burgum Said They Are To Get

Elected? - Money Squanders, Career Politicians & Good Old

Boys

Yep, "New Bold Leadership" - Burgum Doesn't Say Or Do A

Thing Since He Became One Of Them

When The Next Generation

Asks You, Why Didn’t You Do Something? Why

Didn’t You Speak Up? What Are You Going To

Say?

You Can Pay Off Your Mortgage -

Create Equity - But You Will Never Pay Off

Bureaucratic Runaway Property & Sales Taxes

- Your Renting & Buying From The

Bureaucrats.

Do You Know Where

Taxmakers Tax Slave's Are When There Spending,

Indebting, & Taxing? There Out Working To Pay

Equity Taxes & To Keep A Decent Life For Family

& Or Themselves!

For What Is Lost In The Great Equation Is The

Rising Price Of Everything To Pay

Taxes, Health Care & Big Pharma - Its

Unsustainable - A Cancer On The Great Society - The

Snowball To Hell

If You Attempted To Drain The Swamp - They Would All

Be Sucked Down & Drowned In The Rabbit Hole

There Has

Been A Lot Of BOOM's In

North Dakota In Recent

Year's & As With Oil

- The Revenue

Streams Have Not

Benefited Taxpayers -

Only Indebted Them!

If You Live In ND

You Are Being Taxed To Death - To Poverty - Moving To North Dakota

- Think Again - Read The No Gimmick Relief Letter From Our Tax

& Equity Leaders

& The Line Of Equity Hype They Would Even Think To Publish -

Then Read The Gimmicks & Fake Numbers Letter From Robert Hale

Of Minot

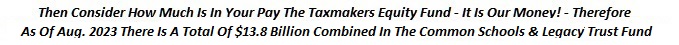

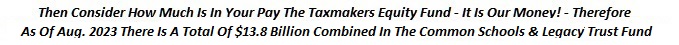

ND Funds - Balances

What do they ever plan on doing with this money?

"We also have an obligation to return

the excess revenue our strong economy has deposited in the

state treasury to the taxpayers.

After all, it is your money, and we are

committed to significant and sustainable relief from the

burden of property, sales and income taxes.

While there are many plans on the table today,

we can guarantee you that before the session ends, you and

your family will see real tax relief."

The Vision By - Carlson, R-Fargo, House majority

leader. Wardner, R-Dickinson, Senate majority leader. -

They Say They Have An Obligation To Return That Money -

Have You Received Yours Yet?

If They

Wont Do What We Elect Them To Do & Respect Our Wishes, Our

Money, Our Lives - Then As The Young People In Florida &

Across This Nation Say - Vote Them Out - Vote Them Out -

From Federal To State To County To City - Vote Them Out

For All The

Hype About The Big Time Energy Production State You Would Never

Know It In Taxes - A House In Minot Paying $4000 to $5000 A Year

In Property Taxes - Thats More Then Amelia Island Florida!

Minot Has The Highest Water & Sewer Rates In The State -

City, County, School Taxes Are Being Raised.

Ward County Tax

Parcel Viewer - gis

Property Tax Viewer

Here is another sign of the Times for

Minot & Ward County

Tax Delinquencies Rise

Equity Is Used In It's

Definition - The Quality Of Being Fair &

Impartial & The Value Of That Fairness &

Impartiality - As In Well Managed Business Equity

Debt - As In Well Managed Public Equity Debt

Created By Local, State & Federal Leaders

The Democracy That Gives Taxpayers A Say In

That Equity Debt. As In New Airports, New Public

Structures, New Schools, New Jails, Healthcare,

Law Enforcement, Addiction Recovery, Tax

Reduction, Private Investing, More Government

& Bureaucrat Waste.

Thank God For Bold New Leadership That Is Of A

Equity State Of Mind. No More Money Squanders, No

More Career Politicians, No More Good Old Boys, No

More Tilting At Windmills Whose Foundations Are

Anchored In Swamps.

Just then they came in sight of thirty or forty

windmills that rise from that plain. And no sooner

did Don Quixote see them that he said to his

squire,

"Fortune is guiding our affairs better than we

ourselves could have wished. Do you see over yonder,

friend Sancho, thirty or forty hulking giants? I

intend to do battle with them and slay them.

With their spoils we shall begin to be rich for this

is a righteous war and the removal of so foul a

brood from off the face of the earth is a service

God will bless."

Second Largest Gas

& Oil Production In The Union & We Dont Have Any

Money? & Taxes Keep Climbing - Whats Up With That?

Governor Calls For Budget Cuts

He Should

Be Screaming

The answer is simple raise property

equity taxes and sales equity taxes. Thats what they keep

doing, why stop.

Raise Wages, God knows a lot of state employees are not making

enough to make ends meet. If you raise there wages they will

get more done.

Did the legislature consider cutting all

the unbelievable wages being paid?

Dozens of political appointees

receiving 11k a month, doctors receiving 31k a month. There

supposed to be equity servants of the taxpayer!

State Payroll

Roster - 2015

State Payroll

Roster - 2021

The

average median income in ND is $60K a year. There isn't one

state, county or city employee who should be paid more then

that.

Then you would see a change in the way things get done!

ND Median Income

Here

is a prime example of taxpayer equity!

One example Burgum offered is the state has 800

legacy information technology programs. The Information

Technology Department spends 91 percent of its time operating

those legacy systems,

9 percent of its time growing existing system and zero time on

transformation, Burgum said.

How many websites does the state have? A Lot.

There are 5 pages of ITD employees!

State Payroll

Roster Page 3

Why don't

they get the state highway department to stop salting roads

that don't need salting and when they do it turns to ice!

When they really need to be out salting and plowing there not!

Here

is why Burgum needs a sword not a scissor to cut the budget

& how the can just keeps getting kicked down the road

Come On!

Cut these

cronies at the state fair - $18,500 a month for a manager and

assistant manager!

State Payroll

Roster Page 117

When the fair looses money year after year!

Rewarding A Looser!

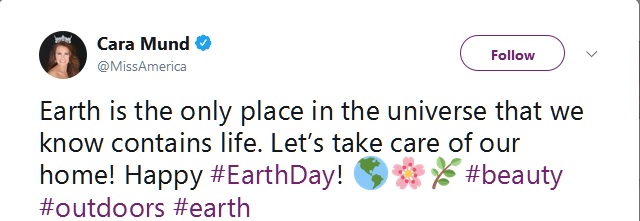

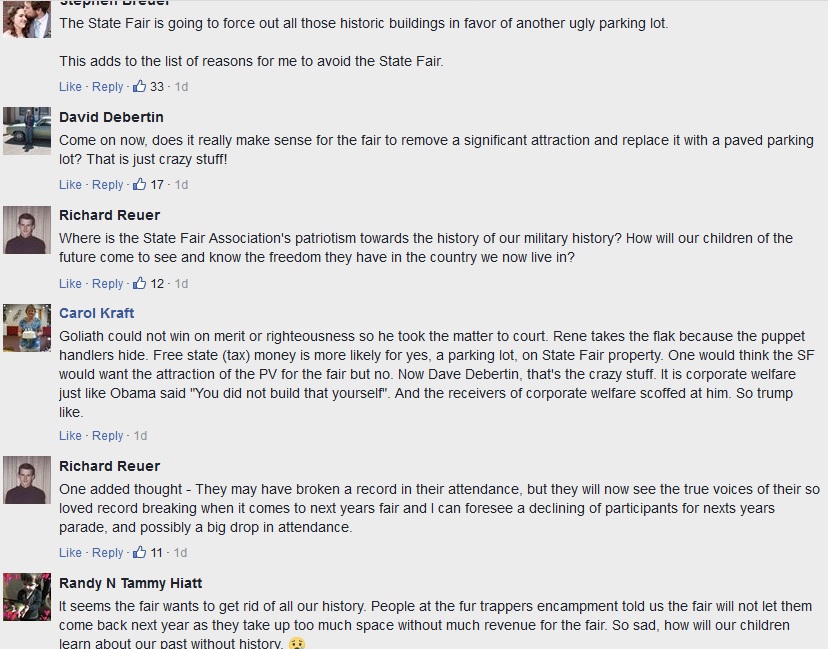

They want the Ward County Historical

Society off the fairgrounds so they can build a Convention

Center - While in Minot aren't there enough

centers already?

Based on the years of loosing money the state should look at

moving the fair to Bismarck or Fargo for better numbers and or

replacing the management.

NDSF Manager

Happy With Court Ruling

The NDSF "Should Represent" The Past, The

Present, The Future, of North Dakota

It Does Not.

Ask yourself a few things about the Fair.

Why is it that every food vendor there charges $8.00 or more

for anything. A hot dog, a coney dog, a burger, 8 bucks, 8

bucks, 8 bucks!

Why is it to exit the main parking lot you have to drive

through the ditch? One way out through the ditch!

Why is it for local talent karaoke and free stage bands the

seating is so screwed up, unlevel, one bench here and one

bench there.

For the gate charge and those $8.00 hot dogs, things could and

should be a lot better.

Like so many things in the Trump ERA answer

the NDSF with your Wallet. Boycott It!

Comments in local paper about ruling. They are valid.

During his campaign for

governor, Burgum often talked about shaking up the "good old

boy" party establishment and reining in "runaway spending".

Burgum could save the taxpayer a ton of money by

not being like his predecessor and paying bonuses to public

servants.

You know what you sign up to be a taxpayer public servant or

go to work as a taxpayer public servant employee and you don't

like the wages.

Then Go Get A Job In The Private

Sector & Or Start Your Own Business & See How You like

It

If They Wont Do What We

Elect Them To Do & Respect Our Wishes, Our Money, Our

Lives - Then As The Young People In Florida &

Across This Nation Say - Vote Them Out - Vote Them

Out - From Federal To State To County To City - Vote Them

Out

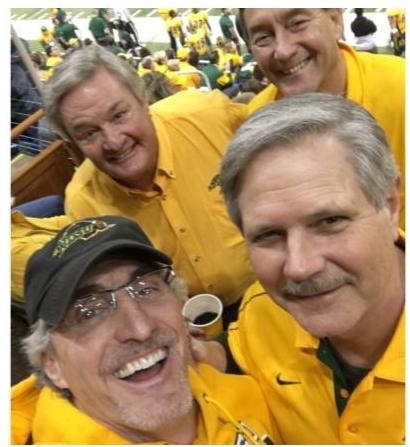

Here is a good selfie of Burgum. I call them names

to get elected and when Iam elected I do the same things they

did, the laughs on you and your wallet!

Burgum and the Legislature mostly agreed on spending priorities

during the session, though friction was evident at times,

especially during a fight over a bill limiting a governor's

ability

to set salary bonuses for staff. Burgum won that veto

fight with the Legislature by arguing the legislation improperly

infringes on the executive branch.

God forbid, just like the last governor lets pay bonuses to

servants of the taxpayer, yet alone did the legislature consider

cutting all the unbelievable wages being paid.

Dozens of political appointees receiving 11k a month, doctors

receiving 31k a month. There supposed to be

servants of the taxpayer!

State Payroll

Roster - 2015

State Payroll

Roster - 2021

State Employees Receive $2.1 Million In Retention and

Recruitment (BOOM) Bonuses 11/2015 - While Crime Rages

The

Plutocracy

Dick Dever of

Bismarck says the state has been competing with the private

sector and the $1.5 million in retention bonuses are

justified.

You know what you sign up to be a taxpayer

public servant or go to work as a taxpayer public servant

employee and you don't like the wages.

Then Go Get A Job In The Private

Sector & Or Start Your Own Business & See How You like

It

What Is It With Burgum & These Selfies?

Stop paying Josh to be the face of North

Dakota!

$840,000.00

Not only that why do you want a man who

reportedly cheats on his wife to be the face of North Dakota?

What Is It With Burgum & These Selfies?

Stop paying Josh to be the face of North

Dakota!

$840,000.00

Not only that why do you want a man who

reportedly cheats on his wife to be the face of North Dakota?

Or has that become the norm now for family values, banging

anything that will have you! The faces of ND & Washington.

That's got to turn some decision making heads when planing the

family vacation - Da North Dakota or Da Disneyland?

"He Reportedly

Bragged About It"

Now imagine the tourism dollars to be had if you

had a real family from North Dakota that pays taxes in ND do

the commercials!

What was that list from some years ago of ten suggested rules

for living? Thou shall not commit adultery. Lets go to

Florida.....

Or would it make more sense to have the face of the nation who

is really the face of North Dakota be that person

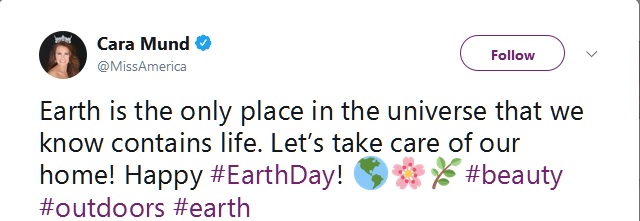

Her tweet on earth day, so true, but it goes against the grain

of the current administration and or she does not know or

realize

there are over 35 billion barrels of biocide laced frack water

buried buy humans in the earth of western North Dakota, that's

taking care of home!

Hydraulic Fracking - Going To Far

Kudos to Cara for standing up and speaking out about the

idiots that run the Miss America (whatever it is or has

become).

It seems to operate more like Fox News and or the King

himself. Thank you Cara Mund. Miss Voice for Girls and Women, Don't Stop

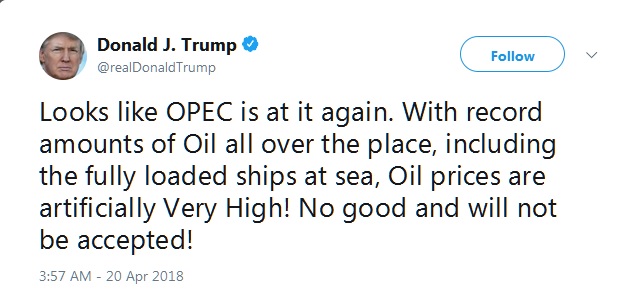

Why

don't they raise the extraction tax on oil? Even the president

has issue on artificial high oil prices. Trump Vs. OPEC

The President Seems To Forget That The Frackers Need High

Oil Prices - But He Seems To Remember What He Said In 2008

Flashback "If I were president, you'd

have $30 oil right now," Trump said. "I would call

up Saudi Arabia ... and I would say, 'That f***ing

price is coming down, and it's coming down now.'

The President Seems To Forget That The Frackers Need High

Oil Prices - But He Seems To Remember What He Said In 2008

Flashback "If I were president, you'd

have $30 oil right now," Trump said. "I would call

up Saudi Arabia ... and I would say, 'That f***ing

price is coming down, and it's coming down now.'

And you know what? They'd lower that

price so quickly, and it would be so easy." Trump In

2008 Interview - Now There Friend's - They Have To

Be - They Have The Oil & The IPO

He Doesn't Have To Call - He Just Tweets -

His Tweets Are The Yellow Brick Road!

Trump Said The Market

Is Rigged

When Campaigning - Seems To Be So - All You Need Is A

President Who Tweets About Missiles, Oil, OPEC, Hogs,

Soybeans,

Steal, Aluminum, Foreign & National Policy, Trade, War

Attack Plans, Flipping, Not Flipping, The Media, The FBI,

Etc. It Works Very Well For Traders In The Market!

Its Like Some Weird Subscriber Trade Signal Service To Buy

Or Sell - 24/7 & Its Free - TTT Trade The Tweet

Why The Trump

Presidency Is On Track To Add More Debt

In Its First Term Then Obama Did In Two

Terms - That's Bold

New Leadership!

New Bold

Government

"Bold New Leadership In The White House

& Bismarck"

They create the illusion of Tax Cuts, Tax Reform

while they front load their pockets. While in

reality they are back loading increased spending

and debt on your kids, kids, kids backs to raise the

dykes around the swamp's they will never drain.

Energy Costs Are Climbing - Farm Commodity

Prices Are Declining - Debt Is Exploding - War Is

Announced In A Tweet!

I met a man who bought up

land Wherever his feet would tread

He asked me to El Paso Said I could stay

on his spread He has horses and cows and tractors

and plows

And

all kinds of money to burn But how can I get to Texas

When my wheels won't

turn At a college of knowledge I tried

to learn All the tricks to beat the system

I'd hide in nooks and memorize my

books 'Till I knew I'd never never miss them

Eventually I got my

degree But the real thing I did learn You just can't hit your home run

If your

wheels won't turn

My Wheels Wont Turn

Property

Tax Relief Was Increased In 2017 Session

As Published In The Local Minot Paper

09/28/2017

"Wardner and Carlson

spouted their confusing numbers and assertions claiming the

Legislature tackled property tax & pain relief.

It was all smoke and mirrors – there was never any actual “property tax relief.” - Robert Hale

Property taxes are a hot topic right now, especially in

communities where property tax increases are being considered.

Without exception, no one likes taxes, especially property

taxes.

That said, property taxes are necessary to fund local

schools, law enforcement, emergency services and infrastructure.

It is important to remember that responsibility for determining

the appropriate use and rate of property tax rests solely

with local voters and elected officials.

As part of that debate, the question has been asked as to what

role, if any, the state should play in the assessment,

collection and spending of local property taxes?

That is a great question. Property taxes are levied and spent by

local governments. The state has little, if any, control or

oversight of local property taxes, valuations or spending.

Nonetheless, the Legislature heard the concerns of property

owners across North Dakota and, for over a decade, has been

committed to doing all it can to reduce your local property tax

burden.

In fact, contrary to what you may have read in the media,

the Legislature once again increased the amount spent on

property tax relief in the 2017 session to $1.292 billion.

It all started in 2007. The state Legislature passed the

very first attempt to help reduce the burden of property taxes.

This approach provided an income tax credit equal to 10 percent

of your property tax bill. In 2009, we provided property

tax mil levy reduction grants to local school districts.

We quickly realized that in the absence of any real control over

local spending, tax rates or valuation increases, the state was

on an unsustainable course.

So, in 2013, the Legislature moved to make property tax relief

permanent by incorporating it into the school foundation aid

formula and requiring schools to reduce their property taxes by

125 mils.

In 2017, we also replaced the 12 percent property tax buy

down with permanent state funding for county social services,

which covered up to 20 mils in county property taxes.

What does this mean for property tax payers today?

During the 2015 session, legislators provided $1.241 billion in

property tax relief, including $977 million in school tax

relief, $241 million to fund a 12 percent property tax buy down

and

$23 million to cover the costs of county child welfare and

elderly services. During the 2017 legislative session,

legislators provided $1.292 billion in property tax relief,

including $1.131 billion in school tax relief, $160

million to cover the costs of county social services and another

$23 million for county child welfare and elderly services.

In total, we increased state funded local property tax relief by

$51 million during the 2017 session compared to the 2015

session.

No gimmicks, no funny numbers, just the facts that show our real

commitment to property tax relief, even during difficult times.

But our work did not end there. We also passed property tax

reforms including the truth in taxation legislation, which

requires local government to notify taxpayers of all local taxes

to be

assessed and requires property tax statements to clearly

show the taxes levied in dollars, not mils. As local communities

and voters evaluate their current property tax assessments,

remember that any increase at the local level is likely an

increase in taxation by your local government and not the effect

of state property tax relief reductions.

Of course, the effect on individual local taxing entities may

vary, but the combined effect should be revenue neutral on your

property tax bill.

While painful, we encourage local elected officials to make

spending cuts before increasing property taxes.

Gimmicks Funny Numbers & Fake Facts

As Published In The Local Minot Paper

10/09/2017

Minot

- A recent letter to the editor from Sen. Rich Wardner and Rep. Al

Carlson was dismaying to say the least. It contained a number of

troubling inaccuracies.

These Senate and House leaders stated,

“Property taxes are necessary to fund local

schools.” This is absolutely inaccurate.

Our state constitution clearly states funding public schools

is the responsibility of the state, not local political sub

divisions.

It also states that the state is not permitted to use property

taxes to fund anything other than 1 mill for support of a state

hospital.

Further, the state is sitting on more than $3.6 billion dollars

in the School Lands Trust money. 98-plus percent of which is

invested in Wall Street assets.

As of 6/30/16 not a dime was invested in North Dakota public

schools. As of 3/31/17 more than $624 million was invested in

national real estate ventures – none in our school buildings.

Wardner and Carlson tell us property taxes are needed to fund

most infrastructure. This is not true. Roads, water, sewer,

garbage and the like should properly be funded with user fees.

Gas tax is actually a user fee. User fees are the

appropriate way to fund roads and infrastructure.

Wardner and Carlson tell us the state has little, if any,

control over property taxes. This is also untrue. Just ask any

county councilman.

The state has a property tax manual – it’s 27 pages long – and

lists virtually everything imaginable. In order for local

jurisdictions to receive state funds

(from state sales, income tax and other state revenue) they must

impose state mandated mills as a condition. I believe that might

be considered control.

ND Property Tax Manual

Wardner and Carlson went

on to describe how many billions the state has spent since 2007

to reduce your property taxes. Then they noted,

“We quickly realized (in 2009) that

in the absence of any real control over local spending, tax

rates, or valuation increases the state was on an

unsustainable course.”

What they didn’t tell you was how many billions (more than $4

billion), over the last ten years, they appropriated and spent

to subsidize

the college education of non-resident students whose parents pay

no North Dakota taxes.

Fellow taxpayer, this is the truth. Government is out of

control and what it is doing is unsustainable – EXCEPT – it

isn’t.

Regardless of what Wardner and Carlson say, your taxes

are going to continue to go up and up and up. This is directly

the result of their mismanagement.

Property taxes are political leaders’ ace in the hole. And

that’s why government loves property taxes. People will pay

their property taxes no matter how painful. Why?

Because failure to do so results in the Sheriff selling

your house and putting you and your family on the street or in

government subsidized housing – which, of course, government

controls.

Wardner and Carlson spouted their confusing numbers and

assertions claiming the Legislature tackled property tax relief.

It was all smoke and mirrors – there was never any actual “property tax relief.”

Funding schools is not property tax relief. It is a

constitutional mandate and using property taxes to meet this

state obligation conflicts with our constitution’s mandate to

the state.

The School Lands Trust is sitting on $3.5 billion of public

school money – invested in Wall Street – not our schools.

This fund is growing by hundreds of millions annually. Yet,

virtually all is invested in Wall Street. Not a very safe place

at the moment, by the way.

During the 2006 downturn our Wall Street investments lost

almost 40% of their value. Be prepared. Such a repeat is more

likely than not to occur again.

So much for responsible fiscal management.

With straight faces, Wardner and Carlson tell us,

“No gimmicks, no funny

numbers, just the facts that show our real commitment to

property tax relief, even during difficult times.”

Humm… “Even during

difficult times.” These leaders led a spending

spree, over the last ten years, that defies logic and good

management.

They burned through billions with no let up in

taxes. Taxpayers received virtually none of the billions in

windfall revenue from oil and gas.

They funded infrastructure with ‘one time spending.’ This

guaranteed that we would get no tax relief. It was foolish

because infrastructure is appropriately funded with long-term

debt.

Jurisdiction after jurisdiction increased local option sales

taxes. Today, North Dakota’s average sales tax has

jumped from 5 percent to 7.5 percent.

That’s a 50 percent increase. Income taxes have not abated.

Property taxes are higher today than ever.

These political leaders have the gall to tell us, “While painful, we encourage local elected

officials to make spending cuts before increasing property

taxes.”

When our oil windfall came these same individuals spent like

drunken sailors. Instead of lowering taxes they refused.

They took billions in oil revenue, washed it through what they

call the Strategic Investment and Improvement Fund and foolishly

spent it on what they called – ‘one time spending.’

Thus, no tax relief for us.

The fact is there is only one way to reduce our tax burden.

That is to take away some of government’s sources of revenue.

The only way to keep us secure in our home and not have to rent

our own homes from government is to eliminate government’s

ability to tax our homes.

What spending can be cut? Maybe we start by looking at the more

than $3.6 billion we spend in North Dakota on welfare.

According to recent reports our state has the lowest

unemployment rate in the nation. North Dakota spends more on

welfare than all K-12 and Higher Ed combined.

Since 2005 welfare spending has gone from $1.5 billion to $3.6

billion per biennium.

It’s time to care for our families and home security. Tell our

elected officials they need to do the “painful”

job they are elected to do and cut the size and cost of

government.

It’s time they represent those of us

who work and pay taxes, not special interests.

I, for one, am tired of these officials

playing games with gimmicks, funny numbers, convoluted

excuses and fake facts.

Maybe it’s time we assert ourselves and take our government

back. A good start might be to take away the property tax power.

Clearly, our elected officials have lost control and no

longer deserve to continue holding our homes hostage to their

mismanagement.

The 2013

Vision - After all, it is your money, and we

are committed to significant and sustainable relief from the

burden of property, sales and income taxes.

So Much For That Vision

As Published January 2013

We live in an incredible time in North Dakota history. The

state's growth in our economy, population and wealth is

unprecedented.

These achievements are even more impressive when viewed

against the backdrop of the national and world economy.

Growth in the oil industry has helped propel our state's

recent success. And while we didn't put oil in the ground, we

have worked hard to help make sure

North Dakota can take full advantage of energy

resources. But the story of the state's success isn't

just about energy development.

Virtually every segment of the economy is growing including

agriculture, advanced manufacturing, tourism and information

technology.

As leaders of the Legislature, our first priority will be to

do all we can to ensure the continuation of robust economic

growth.

We must and will continue to empower private enterprise

to create more good-paying jobs across our state.

And we must diversify our economy as a hedge against being too

reliant on any one sector for long-term prosperity.

To accomplish that goal, we will continue to strengthen the

business climate through regulatory and tax reform to attract

private investment, high-paying jobs and economic diversity.

We recognize that economic success has also created

challenges, and we are prepared to meet these challenges head

on.

We stand ready to make historic investments in infrastructure.

We will make major investments in road, flood and water

projects across North Dakota over the next two years.

And that is in addition to major infrastructure

investments we have made over the past several bienniums.

Our willingness to invest in the future extends to education.

Not only do we have a constitutional mandate to adequately

fund education,

we have a moral obligation to ensure we have given children

the tools they need to succeed. To meet that challenge, we are

planning to increase investment in local schools to help

offset the pressures of population growth, ensure all children

receive a quality education and prepare kids for a future

bright with opportunity.

We also have an obligation to return the excess revenue

our strong economy has deposited in the state treasury to

the taxpayers.

After all, it is your money, and we are committed to

significant and sustainable relief from the burden of

property, sales and income taxes.

While there are many plans on the table today, we can

guarantee you that before the session ends, you and your

family will see real tax relief.

To sustain our plan into the future and protect residents

from tax increases, we must build a strong reserve.

Reserves are a hedge against a volatile national economy

and overzealous federal regulations. Anything less is

irresponsible.

By building a strong reserve, cutting taxes wherever we can

and making prudent investments in priorities, we can and will

make North Dakota an even better place to live,

work and raise a family. That is the promise Republicans

make as we deliberate during the legislative session.

Carlson, R-Fargo, is House majority leader. Wardner,

R-Dickinson, is Senate majority leader.

The Current State Of

Bakken Energy Independence - Letter's to the Minot Daily

- 08-13-2017 Special Tax ?

Call It The ‘Cost of Living In Minot’

Tax

Troy Johnson - Williston - I

see a solution to Minot’s money problems, to start with,

do what the oilfield does, lay everyone off, start over

at a lower wage, take all the benefits away,

including vacations

and start from scratch. Also the ones that can’t get

laid off gets a 10 percent cut, including the city

attorney. Second, start bidding things out and stick to

the amount, if the company doesn’t follow through,

make sure they can’t work in the state

anymore. I suggest using local help and negotiate

better, buy cheaper slightly used equipment, I know

health care keeps going up and that is the governments

fault,

run the police cars another year, things

like that. Or raise everyone’s property taxes at least

10 percent, and call it cost of living in Minot.

Williston is not far behind, with its $250 million

deficit.

Dumb & Dumber - A Postcard Tax

Filing - They Forgot The Part About Donating To Their

Campaigns

When was the last time you were able

to do a paper return - you end up at ripmeoffonmytaxreturn.com

just to do a simple 1040EZ

Where does your SS # go and the

secret code you create every year that has to be cross matched

with last years secret code or to these two, Hoeven &

Cramer.

Identity theft doesn't matter? Since they

voted to take away your right to sue banks and credit agencies.

You Can Only Reduce Taxes Once You Reduce Bureaucrat Waste - "Drain The Swamp"

As That One Guy Is Always Saying!

Over 21

Trillion In Debt - Over 151 Trillion In Unfunded Liabilities - No

Nationwide Healthcare - Them Double Dipping Social Security

North Dakota Over $7 Billion In Debt - ND - Debt &

Spending

That's Roughly $10,000.00 For Every Man Women & Child In North

Dakota - Without Interest

Why is

it a struggling adult with a child gets a credit and a

struggling adult with no child does not?

Why is it you get a earned income credit for earning

less and having children to earn even more earned

income credit?

There should be a I knew I was struggling and would

place a burden on a child with my struggling credit

They could add one more line and call it the - I

Kept It In My Pants Credit

Then one more line for donations to Big Pharma so

their buddies can pay the lawsuits underway about

Opioid's

This Is What These Two

Federal Tax Makers Come Back To North Dakota To Show

People

A Postcard

- Its A Comedy

Show

It has to be, because where are the 20 pages of

formulas you will need to fill out to even get to a

number on anyone of these credits?

For if we had a functioning Federal Government one

would simply log into the IRS database and everything

is or would be electronically reported and you would

file your return.

Including all your Alleged & Non Alleged Insider

Stock Trades When Your A Sitting Congressman &

Corporate Insider

Trumps Favorite GOP Congressman

Chris Collins Arrested For Insider

Trading

Apparently the post card tax return didn't have any

lines for Trading results and the use of Campaign

funds for legal bills!

These Two Tax Leaders Are GOP & They Say Or Do

Nothing In Response To The President

Cramer

Gets Behind Trump -

Not ND Farmers

The

Trump

Presidency Is

On Track To

Add More Debt

In Its First

Term Then

Obama Did In

Two Terms The Balance Thats Bold New

Leadership!

Cramer & Chris Collins - One

can only imagine what they are

talking about at the Facebook

Hearing?

Collins is looking at 150 years

in prison for insider trading.

Lets see how loud he can sing

and how far he can flip!

Trumps Favorite GOP

Congressman

Chris Collins

Arrested For

Insider

Trading

More Dumb & Dumber

They Gained

National Attention For Their Tax & Pain Attitude For Women

Sundays are for “spending time with your

wife, your husband… Making him breakfast, bringing it

to him in bed and then after that go take the kids for

a walk.”

“I don’t know about you, but my wife has no

problem spending everything I earn in 6 and a half

days.”

This Is Really To Much - taxed to addiction and death,

women are struggling to keep family and home together

and these two tax and pain leaders are the lawmakers

for North Dakota!

They should get rid of the blue laws

and call it the Tax & Pain law - People used to have one

job, now they have two or three just to frickin survive.....

Why They Keep taxing and indebting and taxing and

indebting and taxing, the kids have to get jobs to

have money, this is how removed these tax and pain

lawmakers are!

Instead Of Putting Women Down

They Should Cut Their Tax Addiction So Women & Children

Could Afford To Have Breakfast

Ladies - Lawmakers

Are Concerned With You Having Sunday Morning Off & Your Lack

Of A Sense Of Humor

What Was It Doug Burgum Said They Are? - Money

Squanders, Career Politicians & Good Old Boys - The

Taxmakers Have A Great Sense Of Humor!!!!

The

Plutocracy

So tell me what I see when I

look in your eyes

Is that you baby or

just a brilliant disguise

What A Brilliant

Disguise

Our

Taxmakers Should Say A Lot About Women & Girls, Mothers,

Daughters, Sisters - Not How They Put Them Down - No

Respect!

To

Governor Burgum, Senator Hoeven and Cramer

To

The Local Minot Paper - 10-29-2017

Krisanna

Peterson Bismarck

I hope that your moral judgement compass has been going off. I

want to commend what Sen. Jeff Flake’s said today.

I can tell in his voice he was scared. Finally a

republican in our US legislature has said what the president is

doing is not acceptable.

I hope all of you will all consider saying how scary the

President is. I am asking for you to stop looking away, from

President Trump’s devastating words and actions.

I am grateful for Sen. Flake’s Bravery and Honesty when he

stated ” When the next generation asks

us, Why didn’t you do something? Why didn’t you speak up? —

what are we going to say?”

The President is taking our country to a extremely scary place.

Even my Republican friends and family members are in agreement

with that President Trump’s Leadership is damning our country.

His actions are clear that my ten year old son, calls out our

President for his negative actions. So I can for sure say you

very well are aware of Trumps actions!

If you call yourself Christian? I know that Governor Hoeven is

Catholic and I have seen him at church before.

According to http://www.catholicnews.com from 5/9/16 Pope

Francis stated “Health is not a

consumer good but a universal right, so access to health

services cannot be a privilege.

” What all of you have been voting or recommending is

not Christian! What would Jesus do? Would Jesus take from the

poor and give to the rich?

Take away medicaid and medicare? Take away Education for Head

Start and Pell Grants. You all are aware the trickle down system

doesn’t work.

You know why the democrats didn’t vote for the last bill on

taxes. You can claim it’s for the middle class but it is NOT for

the middle class.

You can only trick others so long. I am aware of what is

going on and my ten year old is aware we are all tired of your

lies. Lying is not Christian!

I hope all of you have a open town hall soon. I believe Cramer

will. I have been trying to meet with Governor Burgum and

Senator Hoeven about my family situation since April.

I think it’s time that both Burgum and Hoeven have a Open

Town Hall.

I am waiting…Concerned North Dakotan Catholic Mother

It's sad that a ten year old knows he is being lied to. By

his government.

Consumers

Loose The Right To Sue

Companies

Courtesy

Of The

Congress -

Making America

Great Again

So

when your chasing your

identity around the world

you can bend over for Equifax

When

you find out you have an

account at Wells

Fargo

you never opened you can

stay bent over!

Why would

Hoeven vote any other way -

he owns a bank!

The

Taxpayer's Interest

& Right's Always

Come First

How does

that work, the company

that's supposed to hold your

credit and personal identity

in trust looses that

information and you have no

right to sue for damages!

The company that's supposed

to hold your money in trust

opens an account in your

name and charges you fees

and reports you to the

company that lost

your identity because

you didn't pay the fees and

you cant sue for damages!

The congress passes a law

that says their correct and

your wrong. What's Next?

They'll Probably

Pass A Law That Protects

The Rights Of Hackers!

Or Did They Just Do

That?

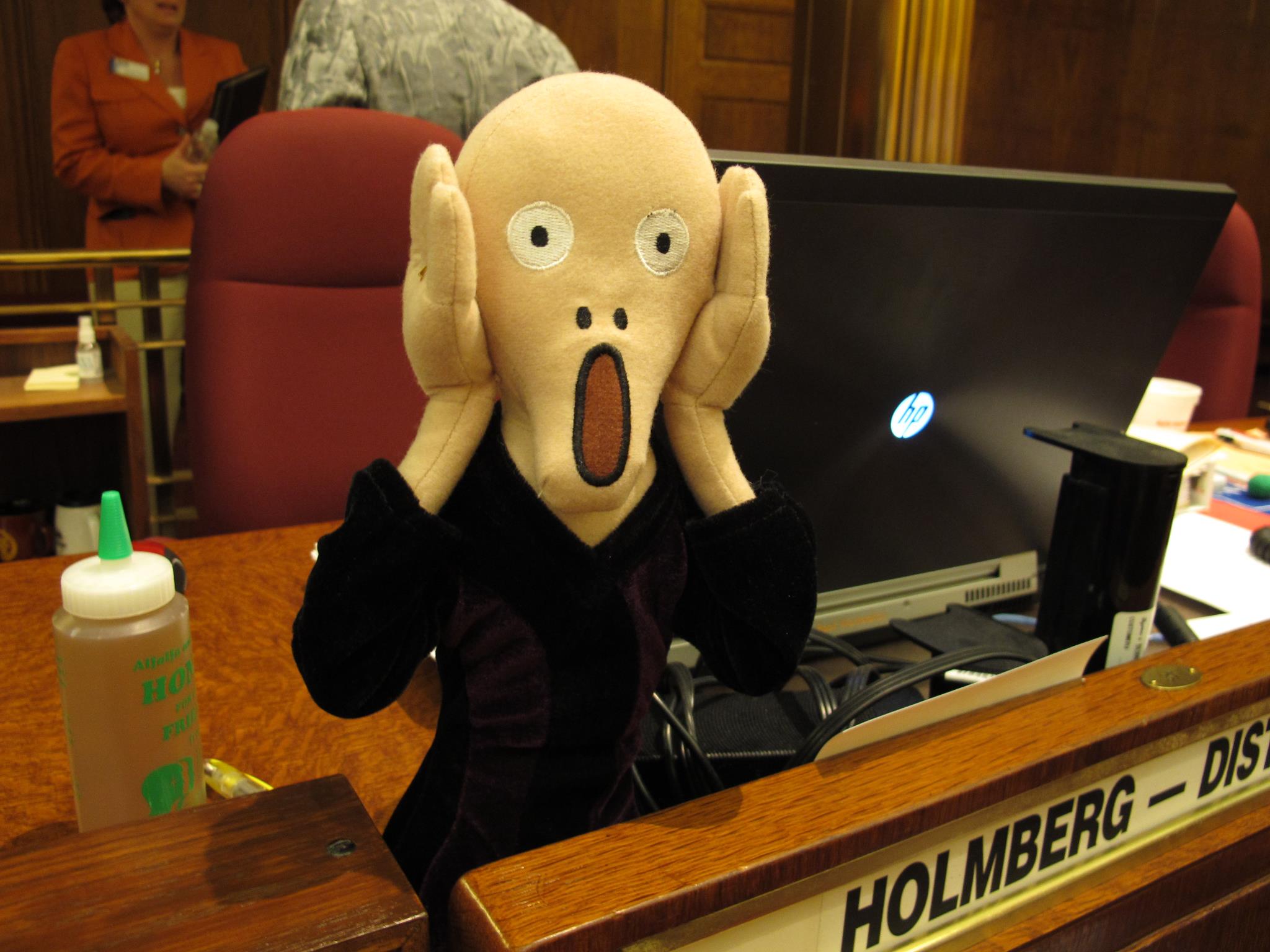

Remember Bank Is A Four Letter Word

"No one can spend money except us,"

Carlson said. "No one can pass laws except us."

North

Dakota Legislative Panel To Sue Governor Over Vetoes

A bipartisan panel of North Dakota lawmakers

voted Thursday to sue first-term Gov. Doug Burgum over his

veto powers, saying its aim is to protect the integrity of the

Legislature.

The Legislative Management Committee voted

12-4 to pursue the lawsuit in North Dakota's Supreme Court,

which would make it the first challenge over vetoes in the

state's highest court in nearly four decades.

Grand Forks GOP Sen. Ray Holmberg, who heads

the committee of lawmakers that oversees the Republican-led

Legislature's business between sessions, said he didn't

expect the lawsuit to be filed for "months."

The dispute centers on Burgum's use of his

line-item veto d to change parts of several spending bills.

Legislators contend he violated his veto powers by deleting

words or phrases that would have

changed the intent. He used his veto powers a week

after the Legislature adjourned on April 27.

Burgum, who is also a Republican, said a

lawsuit would be a waste of money. He said his office will

"respond accordingly to any legal action that attempts to

infringe on executive branch authority."

The decision to sue came after the committee

met for about an hour behind closed doors with private

attorneys to talk about litigation strategy.

It likely was the first time that North Dakota lawmakers

have closed a public meeting to discuss any issue.

"We are making history today," Holmberg said.

Burgum signed 440 bills in the session. He

vetoed three bills entirely and made line-item vetoes in 10.

The nonpartisan Legislative Council, which is

the Legislature's research arm, has said Burgum altered

legislation on spending bills at least four times,

including a three-word phrase forbidding a university from

cutting "any portion of" a nursing program.

In his veto message, Burgum called the phrase

ambiguous.

"This is all about protecting the legislative

branch of government," said Republican House Majority Leader

Al Carlson of Fargo, the vice chairman of the committee.

"No one can spend money except us," Carlson

said. "No one can pass laws except us."

The Legislative Council estimated the cost

of the lawsuit at about $34,000, including $2,000 already

spent on Bismarck attorneys Randall Bakke and Shawn

Grinolds for consultation.

The state constitution gives the governor

power to veto provisions in a spending bill without

rejecting the entire measure. Carlson and Republican

Senate Majority Leader Rich Wardner of Dickinson

requested an attorney general's opinion in May,

questioning whether the governor could veto parts of

appropriation bills in ways that change the legislative

intent.

Wardner, who voted against pursuing the

lawsuit, believed the "integrity of the Legislature is in

question here," but worried that the Legislature was on

"thin ice" and may not prevail in the state's high court.

He said he preferred calling lawmakers back to

Bismarck to address the vetoes.

Returning to session would cost an

estimated $80,000 a day, not including legal costs.

Most others believed the state Supreme

Court needs to settle the dispute because the issue could

come up again.

"I think we need clarity for the people of

North Dakota," Fargo Democratic Rep. Kathy Hogan said.

Burgum's relationship with the Legislature

was testy even before he took office. The former Microsoft

executive ran an outsider campaign for governor,

angering legislators with TV ads claiming they had

squandered much of the state's oil bounty and criticizing

what he called the "good old boy" establishment.

He bucked party tradition and ran against

longtime Attorney General Wayne Stenehjem, the Republican

establishment's preferred candidate.

Burgum won the primary easily before winning the general

election in a state that hasn't elected a Democratic

governor in more than a quarter-century.

Burgum and the Legislature mostly agreed on

spending priorities during the session, though friction

was evident at times, especially during a fight over a

bill limiting a governor's ability

to set salary bonuses for staff. Burgum won that

veto fight with the Legislature by arguing the legislation

improperly infringes on the executive branch.

God forbid, just like the last governor lets pay

bonuses to servants of the taxpayer, yet alone did the

legislature consider cutting all the unbelievable wages

being paid.

Dozens of political appointees receiving 11k a month,

doctors receiving 31k a month. There

supposed to be servants of the taxpayer!

State Payroll Roster

State Employees Receive $2.1 Million In Retention and

Recruitment (BOOM) Bonuses 11/2015 - While Crime Rages

Dick

Dever of

Bismarck says the state has been competing with the

private sector and the $1.5 million in retention bonuses

are justified.

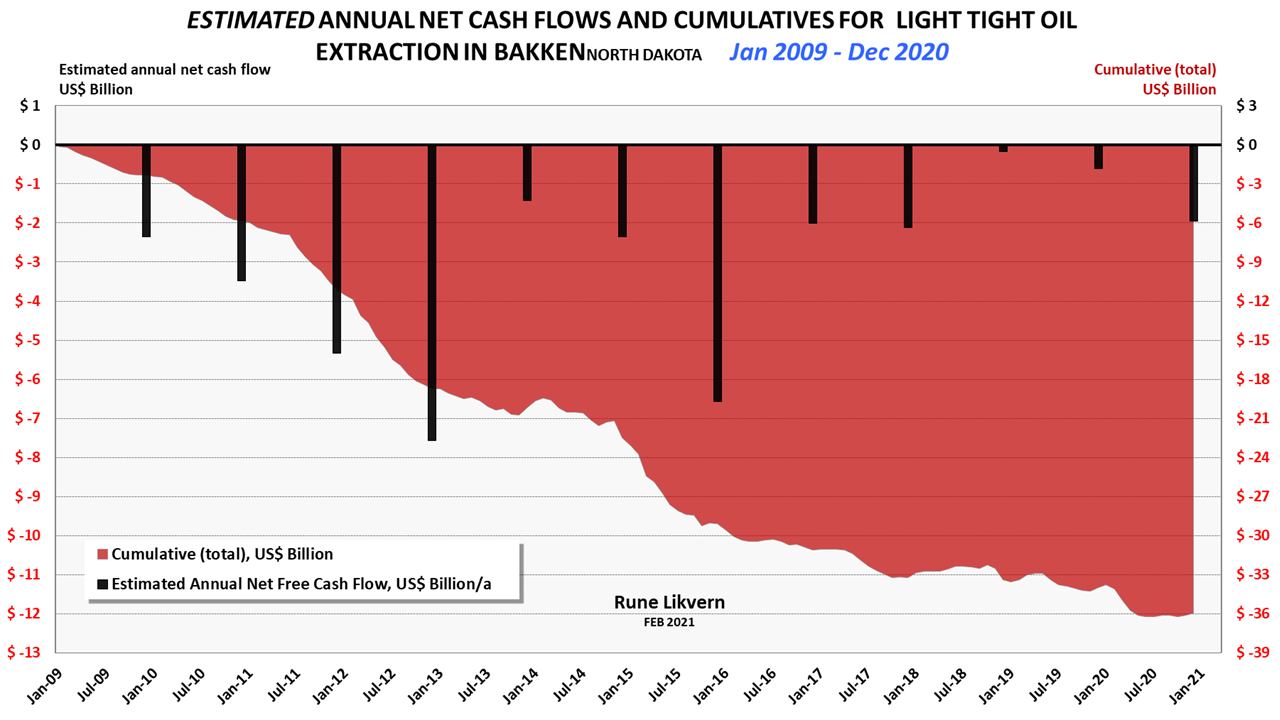

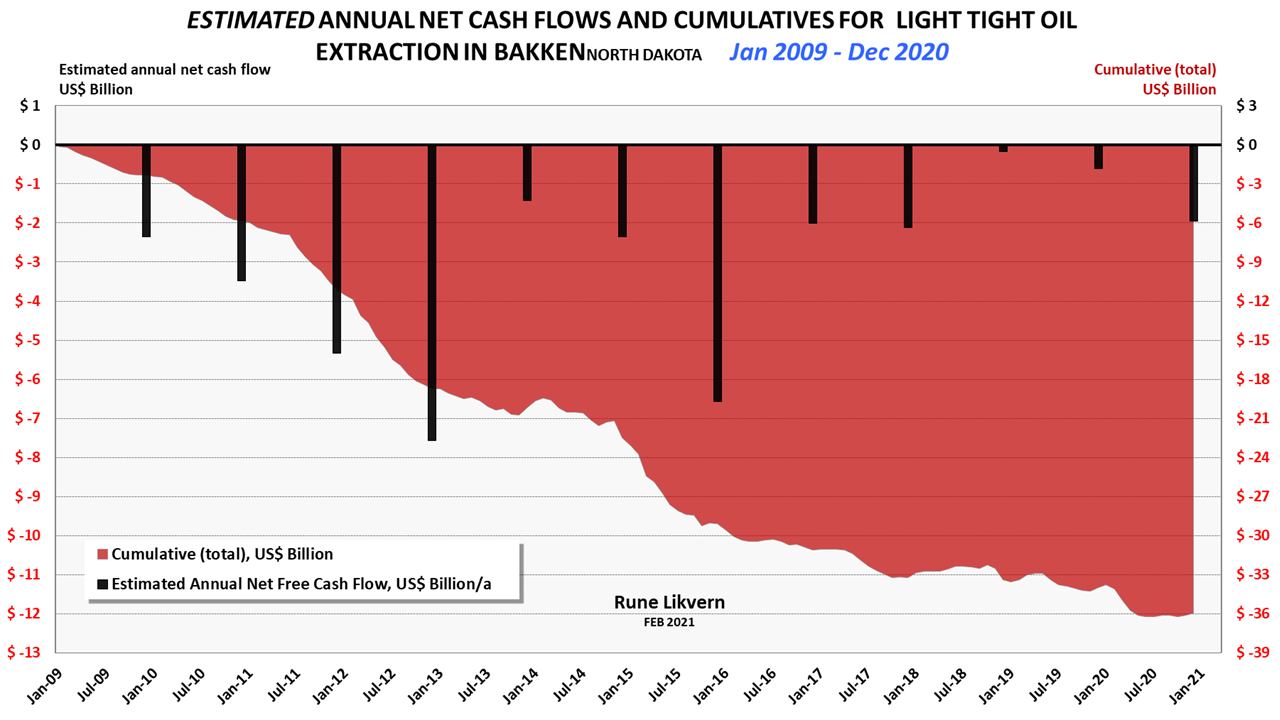

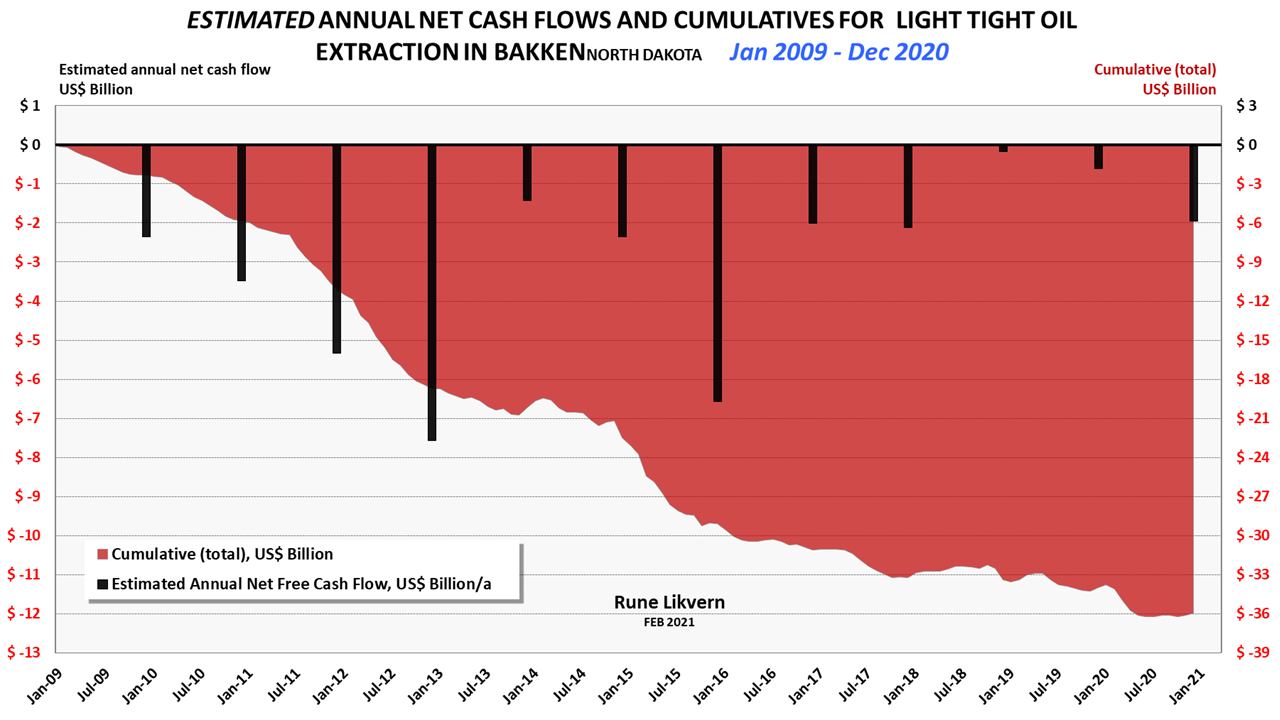

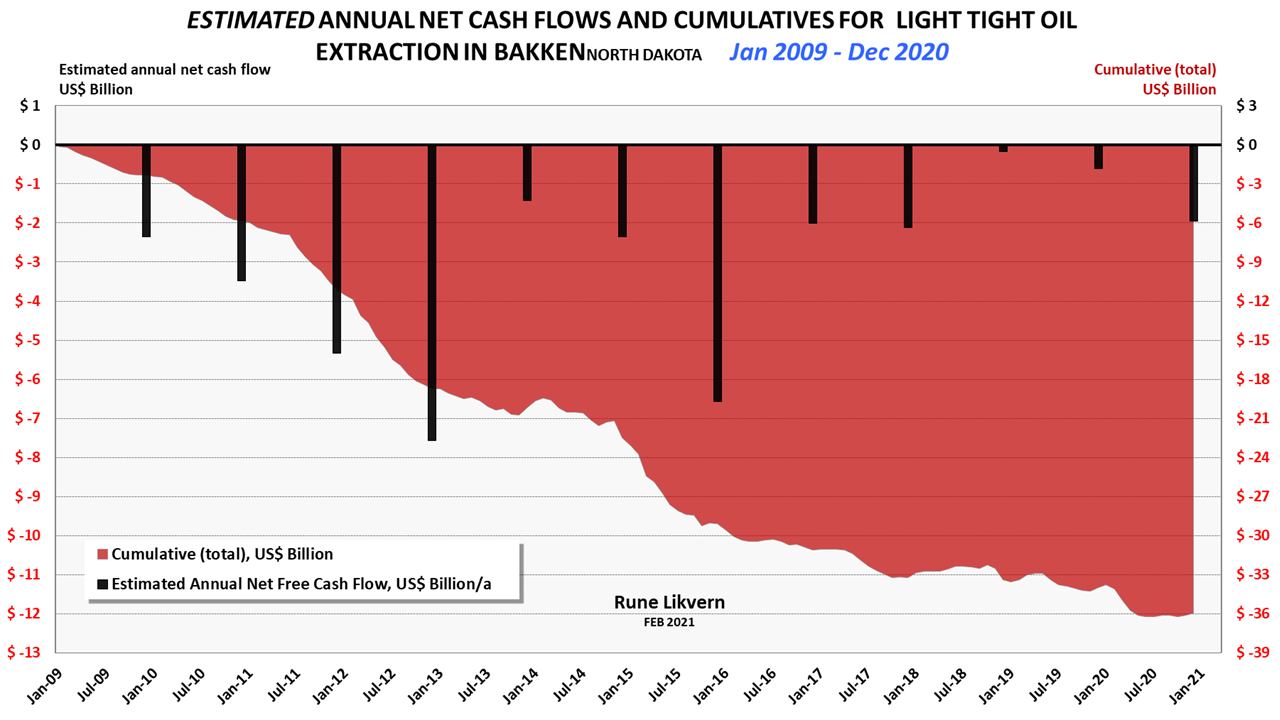

The Tax(Leg)islature Has & Had

Access To All The Data In The World &

Choose To Ignore It - They Went With Hype -

The Money

Some Of The Most Expensive Production Of Oil

In The World & They Played It As Going

On Forever - Oil Price Has Returned To The

Mean

They Choose To Ignore When It All Went bam -

boom - bubble - bust - bump - bang

Burgum got elected governor claiming the

tax(leg)islature had squandered much of the state's oil

bounty and criticizing what he called the "good old boy"

establishment. He was correct.

Now you hear nothing from him and he wants the E&P's to

shoot for two million barrels a day, while they still burn

off 13% of the daily natural gas. Which is increasing.

The extraction tax should be based on waste, not on good old

boy welfare to the E&P's. The dumbest person in the

world can take production data, decline rates, SEC filings

and see this is a lost cause.

One has to ask you blew through billions on crap that was

never needed, have left the Bakken towns over a billion in

debt and are sitting on $8 billion in cash with $7 Billion

in state debt, do you cover your bet

and call it a day? Or do you keep feeding the tax slave's a

line of crap about pain? North Dakota was never this way, it

was a state based on being very conservative. You sold the

hype to the new comer,

to the county's, to the town's, to the dog in the street,

you either did not do due diligence, or you just choose to

ignore it and keep selling the hype, while everybody else

bought it you kept selling them short!

If the USGS is correct in there being four billion

barrels of recoverable oil in the bakken and you could

bring it all to the surface tomorrow,

The USA could burn through it in the course of a

year! - The world burns a billion barrels every eleven

days.

"When

The Landscape Is Quiet Again"

A Great Thank You To Art Berman At

artberman.com - For The Amazing Data

He Compiles

A Great Thank You To Rune Likvern

At fractionalflow.com - For

The Amazing Math He Compiles

A Great Thank You To Enno Peters At

shaleprofile.com -

For Visualizing US Shale (Tight Oil) Production

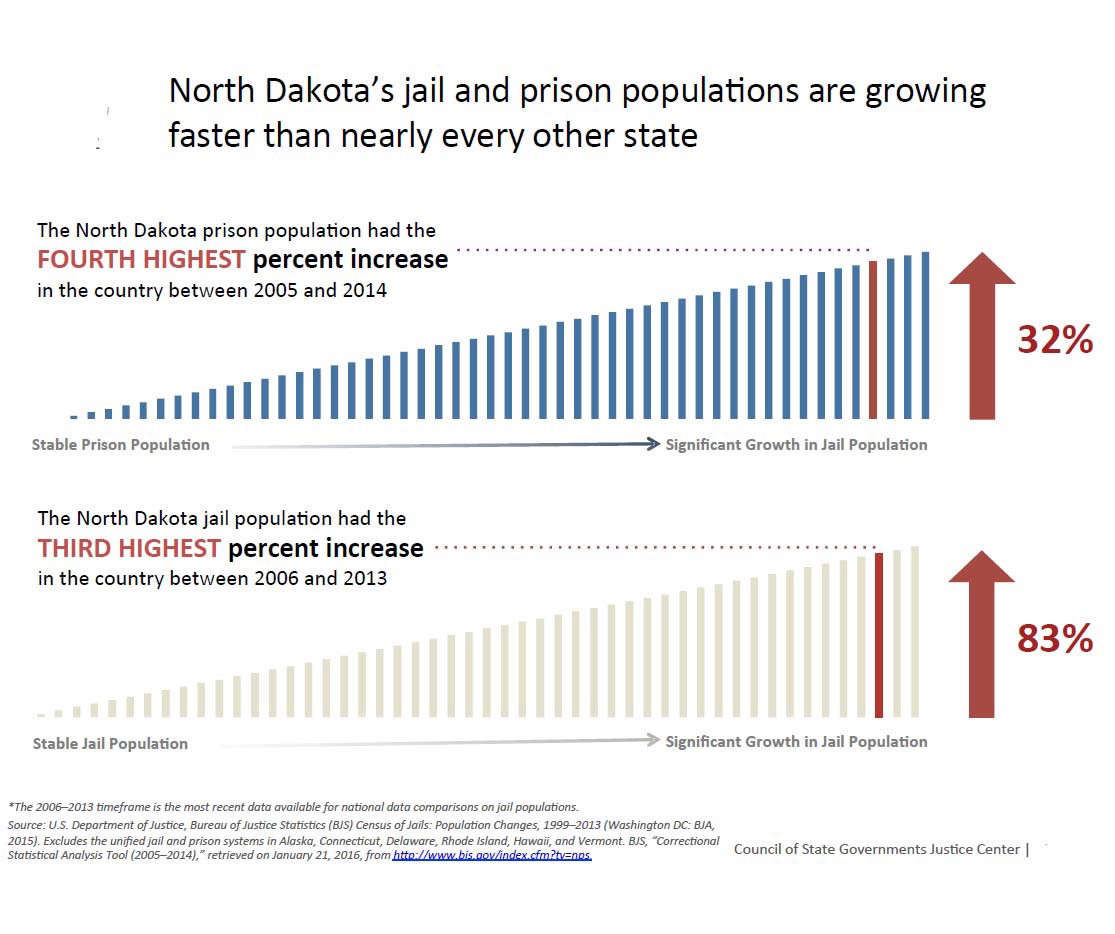

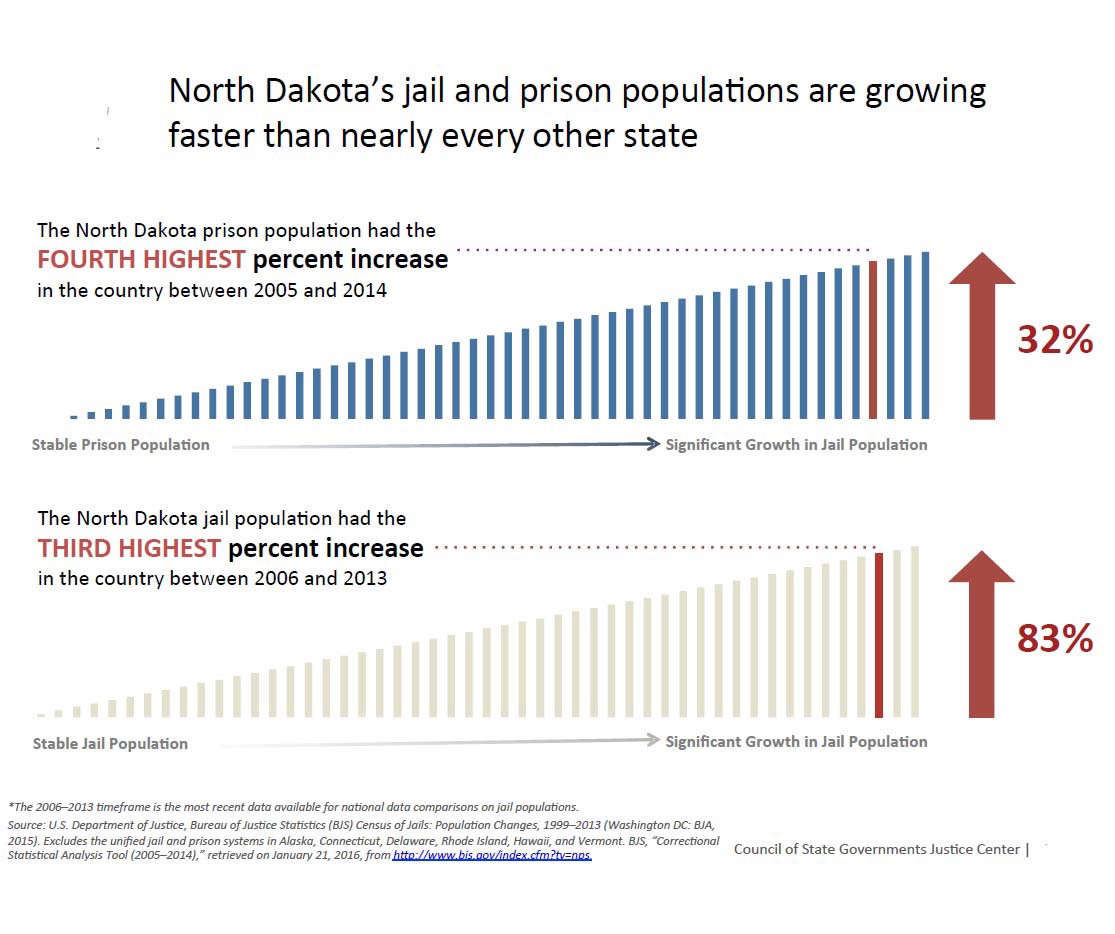

Seems

a little late to finally consider how we deal with

people in trouble. Tens of millions spent on jails and

taxed onto the taxpayer to late.

Better later then never? NO. The warning lights were

flashing back in 06-07

It just now in 2017 is seen as a problem, after the

counties have gone on a jail building binge!

The state has a budget of $215 million for prisons in

2017-2019. The counties are above and beyond that.

Those jails will suck the taxpayer dry for years too

come. For all the empty man camps and shut down

business work yards that could have

been utilized as work camps, training, reform,

addiction and recovery while serving a sentence with

some intent of reforming the offender.

Why do we lock up minor offenders, people with

addiction issues, people who do just dumb things in

cages that are of the level you would

lock up a terrorist or some hideous offender? Those

cages should be kept for animals who are never ever

going to change.

Not only that we live in a society of delusion,

materialism, drugs, alcohol and just being taxed to

death. It seems futile to try and succeed!

Putting people in cages does nothing to help them be

people, putting taxpayers in debt does nothing to help

these people.

The cost of prison's in ND could quickly exceed

$485 Million

Justice Reinvestment

Act - Seven million dollars

over two years is $9589.00 a

day, how much of this will go

to more staff to ad-minster

it?

According to NDJRAPDF

Page 28 no less then six new

employees will be hired, that

will easily eat up a million

dollars in two years.

(true definition of a

bureaucracy, create a position

and insulate by five layers

and get that five layers to do

the same)

So now were down to $8219.00 a

day, divide that by the eight

largest towns in ND and it

gives $1027.00 to do what?

Six million dollars divided by

757,000 people in ND is $7.92

per person, divided by two

years, 730 days is $.01 per

day per person.

How much of this will

actually trickle down to

people that really need help?

There's not much there, in

fact there isn't squat.

It should have been $70

million and one mean humble

person outside of the rabbit

hole to manage it.

The counties all went on a Jail

Building Boom and they

are going to fill those jails.

There

Has Been Alot Of BOOM's In

North Dakota In Recent

Year's & As With Oil The

Revenue Streams Have Not

Benefited Taxpayers - Only

Indebted Them!

"Excludes the

9 largest oil and gas producing counties (their previous funding

stays in place") ND has 53 counties.

"Big Ideas Big Results" - $280 Million minus $40 Million for

Cass County Leaves 43 Counties to about $5 million a piece.

Its Laughable - Carlson is in Cass County & Wardner is in

a Oil Producing County.

As Published In The Local Minot Paper

08/05/2018

How Have All North Dakotan's Benefited From the World

Class Oil Play?

At

least they call it what it is, a Oil Play not a Oil

Field, a Oil Play is about speculation, massive

debt, drill the sweet spots and short term,

A Oil Field is established by drilling from the

outside boundaries and in filled long term.

North Dakotan's have benefited greatly over the last decade

by the world class oil play in the Bakken.

As revenues began rolling in from oil taxes, the

Republican led legislature, along with the voters, put various

funds into place to make sure that the money was both spent

responsibly and saved for future generations. This

careful planning has led, in part, to several funds, or “buckets,” established by the

legislature to distribute spending on a priority

basis, starting with the General Fund and ending with the

Strategic Investment and Infrastructure Fund (SIIF).

This SIIF fund has filled even when oil revenues were at their

lowest.

In 2015, the legislature passed the “Surge

Bill,” which distributed $1.3 billion

SIIF dollars for essential infrastructure funding to

communities across the state.

Because of the oil boom, much of the Surge funding was

allocated in western counties to deal with community

impacts associated with rapid growth.

It was the right thing to do for western North Dakota.

But now it’s time to refocus our attention to non-oil

counties.

The package rolled out last week would provide $280

million in funding for critically needed infrastructure

improvements in non-oil producing cities and counties.

While funding to oil and gas producing counties and hub cities

will continue, the new package specifically targets these

non-oil areas. This package takes an innovative approach

to funding these essential state-wide infrastructure

projects and is not solely based on oil price and oil

production. Here’s how the new package would look:

2015 - $1.3 Billion, went to the Oil Producing Counties,

2018 - $280 Million for the rest of the State to catch up,

"Big Ideas Big Results".

With $40 Million going directly to Cass County - Home of

Carlson.

The whole $280 million breaks down to $1 dollar a day for a

year, for every person in ND. - 280 million divided by

735,000 people is $1.04 a day.

North Dakota operates on a two year Biennium budget so make

it $.50 cents a day, so every three days you might afford a

Candy bar.

"Big Ideas Big Results".

Creates three new “buckets”

above the SIIF in the state funding mechanism from oil taxes

— $115 million County/Township Infrastructure Fund

— $115 million Municipal Infrastructure Fund

— $50 million Airport Infrastructure Fund

The Municipal Fund and the County/Township Fund “buckets” fill simultaneously. The

Airport Infrastructure funding would only begin once the

aforementioned buckets have filled.

Here’s how the funds would get allocated to communities:

County/Township Fund ($115 million):

— Excludes the 9 largest oil and gas producing counties

(their previous funding stays in place)

— Provides $10,000 per township outside of the nine oil

counties (capped at $15 million)

— Remaining $100 million distributed to remaining counties

based on needs determined by the Upper Great Plans

Transportation Institute

— Municipal Infrastructure Fund ($115 million)

— Provides $30 million in base funding to communities with a

population over 1,000 to be paid out once $30 million is

reached.

Remaining $85 million will be paid when filled once based on:

— A funding formula based on a previous year’s census, a

3-year average of population growth and a 3-year average of

taxable valuation change

— Airport Infrastructure Fund ($50 million)

— Awards grants to be administered by the North Dakota

Aeronautics Commission

Most importantly, this new package will focus on reducing the

local tax burden for these non-oil counties and cities.

For example, Fargo, West Fargo, and Cass County will see an

additional $40 million in infrastructure dollars for roads,

sewer, water and other essential infrastructure needs.

A dollar through this program to Fargo, is one less the city

has to tax its citizens for these projects.

We want to make sure we have a stable formula for our

community leaders to plan now and in the future.

We are proud of the hard work we’ve done to put this proposal

in place.

Having big ideas and following through on them

is why we’re elected, and we will continue to do that as

your leaders.

The whole $280 million breaks down to $1 dollar a day

for a year, for every person in ND. - 280 million divided

by 735,000 people is $1.04 a day.

North Dakota operates on a two year Biennium budget so

make it $.50 cents a day, so every three days you might

afford a Candy bar.

"Big Ideas Big Results".

"buckets" Full Of Cash

The

"Big Idea"

Is to spend $280 Million, which would be 3.2% of

whats in the $8.7 Billion dollar bucket!

Laughable is the "Big Result"

ND Funds - Balances

How Have All

North Dakotan's Benefited From the World

Class Oil Play?

At least they

call it what it is, a Oil Play not a Oil

Field, a Oil Play is about speculation,

massive debt, drill the sweet spots and

short term,

A Oil Field is established by drilling

from the outside boundaries and in filled

long term.

Billion's In

The Bucket - "Big Idea - Big Result"

One North Dakotan Gets

It

As Published In The Local Minot Paper

08/26/2018

Republicans gave away too

much oil revenue

Kenton Onstad Parshall

"North Dakotan's have benefited greatly over the last

decade by the world class oil play in the Bakken."

Wardner & Carlson said those words, think about it as

you read this letter. Oil Play - Oil Field

At least they

call it what it is, a Oil Play not a Oil

Field, a Oil Play is about speculation,

massive debt, drill the sweet spots and

short term,

A Oil Field is established by drilling

from the outside boundaries and in filled

long term.

In response to the recent article by Sen.

Rich Wardner and Rep. Al Carlson ” Big Ideas, big results”

they make what could have been

“So Simple” very complicated. You cannot deny the Bakken oil

play has been a huge benefit to the entire state of North

Dakota.

At the beginning, our money coffers were very low and

the development of our oil resources provided an opportunity

to help many North Dakotan's.

We did that, but along the way, we helped a lot of

non-North Dakotan's as well.

The huge impact to western North Dakota could have been

prevented by not allowing an open door to oil permitting and

still receive the benefits.

That decision alone by the Republican-controlled

Industrial Commission gave oil companies a 5-year window to

secure hundreds of thousands of leases.

“Drill Baby Drill” was the word and former governors John

Hoeven and Jack Dalrymple both took credit for a booming

economy and discovery of a natural

resource that was there long before statehood. The “Drill

Baby Drill” open door policy alone created turmoil amongst

communities in Western North Dakota.

The Republican controlled Legislature wants to take credit

for futuristic planning but in reality, as the sessions

plugged away, it was mostly reactive

rather than proactive. The State of North Dakota could have

easily adopted the funding formula so that 40% would go back

to western oil producing counties

like our counterparts in adjoining oil producing

states have adopted. Oil producing counties along with

cities and counties would not have had to go begging

each session and tell the same story; how the state

needs to address the impact to cities, counties, townships

and schools in western North Dakota, and the need for

increased funding. Remember the actions to lower other

revenue streams put a certain restraint on the growing

state’s economy and very needy programs.

They would not have had to go around the entire state

promoting a surge bill and fill it full of trinkets to

entice eastern legislators for their vote.

The need for the hub city concept would not have been

necessary to address impacts on infrastructure. Sending

small bits back to cities and

counties in western North Dakota and praising the

delivery as a huge investment by the Republican Legislature

was misleading and inadequate.

It could have been so simple but we grew government and made

it very complicated.

There would have been plenty to improve infrastructure,

support schools, counties and cities all across the state

but remember the

Republican controlled Legislature had to lower income

and corporate taxes that went to a majority of entities

outside the state of North Dakota.

A Oil Field Would Not

Display This Type Of Financial Chart - A Oil Play

Would - Where Is The Green?

Here

Is Another Award Winning "Big Idea"

Have

the taxpayers pay interest on loans to borrow

money from the Tax Revenue (Legacy Fund) to

pay for taxpayer project's.

That is a Ponzi Scheme that Escapes the

Imagination - Next they will want you to pay

Income Tax on your Taxes!

Stockpiling Taxes

Since when in the Hell should Taxpayers pay Interest on

Tax Revenue that was supposed to be used for the

Taxpayer?

Since when did the Taxpayers Tax Revenue become a Bank?

With the Taxpayer paying Interest to have Their taxes

used for the Taxpayer.

Ask Yourself ?

Does the Fed or State pay you Interest when you have

been over paying Taxes for the year?

Does the Fed or State pay you Interest on your paid

Taxes until they are spent?

Does the Fed or State pay you a dividend or portion of

Interest on Taxes they have Stockpiled?

Does the Fed or State

charge you Interest when you haven't paid enough Taxes

or pay your Taxes late?

What Was It Doug Burgum Said They Are To

Get Elected? - Money Squanders, Career Politicians &

Good Old Boys

Yep, "New Bold Leadership" - Burgum Doesn't Say Or

Do A Thing Since He Became One Of Them

Billion's

In The Bucket - "Big Idea - Big Result" - Lets

Loan The Tax Revenue Back To The Taxpayers!

"New Bold

Leadership In The White House

And In Bismarck"

"New Bold

Leadership In The White House

And In Bismarck"

The

Phrase Was Coined By Now North

Dakota GOP Governor Doug Burgum

- The

Only Candidate For Governor To

Endorse Trump

Now

Governor Burgum Called His

Opponent & State

Legislators "Money

Squanders, Career

Politicians & Good Old

Boys" To Get Elected

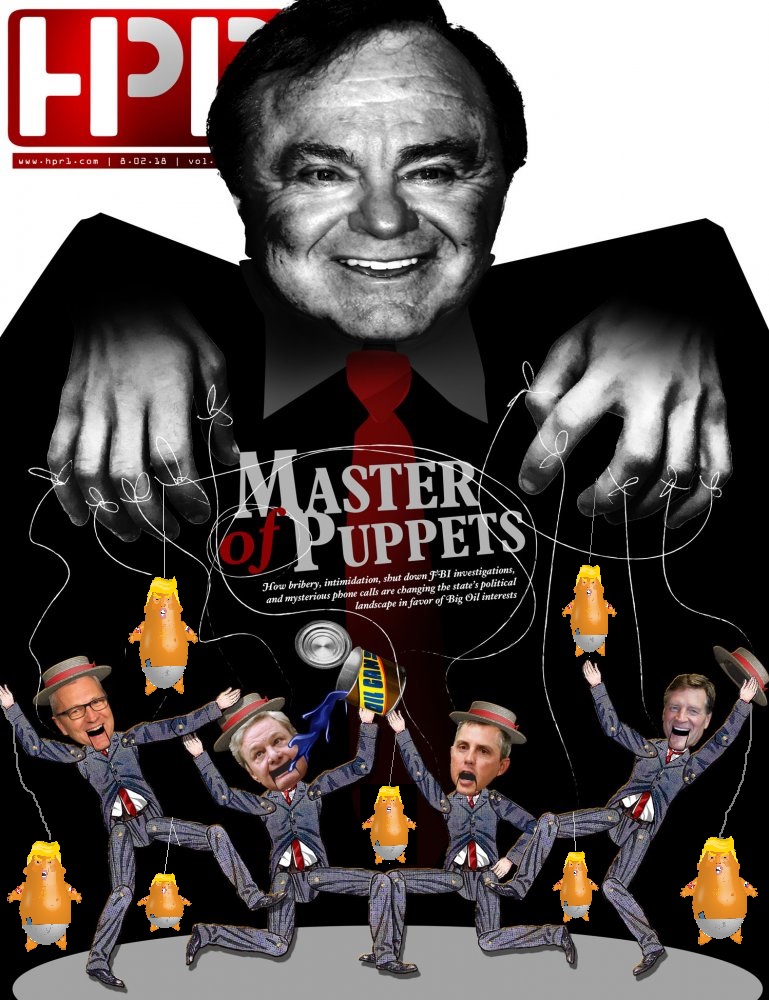

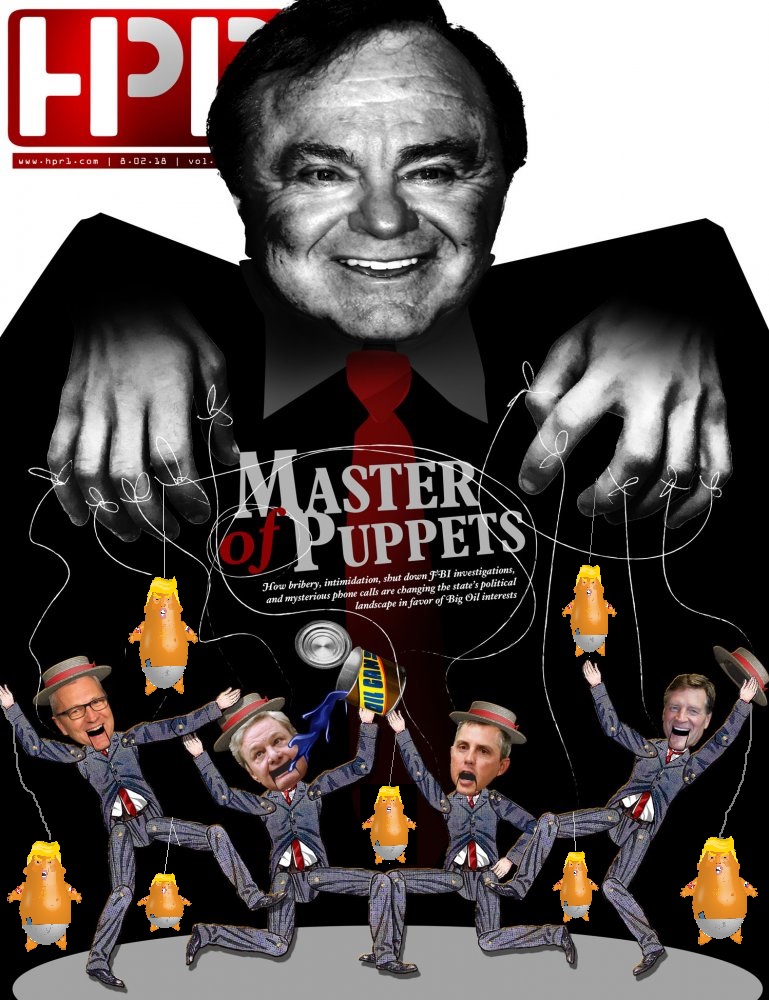

"How

Bribery, Intimidation, Shut Down

FBI Investigations, Mysterious

Phone Calls, are Changing The

States Political Landscape In

Favor of Big Oil"

As

Published In The High Plains Reader August 2018

Master Of

Puppets

Trump said the following

at a June speech in Fargo ND with

Harold Hamm in attendance & it

went something like this

"Harold Hamm - He

puts a straw in the ground &

oil comes out - There squeezing

this oil from rocks".

Trumps Fargo

Speech

So why did Trump have to call

Saudi for oil when Harold can stick

straws in the ground and get oil?

So how many straws would it take for

Harold to ratchet up 2 million

barrels a day in new production by

the end of the day?

Based

on the combined production of the big

3, Bakken, Permian, and Eagle Ford of

33.4 bbl's a well per day March 2018,

You would need 59,880 more straws

(wells) at a estimated $8 million a

well is some $479 billion

The

Bakken by itself, 84.1 bbl's a well

per day April 2018, you would need

23,781 more Straws (wells) at a

estimated $8 million a well is some

$190 billion

The Eagle Ford by itself, 29.9 bbl's a

well per day March 2018, you would

need 66,890 more Straws (wells) at a

estimated $8 million a well is some

$535 billion

The Permian by itself, 24.5 bbl's a

well per day March 2018, you would

need 81,633 more Straws (wells) at a

estimated $8 million a well is some

$653 billion

So When

You Need Straws At A Speech You

Call Harold Hamm? - When You Need

Real Oil You Call Saudi?

One who would describe

the Exploration of Hydrocarbons as

Simple as using a Straw has No

Concept of the Risk and Reward and

Cost of this Chore! Yet alone the

Financial and Global Ramifications

of Failure.

Define Straw Man -

An intentionally misrepresented

proposition that is set up because

it is easier to defeat than an

opponent's real argument.

Harold Hamm is the

CEO of Continental Resources - His

net worth is dependent on high oil

prices - As of August 2018 CLR has

$6.1 billion in debt & $98 Million In

Cash

You would think with all

the hype and

the ability to

produce Oil

with Straws

the debt would

be $98 million

and cash on

hand would be

$6.1 billion

In Comparisons

- Exxon has as

of August 2018

$40 billion in

debt and $4

Billion In

Cash

Saudi Aramco

is privately

held by the

Kingdom and is

valued at $2

Trillion

The Inflatable

Baby Trump Is Available At

Mad

Dog Pac .com

It will take a

lot of straws

to suck up all

that debt.

As Published In The

Local Minot Paper 08/09/2018

North Dakota finances are a house of

cards - Lloyd Omdahl

We have the well-plugging fund, budget stabilization fund,

abandoned mine fund, highway tax distribution fund, Legacy Fund,

coal development fund, Center of Excellence Fund and a few dozen

more funds listed on the home page of the state treasurer.

I would also recommend checking the five charts on her

website explaining the oil tax distribution system we have

patched together since oil was discovered in 1951.

The only thing we lack is a “go-fund-me”

fund.

This house of fiscal cards has been created and compounded by

a part-time Legislature that doesn’t have time to organize a

rational funding system based on sound tax principles.

Every session seems to create more funds in response to

the whims of interest groups and other beneficiaries.

Toward the end of the last legislative session, in an unusual

burst of generosity, the Legislature appropriated over $10

million to give every one of our 1,100 townships $10K each.

It wasn’t even Christmas but every township was going to get

money even though the population and need varied widely from

county to county.

The taxpayers were saved when Governor Doug Burgum

vetoed the measure.

According to the media, we now have a group of eastern

legislators planning to get some of that western oil money for

infrastructure.

Now they have reason to be envious. To accommodate the

development of the Bakken, the state was overly generous with

local communities –

new schools, new highways and new county and community

staffing. The west needed help and got it.

After 10 years of this, some eastern legislators are

wondering whether or not the rest of the state ought to share

the spoils, raising the issue of equity in the entire state

budget.

The state tax and spend system is a royal mess. The

helter-skelter cramming of a burgeoning budget into an 80-day

biennial legislative session is futile.

When we keep managing fiscal affairs without the availability

of thoughtful study, decisions are made on the basis of

politics.

Take the Legacy Fund being fed millions of dedicated oil

dollars every month. The fund boasts over $5 billion and is

still growing.

Was there any rational discussion preceding the dedication of

this money? Were there alternatives proposed and evaluated?

No, the Legislature put it on the ballot as a constitutional

amendment. Why a constitutional amendment?

So that future legislatures couldn’t spend it – an

assumption that future legislatures would not be responsible

or frugal.

Sponsors and defenders of the Legacy Fund will justify it by

arguing that the people voted for it. No, the people voted for

“Legacy” because all legacies

are good.

Attach “legacy” to a

steamboat on Lake Sakakawea and the people will vote for it.

However, all legacies are not equal.

There was too little research at the legislative level. What

were the principles of taxation considered? Who has a

legitimate claim to the oil money?

The folks in the western part of the state? All citizens

of the state? The present generation or future generations?

On the whole, the North Dakota tax system is regressive,

meaning that the lower income people pay for more than their

fair share for

governmental services because the progressivity of the income

tax is more than offset by the regressivity of the sales tax.

Our response is that the lower-income people require more

than their share of governmental services therefore they ought

to pay more than their share of taxes.

But this blanket generalization does not result in

equity.

All low-income people do not use governmental services equally

so we end up with a system that benefits some and punishes

others.

Cleaning up this 200-year-old pile of incoherent fiscal

legislation will not be easy. But we could apply better equity

tests to new proposals.

Those Who

Cannot Remember The Past Are Condemned To Repeat It Geroge

Santayana So Are Those Who Do Not Study Their History

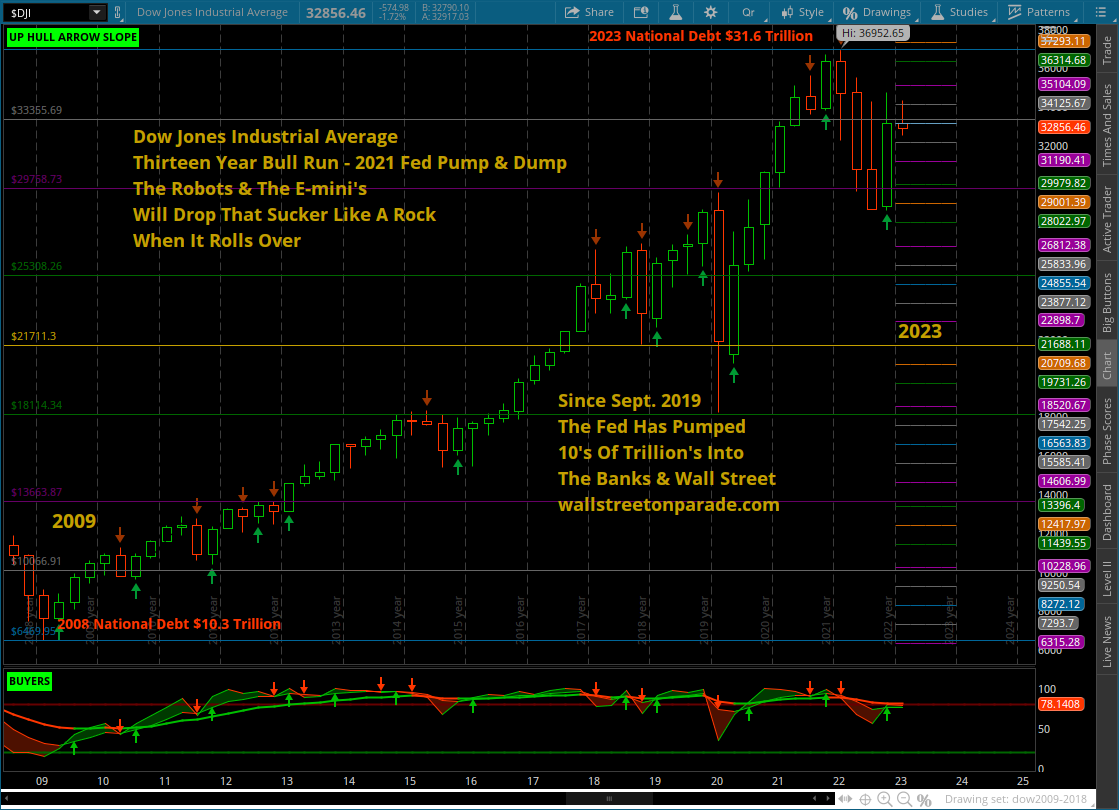

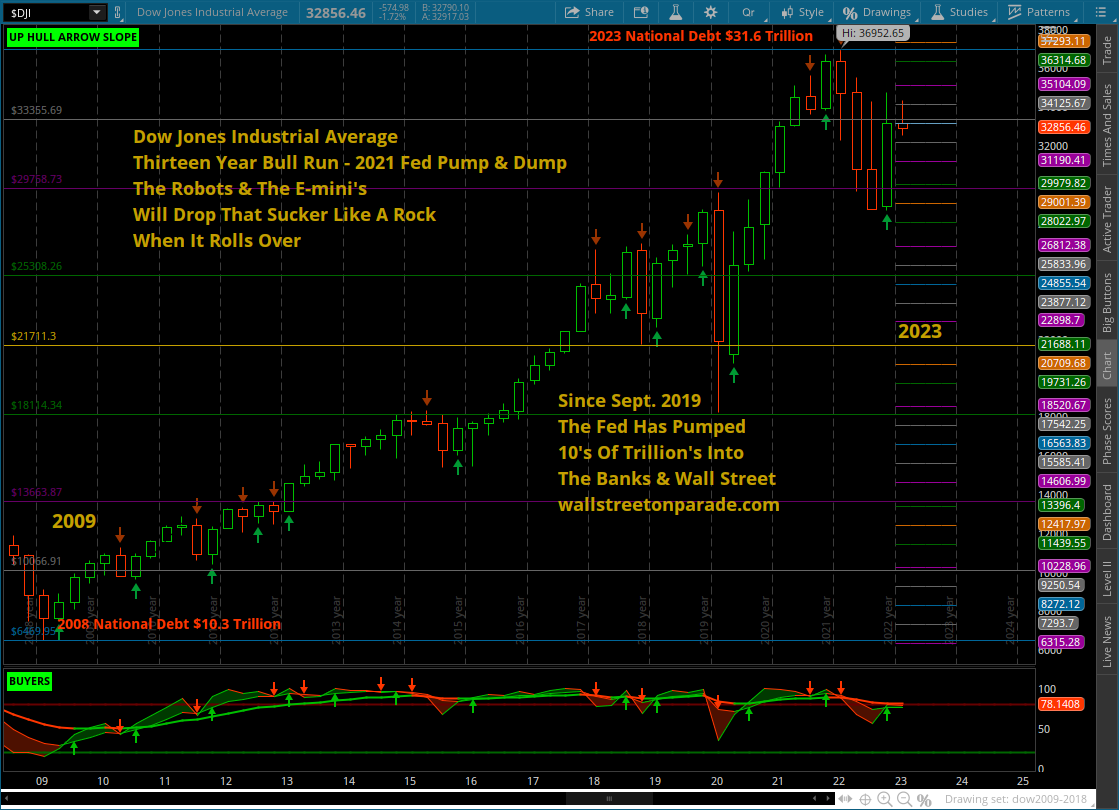

In Recent Past The USA Went Into The Worst Financial

Crisis Since The 1930's Dow Crash - Just A Short Ten

Years Ago - Those Equity Debt Issues Still Exist

With Bold New Leadership In Washington & Bismarck

- There Is Just No Way This Can Happen Again - Is

There?

You Cant Help But Give Equity To The Charts - The

Comparisons Are Startling - The Roaring Teens Of Now -

Never Ending Equity & Debt

The Nation In A Opioid Epidemic - At War & The

Rumblings Of More War

Dow - 2019

The (Trump & Dump) Rally Is Unstoppable - It Goes

Against Underlying Fundamentals - It Has Got To Be

Bold New Government Driving It - Building Equity

You Cant Help But Give Equity To

The Charts - The Comparisons Are Startling - The

Roaring 1920's Of Then - Never Ending Equity

& Debt

The Nation In A Opioid Epidemic - Yes - Yet

Alone You Had A Constitutional Prohibition On

Alcohol From 1920 To 1933

The USA Entered WW1 In 1917 & Some 20

Years Later WW2 Started - The USA Engaged In

1941

From

Teddy To Trump

- Big Pharma -

Epidemic Then

- Epidemic Now

Big Pharma

Then & Now

Plays &

Played A Role

Big

Pharma Then

The

U.S.

government’s

investigation

of all the

factors

leading to the

Second World

War in 1946

came to the

conclusion

that without

IG Farben the

Second World

War would

simply not

have been

possible.

We have to

come to grips

with the fact

that it was

not the

psychopath,

Adolph Hitler,

or bad genes

of the German

people that

brought about

the Second

World War.

Economic greed

by companies

like Bayer,

BASF and

Hoechst was

the key factor

in bringing

about the

Holocaust.

The

Dow In The 1920's - Price Would Retrace 123%

Before It Found Bottom & Start A Depression

That Lasted Until & Into WW2

The Stock Market

Underwent Rapid Expansion, After A Period Of

Wild Speculation - Sounds Like Now - Crash

Started Oct. 1929

What Are Fibonacci Retracement's ?

2019 Fibonacci Fivots -

The Robots Have Gone To Them Like A Magnet

Seems it's just another day Guess I'm

goin' another way Away from

home

Away From Home

We're setting sail To the place on the map from which no one has ever

returned

We're setting sail To the place on the map from which no one has ever

returned

Drawn by the promise of the

joker and the fool By

the light of the crosses that burn

Oh, save me. Save me from

tomorrow I don't

want to sail with this ship of fools

Ship Of Fools

As

A

Investor One Should Always Do Due Diligence To

Protect Oneself.

One

Can Only Interpret The Unknown Right Hand Side

Of The Chart By Gageing The Known Left Hand

Side

"New

Bold Leadership In The

White House And In

Bismarck"

The

Phrase Was Coined By Now North

Dakota GOP Governor Doug

Burgum - The Only Candidate For

Governor To Endorse Trump

Now Governor Burgum Called His Opponent &

State

Legislators

"Money

Squanders,

Career

Politicians

& Good Old

Boys" To Get

Elected

To

the fullest extent of the law, we will not be liable

to any person or entity for the quality, accuracy,

completeness, reliability, or timeliness of the

information provided on this website,

or for any direct, indirect, consequential,

incidental, special or punitive damages that may

arise out of the use of information we provide to any

person or entity

(including, but not limited to, lost profits, loss of

opportunities, trading losses, and damages that may

result from any inaccuracy or incompleteness of this

information).

We encourage you to invest

carefully and read investment information available at

the websites of the SEC at http://www.sec.gov

and FINRA at http://www.finra.org.

IF YOU DO NOT AGREE WITH THE

TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE

IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED

USE OF THIS SITE

OR THE INFORMATION

PROVIDED HEREIN SHALL INDICATE YOUR CONSENT AND

AGREEMENT TO THESE TERMS.

Honor - Respect -

Freedom - Country - USA

anchor <a

name="----">----</a>